1/

Get a cup of coffee.

In this thread, I'll help you understand Stock Based Compensation (SBC).

As investors, I think we can gain a lot of insight into companies by looking at their SBC policies -- what incentives they create, how much they cost, etc.

Get a cup of coffee.

In this thread, I'll help you understand Stock Based Compensation (SBC).

As investors, I think we can gain a lot of insight into companies by looking at their SBC policies -- what incentives they create, how much they cost, etc.

2/

The goal behind SBC is: we want a company's *executives* -- the CEO, upper management, ideally anyone making important decisions -- to think like *owners*.

That way, they'll run the company in a way that maximizes the long-term interests of the owners (us shareholders).

The goal behind SBC is: we want a company's *executives* -- the CEO, upper management, ideally anyone making important decisions -- to think like *owners*.

That way, they'll run the company in a way that maximizes the long-term interests of the owners (us shareholders).

3/

The logic goes: if we want executives to *think* like owners, why not just give them shares of the company and *make* them owners?

So that's the idea. We pay executives only partly in cash. The rest of their salary is in the form of company shares.

That's SBC.

The logic goes: if we want executives to *think* like owners, why not just give them shares of the company and *make* them owners?

So that's the idea. We pay executives only partly in cash. The rest of their salary is in the form of company shares.

That's SBC.

4/

There are many advantages to paying executives in shares.

First, shares are like the company's own *currency*.

Just as governments can print all the money they want, companies can (mostly) create all the shares they want out of thin air. It *seemingly* costs nothing.

There are many advantages to paying executives in shares.

First, shares are like the company's own *currency*.

Just as governments can print all the money they want, companies can (mostly) create all the shares they want out of thin air. It *seemingly* costs nothing.

5/

Second, there are tax advantages.

Suppose a company pays its CEO $1M in cash.

This $1M is clearly a cost to the company. And so, it is deducted from the company's earnings *before* income taxes are paid.

Second, there are tax advantages.

Suppose a company pays its CEO $1M in cash.

This $1M is clearly a cost to the company. And so, it is deducted from the company's earnings *before* income taxes are paid.

6/

Similar reasoning applies when the CEO is paid $1M worth of shares.

Of course, tax laws are super complicated. Only a portion of SBC may be deductible for tax purposes -- so the numbers may not work out exactly the same. But there are usually important tax advantages to SBC.

Similar reasoning applies when the CEO is paid $1M worth of shares.

Of course, tax laws are super complicated. Only a portion of SBC may be deductible for tax purposes -- so the numbers may not work out exactly the same. But there are usually important tax advantages to SBC.

7/

There are 2 main types of SBC: 1) options, and 2) Restricted Share Units (RSUs).

What we've been discussing so far -- issuing new shares and paying executives with them -- that's RSUs.

There are 2 main types of SBC: 1) options, and 2) Restricted Share Units (RSUs).

What we've been discussing so far -- issuing new shares and paying executives with them -- that's RSUs.

8/

Options are somewhat more complicated. Instead of directly giving executives shares, we give them the *right* to buy shares at a particular price at a particular time in the future.

For more:

Options are somewhat more complicated. Instead of directly giving executives shares, we give them the *right* to buy shares at a particular price at a particular time in the future.

For more:

https://twitter.com/10kdiver/status/1276905920929206272

9/

There's also the concept of "vesting".

For example, a CEO may be promised 1M shares as SBC. But he may not get all the shares right away. He may have to *earn* them over a period of time. That's called *vesting*.

There's also the concept of "vesting".

For example, a CEO may be promised 1M shares as SBC. But he may not get all the shares right away. He may have to *earn* them over a period of time. That's called *vesting*.

10/

For example, if the 1M promised shares vest uniformly over 4 years, the CEO will become eligible to get 250K shares in Year 1, another 250K shares in Year 2, and so on up to and including Year 4.

For example, if the 1M promised shares vest uniformly over 4 years, the CEO will become eligible to get 250K shares in Year 1, another 250K shares in Year 2, and so on up to and including Year 4.

11/

And vesting need not be automatic. It can be conditional on the executives achieving some performance targets.

For example, 500K of the 1M shares above may vest *no matter what*, but the other 500K may vest only if per-share earnings double over the next 4 years.

