Hands down one of the coolest DeFi products I've seen in recent months is Alpha Homora by @AlphaFinanceLab.

The product has seen a lot of attention over recent days as investors seek higher yields on Ethereum yield farming and liquidity mining.

Let's take a closer look.

👇

The product has seen a lot of attention over recent days as investors seek higher yields on Ethereum yield farming and liquidity mining.

Let's take a closer look.

👇

To put it simply, Alpha Homora allows users to obtain leverage on Ethereum yield farming.

It also automates the yield farming process, even if the user does not want to take leverage.

This is similar to what the @zapper_fi team did in its early days with Zaps.

It also automates the yield farming process, even if the user does not want to take leverage.

This is similar to what the @zapper_fi team did in its early days with Zaps.

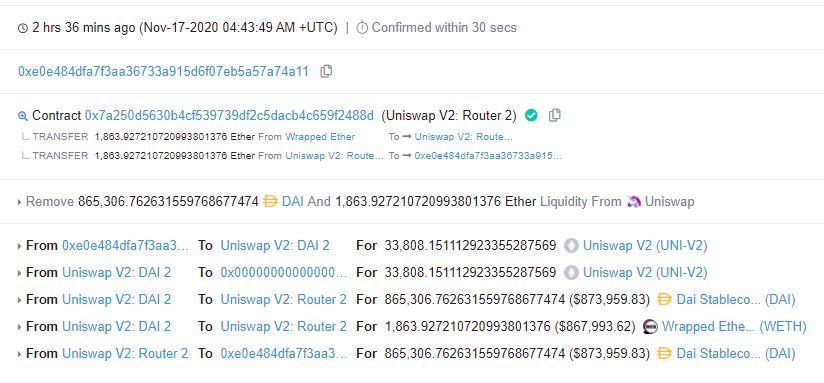

When you want to LP one ETH into ETH/WBTC on Uniswap, you swap 0.5 ETH into WBTC, then supply both to the pool. Cool.

But let's say you want to collect more in trading fees or in UNI (if rewards are voted back in), you can take leverage of up to 2.5x (used to be like 3x).

But let's say you want to collect more in trading fees or in UNI (if rewards are voted back in), you can take leverage of up to 2.5x (used to be like 3x).

Alpha automates the processing of entering the liquidity pool, which is often gas-intensive for small farmers, and boosts LP rewards and yield farming rewards with those LP tokens.

Of course, since there's leverage involved, there are risks.

Firstly, your exposure to IL increases proportionally with the leverage you take.

Secondly, you can get liquidated if you're not careful.

Firstly, your exposure to IL increases proportionally with the leverage you take.

Secondly, you can get liquidated if you're not careful.

As a reminder, by taking leverage in this fashion, you're basically shorting some ETH to some extent.

Like with borrowing through Aave, Compound, or otherwise, keep an eye on the health factors of your positions.

Like with borrowing through Aave, Compound, or otherwise, keep an eye on the health factors of your positions.

I want to take a moment to highlight Alpha's interest-bearing ETH vault.

It's the epitome of a symbiotic DeFi product benefiting all participants.

I believe this may be one of the highest yield farming products that pays out yields in ETH proper, not governance tokens.

It's the epitome of a symbiotic DeFi product benefiting all participants.

I believe this may be one of the highest yield farming products that pays out yields in ETH proper, not governance tokens.

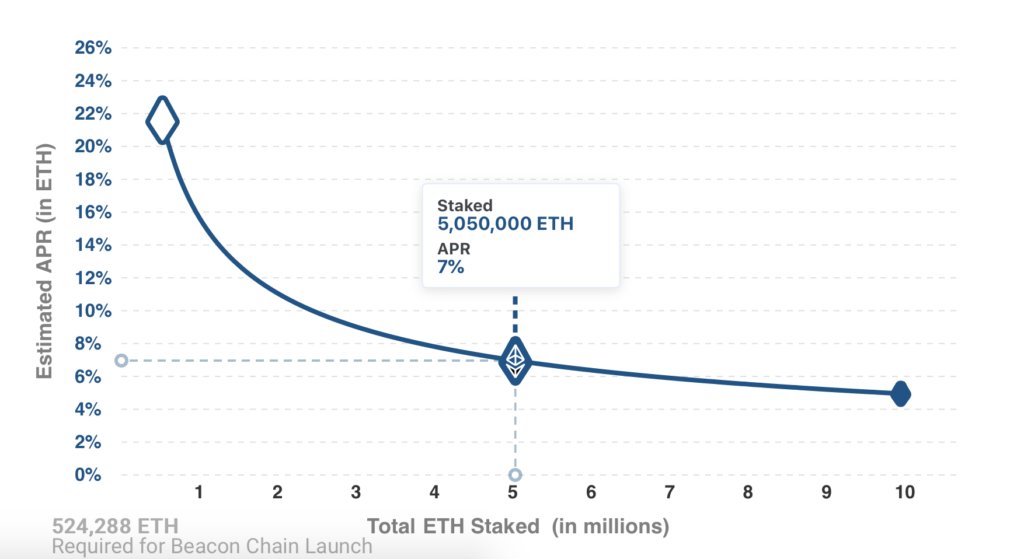

To allow users to take leverage on their LP or farming deposits, there needs to be a pool of ETH that can be drawn upon to act as leverage.

The yield of the pool scales with utilization (7-100% APY), though it's sat fairly steady in the 10-15% APY range over the past week.

The yield of the pool scales with utilization (7-100% APY), though it's sat fairly steady in the 10-15% APY range over the past week.

The reason why farmers are fine paying this much in interest on borrowing ETH (normally 0-1% on Aave or Compound) is the yields they are getting outweigh their interest cost.

As a result, ibETH depositors win, as do the yield farmers using the protocol.

Win-win, right?

As a result, ibETH depositors win, as do the yield farmers using the protocol.

Win-win, right?

Another cool aspect of Alpha Homora is the bounty hunters.

To ensure farms have compounding principal, Alpha enlists "bounty hunters" to call reinvest. 3% of the pending reward is distributed to the bounty hunter.

I'm sure it's all bots at this point - still cool tho.

To ensure farms have compounding principal, Alpha enlists "bounty hunters" to call reinvest. 3% of the pending reward is distributed to the bounty hunter.

I'm sure it's all bots at this point - still cool tho.

For those wondering about the recent concerns about the centralization of ALPHA in one Ethereum address, the team published a comprehensive response:

https://twitter.com/AlphaFinanceLab/status/1328958898557100032

Overall, @AlphaFinanceLab's product ties in some of the best primitives DeFi has to offer (yield farming, decentralized pooled loans, etc.) to bolster yields for users.

Of course, that comes at the cost of increased IL risk and smart contract risk. Cool product nonetheless.

Of course, that comes at the cost of increased IL risk and smart contract risk. Cool product nonetheless.

Disclosure: I do not hold ALPHA right now, though I used Alpha Homora to yield farm for a few weeks and held a small amount of ALPHA.

I genuinely think Alpha Homora is a fascinating product worth looking at, even if ALPHA doesn't catch your fancy.

I genuinely think Alpha Homora is a fascinating product worth looking at, even if ALPHA doesn't catch your fancy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh