Wanted to bump this thread due to the Saffron Finance craze.

What I said about BarnBridge applies to Saffron - they're fundamentally similar projects with similar goals.

Saffron just launched first.

Here's a brief explanation of why $SFI is rallying so hard (up 400% today).

What I said about BarnBridge applies to Saffron - they're fundamentally similar projects with similar goals.

Saffron just launched first.

Here's a brief explanation of why $SFI is rallying so hard (up 400% today).

https://twitter.com/n2ckchong/status/1318314737864638464

Tranches in finance are when a financial product/vehicle is split up into separate baskets to divvy up risk and yields to appeal to different investors.

There are junior tranches, which carry the most risk. If there is a default/crash, junior tranche holders take most losses.

There are junior tranches, which carry the most risk. If there is a default/crash, junior tranche holders take most losses.

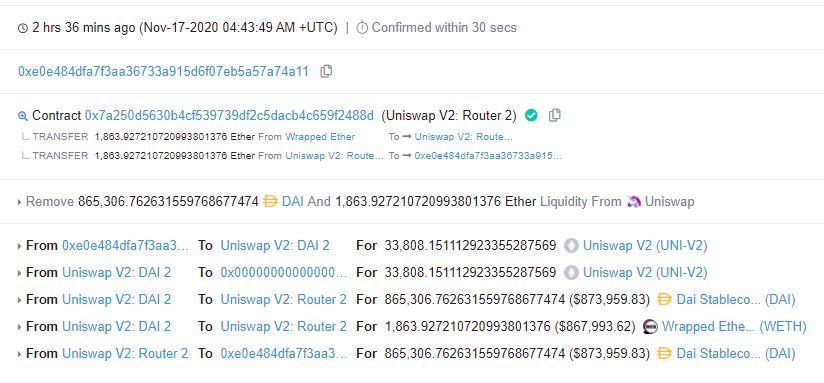

To acquire Saffron Finance's governance token, SFI, users must deposit ETH-SFI Uniswap LP tokens or deposit into the two supported tranches, the "S" (senior) tranche and the "A" (junior) tranche.

- S tranche gets 71.25% of emissions

- A tranche gets 3.75%

- Uniswap LPs get 25%

- S tranche gets 71.25% of emissions

- A tranche gets 3.75%

- Uniswap LPs get 25%

To deposit in the S tranche, all you need is DAI. You deposit DAI and get paid in interest from Compound and SFI.

To deposit in the A tranche, you need DAI *AND* SFI at a 1,000:1 ratio. The A tranche is yielding over 10x what the S tranche is yielding in Compound interest alone.

To deposit in the A tranche, you need DAI *AND* SFI at a 1,000:1 ratio. The A tranche is yielding over 10x what the S tranche is yielding in Compound interest alone.

As the A tranche has a higher barrier to entry, the amount of capital in the pool is minimal, far below that of the S tranche.

It's at a point where someone depositing DAI into the A tranche will get 4x the SFI rewards they would depositing that same DAI in the S tranche.

It's at a point where someone depositing DAI into the A tranche will get 4x the SFI rewards they would depositing that same DAI in the S tranche.

The A tranche is becoming increasingly attractive as the price of SFI rises, meaning that those that want in must buy SFI on Uniswap.

Couple that with limited liquidity and the SFI pump is becoming recursive upward.

Couple that with limited liquidity and the SFI pump is becoming recursive upward.

@MrGavinLow did a great job running the exact numbers for SFI farming in this thread.

Check it out:

But in my opinion, I think SFI is temporarily overvalued. The market doesn't know how to react to this unique tokenomics decision.

Check it out:

https://twitter.com/MrGavinLow/status/1329464821402660864

But in my opinion, I think SFI is temporarily overvalued. The market doesn't know how to react to this unique tokenomics decision.

Per his numbers, a $10,000 DAI deposit will yield approximately 17.5 SFI at the end of the epoch in 10 days. That SFI currently has a value of $12,250.

It's unwise to assume SFI will hold these levels, but assuming a 50% drop, that's still $6k in SFI + interest in two weeks.

It's unwise to assume SFI will hold these levels, but assuming a 50% drop, that's still $6k in SFI + interest in two weeks.

Disclosure: I don't hold SFI.

Also, since they're an anon team and the contracts are unaudited, please keep your head up with Saffron.

Also, since they're an anon team and the contracts are unaudited, please keep your head up with Saffron.

• • •

Missing some Tweet in this thread? You can try to

force a refresh