Back by popular demand. Again, with everything on DeFi being on-chain, we can see connect firms & addresses.

A breakdown of some of the known Ethereum addresses of a16z, Celsius, Nexo. Also, a look at addresses *likely* operated by firms like Alameda, Struck Capital, & more.

👇

A breakdown of some of the known Ethereum addresses of a16z, Celsius, Nexo. Also, a look at addresses *likely* operated by firms like Alameda, Struck Capital, & more.

👇

a16z's (1/2) interesting because it became the first "mainstream" VC to go big on DeFi tokens.

They have $26m in MKR, $2m in SNX, and $1.5m in REP.

Of note, they're up $11m in their MKR.

They have $26m in MKR, $2m in SNX, and $1.5m in REP.

Of note, they're up $11m in their MKR.

a16z (2/2)

What I really remember about this address is others in the space eyeing it last year:

Someone deposited $250k of SNX into the address.

We still don't know if it was a16z.

Not much else to say though - I guess Pool 2 yield farming isn't in their mandate.

What I really remember about this address is others in the space eyeing it last year:

Someone deposited $250k of SNX into the address.

We still don't know if it was a16z.

Not much else to say though - I guess Pool 2 yield farming isn't in their mandate.

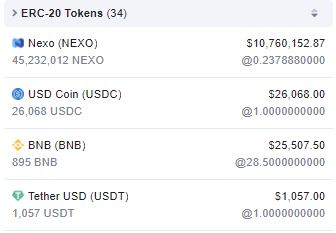

Nexo (1/2):

Nexo is a CeFi lending and borrowing service.

First address seems inactive (no outgoing txes in 400 days), though has $10m in NEXO and the assorted stablecoins seen below.

Nexo is a CeFi lending and borrowing service.

First address seems inactive (no outgoing txes in 400 days), though has $10m in NEXO and the assorted stablecoins seen below.

Nexo (2/3):

Second address has a lot more going on - seems to be the main operation of Nexo.

$6.3m in LINK, $7.5m in assorted stablecoins, $520k in Paxos Gold.

Second address has a lot more going on - seems to be the main operation of Nexo.

$6.3m in LINK, $7.5m in assorted stablecoins, $520k in Paxos Gold.

Nexo (3/3):

Biggest thing to note here is that from my quick glance, outflows are *outweighing* inflows by a good amount.

This simple fact could suggest that DeFi is, well, eating CeFi.

Yields: 8% CeFi vs. 10%+ DeFi

Biggest thing to note here is that from my quick glance, outflows are *outweighing* inflows by a good amount.

This simple fact could suggest that DeFi is, well, eating CeFi.

Yields: 8% CeFi vs. 10%+ DeFi

Celsius (1/6):

Celsius is another top CeFi lender and borrower like Nexo.

Wider variety of coins deposited due to yields offered on many more coins.

Biggest holdings CEL (which it pays out as interest), LINK, Paxos Gold, TrueGBP, and UNI. The address also holds $12.5m in ETH.

Celsius is another top CeFi lender and borrower like Nexo.

Wider variety of coins deposited due to yields offered on many more coins.

Biggest holdings CEL (which it pays out as interest), LINK, Paxos Gold, TrueGBP, and UNI. The address also holds $12.5m in ETH.

Celsius (2/6):

Here's where it gets *really* interesting: I noticed that one address gets regular 5,000 ETH, 10,000 ETH+ from the Celsius web.

This must be a company address: 0xb1a...

$212m address net worth, with many funds yield farming.

Here's where it gets *really* interesting: I noticed that one address gets regular 5,000 ETH, 10,000 ETH+ from the Celsius web.

This must be a company address: 0xb1a...

$212m address net worth, with many funds yield farming.

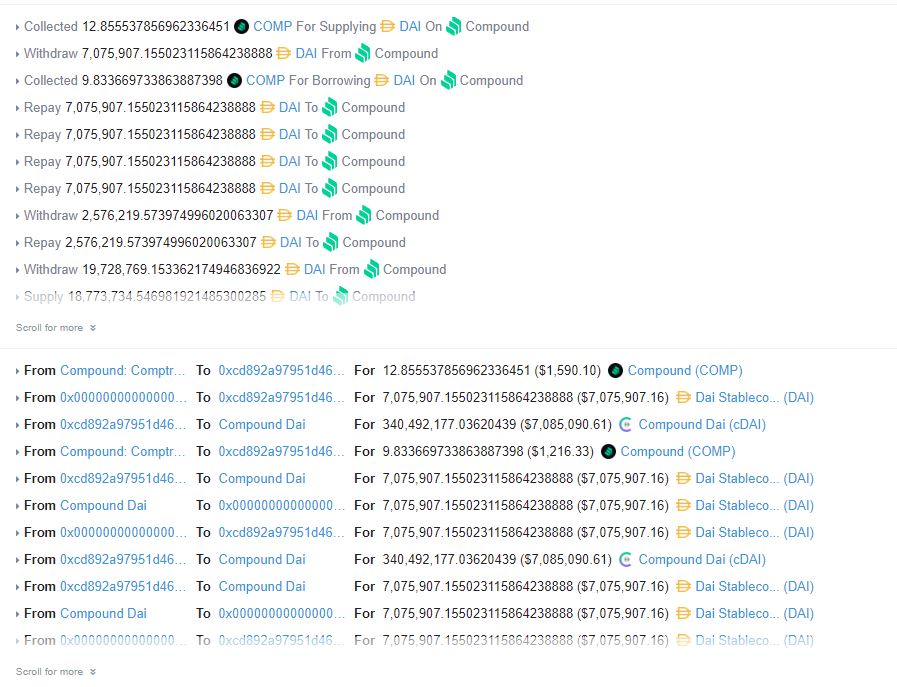

Celsius (3/6) - Expanding more on the last address:

$125m in WBTC, ETH, and LINK collateral deposited into Compound and Aave.

That collateral is being used to withdraw $70m in stables from Compound and $10m in WBTC, $5m in ETH, YFI, SNX, and REN.

$125m in WBTC, ETH, and LINK collateral deposited into Compound and Aave.

That collateral is being used to withdraw $70m in stables from Compound and $10m in WBTC, $5m in ETH, YFI, SNX, and REN.

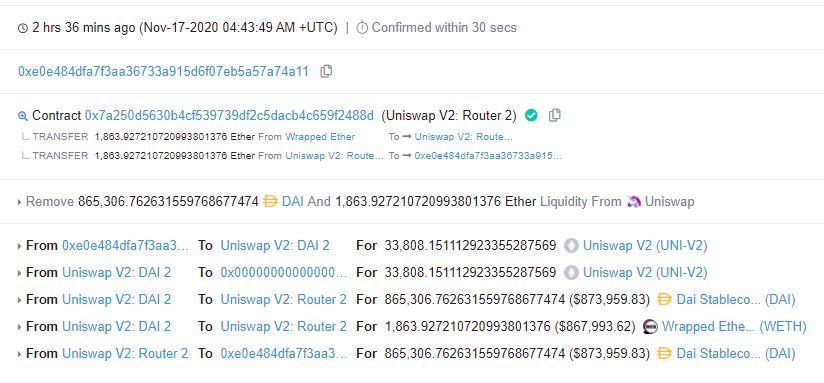

Celsius (4/6) - Cont.:

This address is big on yield farming, as I suggested earlier.

Favorite farms seem to be Uniswap LPs, Keeper, 3pool Curve LP (used to be in yAxis), and Harvest Finance.

Interesting to see the funds stay in Uniswap as opposed to diverting to SushiSwap.

This address is big on yield farming, as I suggested earlier.

Favorite farms seem to be Uniswap LPs, Keeper, 3pool Curve LP (used to be in yAxis), and Harvest Finance.

Interesting to see the funds stay in Uniswap as opposed to diverting to SushiSwap.

Celsius (5/6):

That's not all: This address has around 500,000 LINK in the Yearn AAVE delegated yVault, millions in stable yVaults, some capital in Ichi, and some CREAM and BAL in Cream.

The address is also a big Saffron Finance (SFI) farmer, with around 1m DAI in the pool.

That's not all: This address has around 500,000 LINK in the Yearn AAVE delegated yVault, millions in stable yVaults, some capital in Ichi, and some CREAM and BAL in Cream.

The address is also a big Saffron Finance (SFI) farmer, with around 1m DAI in the pool.

Celsius (6/6):

The Celsius web is much bigger than I depicted here. I noticed a bunch of smaller addresses with millions of different tokens on em: WBTC, stables, etc.

Again, the last address cannot be confirmed. Though, it regularly receives hundreds of thousands in ETH.

The Celsius web is much bigger than I depicted here. I noticed a bunch of smaller addresses with millions of different tokens on em: WBTC, stables, etc.

Again, the last address cannot be confirmed. Though, it regularly receives hundreds of thousands in ETH.

typo, oops. Forget the "see."

Alameda(?) (1/1):

This address has a ton of FTT, SRM, and SUSHI.

Of course, no confirmation it's Alameda, though I'm fairly sure it is.

An interesting note is the 8m xSUSHI.

This address has a ton of FTT, SRM, and SUSHI.

Of course, no confirmation it's Alameda, though I'm fairly sure it is.

An interesting note is the 8m xSUSHI.

Struck Capital(?) (1/1):

Struck (h/t: @nansen_ai) holds $2.5m in SNX, $700k in Rocket Pool, $450k of sUSD as collateral in AAVE, and more.

They also own 1.1m tokens of old SNX for some reason.

Struck (h/t: @nansen_ai) holds $2.5m in SNX, $700k in Rocket Pool, $450k of sUSD as collateral in AAVE, and more.

They also own 1.1m tokens of old SNX for some reason.

There remain a bunch of other entities in the space with publicly-known/likely Ethereum addresses.

Will have to cover those at a later date.

The Celsius one is fascinating to me because they seem to be on top of the yield farming game.

Will have to cover those at a later date.

The Celsius one is fascinating to me because they seem to be on top of the yield farming game.

• • •

Missing some Tweet in this thread? You can try to

force a refresh