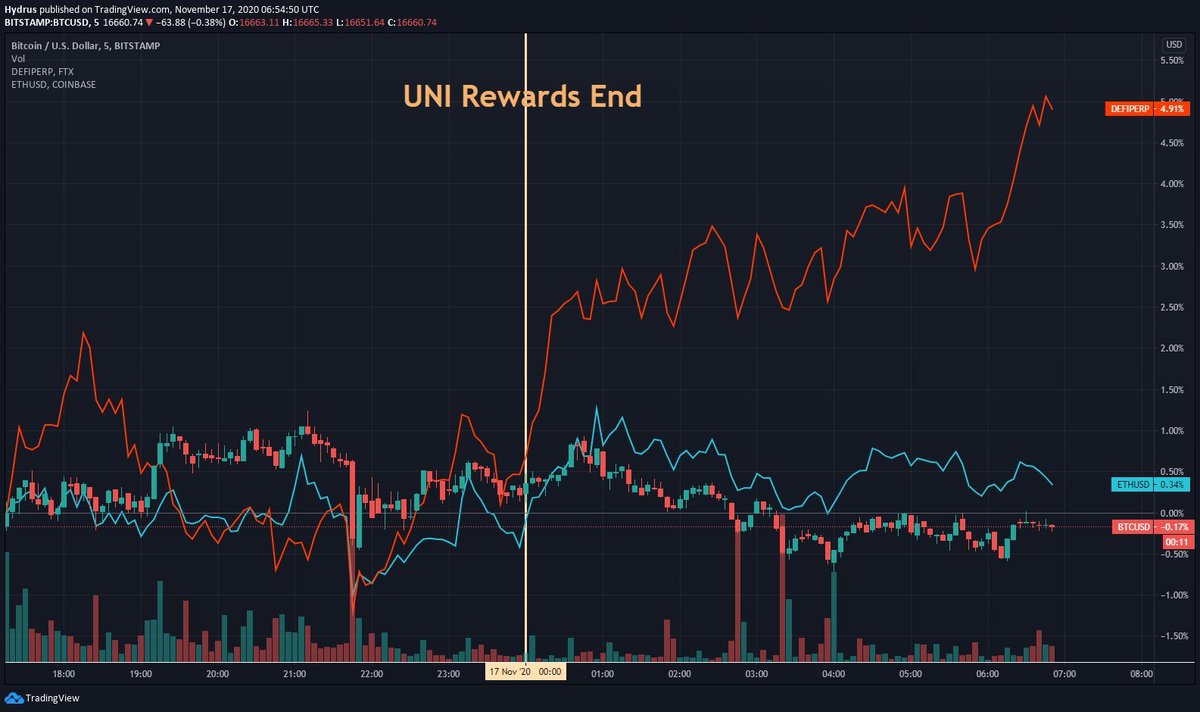

Since UNI rewards ended yesterday, Uniswap's TVL has dropped by 40% to $1.9 billion. The bleeding shows no signs of abating yet.

Let's take a quick look at a few large liquidity providers (at random) and what they are doing with their freed-up capital. 👇

Let's take a quick look at a few large liquidity providers (at random) and what they are doing with their freed-up capital. 👇

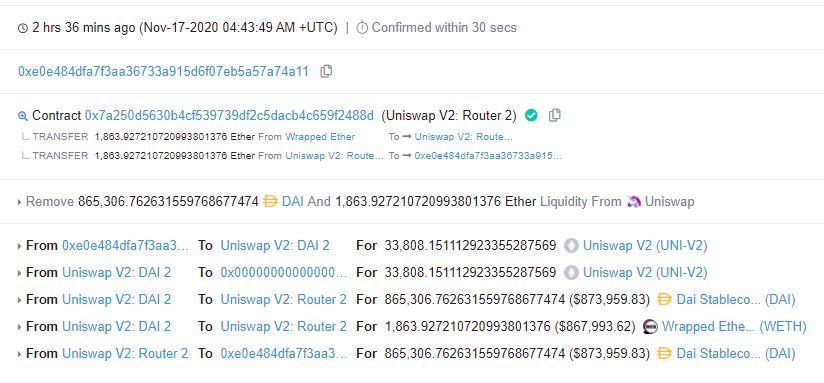

0xe0e withdrew $1.7m worth of liquidity from Uniswap's ETH-DAI pair.

They deposited all of that capital immediately into cAssets, cDAI and cETH.

They deposited all of that capital immediately into cAssets, cDAI and cETH.

0x975 withdrew $2.8m worth of liq from ETH-DAI.

They deposited all that capital back into Binance without converting the ETH into DAI or vice-versa.

They made this addy with the sole purpose of farming UNI, meaning they're probs looking to re-allocate to DeFi or BTC (UOA).

They deposited all that capital back into Binance without converting the ETH into DAI or vice-versa.

They made this addy with the sole purpose of farming UNI, meaning they're probs looking to re-allocate to DeFi or BTC (UOA).

0x7bb withdrew $5.5m in liq from DAI-ETH.

They converted the DAI into USDC, kept the ETH, and distributed the USDC amongst into a number of wallets. Most of the USDC was sent to FTX, though some was deposited into Yearn's cDAI/cUSDC vault.

They converted the DAI into USDC, kept the ETH, and distributed the USDC amongst into a number of wallets. Most of the USDC was sent to FTX, though some was deposited into Yearn's cDAI/cUSDC vault.

0xf92 withdrew $3.3m from ETH-DAI.

The liquidity was quickly zapped into ETH-DAI LP tokens on SushiSwap, then staked for SUSHI.

The liquidity was quickly zapped into ETH-DAI LP tokens on SushiSwap, then staked for SUSHI.

0x161 withdrew $400,000 from ETH-DAI.

The ETH was deposited into Compound's cETH money market and the DAI was converted into DeFireX DAI (dDAI) in another address.

The ETH was deposited into Compound's cETH money market and the DAI was converted into DeFireX DAI (dDAI) in another address.

0x4f7 took the $1.7m they had in ETH-DAI and the $11.5m they had in ETH-WBTC and deposited that into SushiSwap.

Vampire attack 2.0 playing out in real time.

Vampire attack 2.0 playing out in real time.

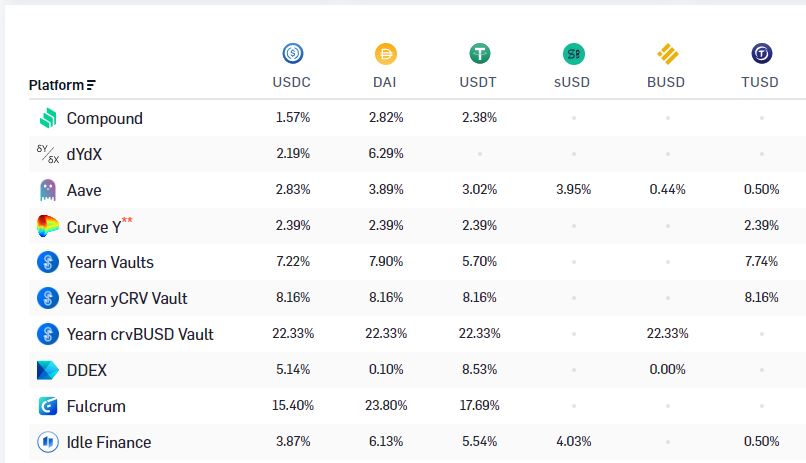

It appears that most are sitting on their stables and ETH for now.

We're probably going to see some interesting movements in DeFi yields and lending protocol TVLs.

Most importantly, we could see movements in coins down the risk curve over the next days.

We're probably going to see some interesting movements in DeFi yields and lending protocol TVLs.

Most importantly, we could see movements in coins down the risk curve over the next days.

https://twitter.com/n2ckchong/status/1328592879896424451

I also expect SushiSwap to absorb lots of TVL.

We're seeing a strategic provision of SUSHI rewards to the four Uniswap pools where rewards were just pulled.

@Wangarian1 did an amazing comprehensive analysis of the SUSHI bull case in this thread:

We're seeing a strategic provision of SUSHI rewards to the four Uniswap pools where rewards were just pulled.

@Wangarian1 did an amazing comprehensive analysis of the SUSHI bull case in this thread:

https://twitter.com/Wangarian1/status/1328005346225319936

Sorry for like the third thread in six hours.

There's just a ton going on in DeFi... as normal.

Will do a follow-up thread with a more granular analysis in a few days.

There's just a ton going on in DeFi... as normal.

Will do a follow-up thread with a more granular analysis in a few days.

• • •

Missing some Tweet in this thread? You can try to

force a refresh