And vesting need not be automatic. It can be conditional on the executives achieving some performance targets.

For example, 500K of the 1M shares above may vest *no matter what*, but the other 500K may vest only if per-share earnings double over the next 4 years.

12/

As shareholders, it's useful to look at SBC both *quantitatively* and *qualitatively*.

Quantitatively, we want to understand how much SBC is likely to cost us over the long run -- via *dilution* of our stake in the company.

As shareholders, it's useful to look at SBC both *quantitatively* and *qualitatively*.

Quantitatively, we want to understand how much SBC is likely to cost us over the long run -- via *dilution* of our stake in the company.

13/

Just as each dollar becomes less valuable (via inflation, more money chasing the same goods/services) when the Fed prints money, each share becomes less valuable when a company issues new shares for SBC.

Thankfully, it's much simpler to analyze dilution than inflation.

Just as each dollar becomes less valuable (via inflation, more money chasing the same goods/services) when the Fed prints money, each share becomes less valuable when a company issues new shares for SBC.

Thankfully, it's much simpler to analyze dilution than inflation.

14/

Qualitatively, we want to understand how the CEO's and other employees' incentives are shaped by the company's SBC plan.

Ideally, we want these incentives to be directly aligned with shareholder interests. After all, that was the whole purpose of SBC in the first place.

Qualitatively, we want to understand how the CEO's and other employees' incentives are shaped by the company's SBC plan.

Ideally, we want these incentives to be directly aligned with shareholder interests. After all, that was the whole purpose of SBC in the first place.

15/

In practice, though, there may be some "mis-alignment" of incentives.

For example, SBC plans may incentivize executives to take on more risks with shareholder capital, or retain more earnings than necessary, or carry out share buybacks at inopportune times.

In practice, though, there may be some "mis-alignment" of incentives.

For example, SBC plans may incentivize executives to take on more risks with shareholder capital, or retain more earnings than necessary, or carry out share buybacks at inopportune times.

16/

Let's take the quantitative part first.

In the US, companies are required to take a charge against reported earnings for SBC.

But does this charge capture the *real* cost of SBC to shareholders? I'd say no.

Let's take the quantitative part first.

In the US, companies are required to take a charge against reported earnings for SBC.

But does this charge capture the *real* cost of SBC to shareholders? I'd say no.

17/

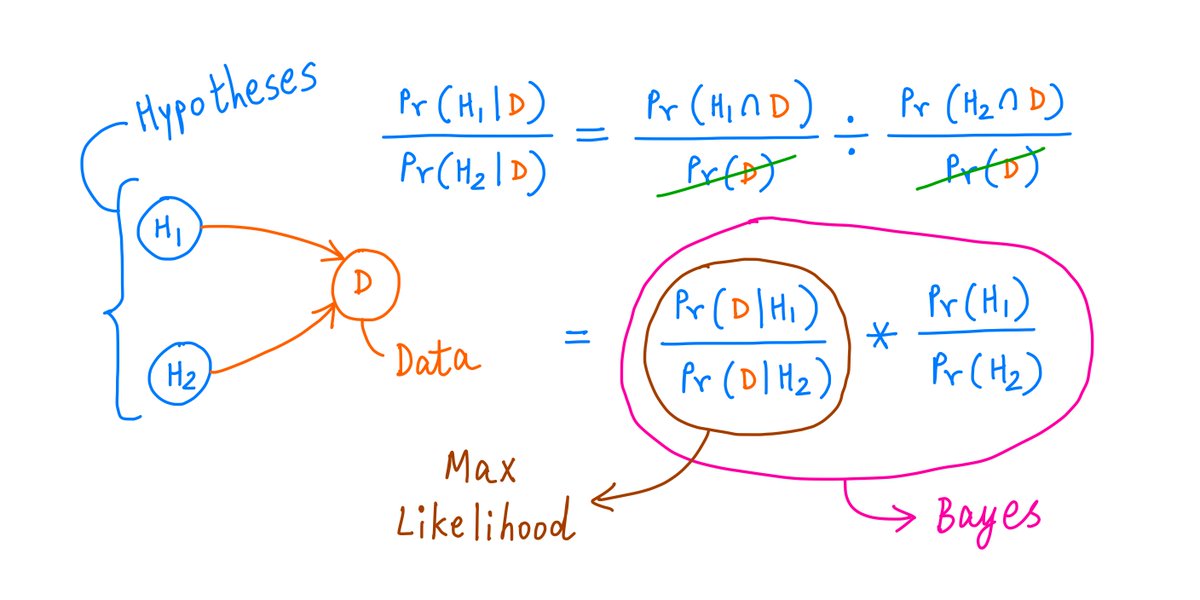

This is where *first principles thinking* helps.

*Per-share earnings* is what counts for shareholders.

The real cost of SBC is not that it reduces the numerator (the company's earnings), but that it increases the denominator (the number of shares outstanding).

This is where *first principles thinking* helps.

*Per-share earnings* is what counts for shareholders.

The real cost of SBC is not that it reduces the numerator (the company's earnings), but that it increases the denominator (the number of shares outstanding).

18/

For example, suppose a company earned $1B this year -- not counting SBC.

Also, suppose the company can earn 15% on all invested capital.

Since this is a good return, the company plans to reinvest all its earnings back into its own business every year for the next 20 years.

For example, suppose a company earned $1B this year -- not counting SBC.

Also, suppose the company can earn 15% on all invested capital.

Since this is a good return, the company plans to reinvest all its earnings back into its own business every year for the next 20 years.

19/

So, over the next 20 years, the company's earnings will grow at a 15% clip.

At the end of 20 years, the company's annual earnings will be $1B*(1.15^20) = ~$16.37B.

That's without considering SBC.

So, over the next 20 years, the company's earnings will grow at a 15% clip.

At the end of 20 years, the company's annual earnings will be $1B*(1.15^20) = ~$16.37B.

That's without considering SBC.

20/

Now, let's say we dilute the company by 2% per year for SBC.

That is, for every 100 shares outstanding, we create 2 shares out of thin air and distribute them to company executives as compensation -- every year for the next 20 years.

Now, let's say we dilute the company by 2% per year for SBC.

That is, for every 100 shares outstanding, we create 2 shares out of thin air and distribute them to company executives as compensation -- every year for the next 20 years.

21/

So, over the next 20 years, the number of shares outstanding will grow by a factor of 1.02^20 = ~1.49.

And what of *per-share* earnings?

They will grow by a factor of (1.15/1.02)^20 = ~11.01.

So, over the next 20 years, the number of shares outstanding will grow by a factor of 1.02^20 = ~1.49.

And what of *per-share* earnings?

They will grow by a factor of (1.15/1.02)^20 = ~11.01.

22/

So, without SBC, earnings grow by a factor of ~16.

But even with a modest (understated, really) 2% SBC, *per-share earnings* only grow by a factor of ~11.

Thus, over the next 20 years, each share will lose about (5/16)'th, or ~31% of its value as a direct result of SBC.

So, without SBC, earnings grow by a factor of ~16.

But even with a modest (understated, really) 2% SBC, *per-share earnings* only grow by a factor of ~11.

Thus, over the next 20 years, each share will lose about (5/16)'th, or ~31% of its value as a direct result of SBC.

23/

I'd argue that this "~31% tax" is the real cost of SBC to long-term shareholders of the company.

In this case, SBC will cause the number of shares outstanding to grow steadily over the next 20 years -- by a factor of ~1.49.

I'd argue that this "~31% tax" is the real cost of SBC to long-term shareholders of the company.

In this case, SBC will cause the number of shares outstanding to grow steadily over the next 20 years -- by a factor of ~1.49.

24/

Many companies don't like to report such increasing share counts. It depresses per-share earnings, and may give shareholders the impression that SBC is out of control.

So companies like to *buy back* shares.

Many companies don't like to report such increasing share counts. It depresses per-share earnings, and may give shareholders the impression that SBC is out of control.

So companies like to *buy back* shares.

25/

With their left hand, they issue new shares and give them to executives as SBC. With their right hand, they buy back shares from the market and retire them.

And then they say -- this year, we returned billions of dollars back to shareholders.😂😂

With their left hand, they issue new shares and give them to executives as SBC. With their right hand, they buy back shares from the market and retire them.

And then they say -- this year, we returned billions of dollars back to shareholders.😂😂

26/

In such cases, I like to ask 3 questions:

1. What did the company say they spent on SBC?

2. How many shares did they say they bought back?

3. What was the actual reduction in shares outstanding?

In such cases, I like to ask 3 questions:

1. What did the company say they spent on SBC?

2. How many shares did they say they bought back?

3. What was the actual reduction in shares outstanding?

27/

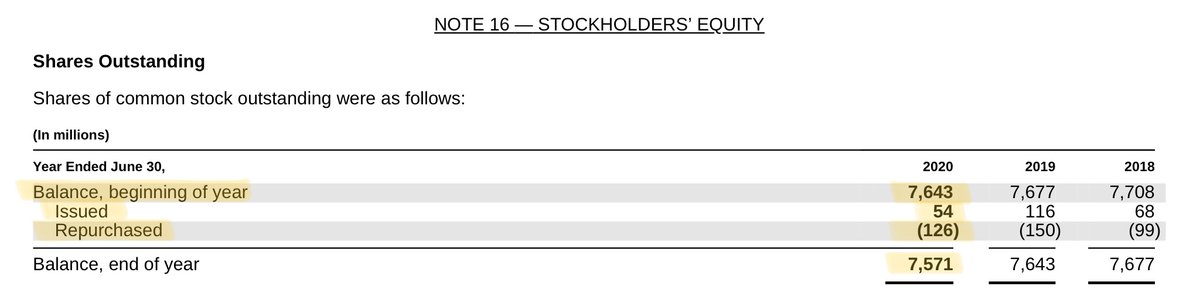

Let's take Microsoft, for example.

In their 2020 10-K, they said they bought back 126M shares for $19.7B.

But the share count declined by only 72M.

That's because the remaining 126M - 72M = 54M shares were issued to executives as SBC -- just this year.

Let's take Microsoft, for example.

In their 2020 10-K, they said they bought back 126M shares for $19.7B.

But the share count declined by only 72M.

That's because the remaining 126M - 72M = 54M shares were issued to executives as SBC -- just this year.

28/

So, about 54/126 (or ~42.86%) of their stock buybacks simply went to offset the dilution caused by SBC -- *not* to retire shares.

Since they spent $19.7B of *cash* to buy back shares, I'd say the *real* cost of SBC to shareholders in 2020 was ~42.86% of $19.7B = ~$8.4B.

So, about 54/126 (or ~42.86%) of their stock buybacks simply went to offset the dilution caused by SBC -- *not* to retire shares.

Since they spent $19.7B of *cash* to buy back shares, I'd say the *real* cost of SBC to shareholders in 2020 was ~42.86% of $19.7B = ~$8.4B.

29/

But how much of a hit did Microsoft take to *earnings* for SBC? Only ~$5.3B.

What about the remaining $8.4B - $5.3B = $3.1B?

I'd say this is a real cost, but it didn't show up in Microsoft's financial statements.

But how much of a hit did Microsoft take to *earnings* for SBC? Only ~$5.3B.

What about the remaining $8.4B - $5.3B = $3.1B?

I'd say this is a real cost, but it didn't show up in Microsoft's financial statements.

30/

In addition, we also have to worry about the *qualitative* costs of SBC.

Proponents of SBC like to argue that giving executives shares puts them in the same boat as owners.

But this "alignment of incentives" may not be all that perfect.

In addition, we also have to worry about the *qualitative* costs of SBC.

Proponents of SBC like to argue that giving executives shares puts them in the same boat as owners.

But this "alignment of incentives" may not be all that perfect.

31/

*Owners* had to shell out actual cash to buy their shares in the market. Big upside, big downside.

*Executives* were just given the shares as compensation. Big upside, somewhat muted downside.

At the very least, there's a big psychological difference between the two.

*Owners* had to shell out actual cash to buy their shares in the market. Big upside, big downside.

*Executives* were just given the shares as compensation. Big upside, somewhat muted downside.

At the very least, there's a big psychological difference between the two.

32/

This asymmetric risk/reward perception created by SBC can create incentives for executives to boost short-term earnings at the expense of long-term results.

For example, it can lead to taking on too much debt, making over-priced acquisitions and share repurchases, etc.

This asymmetric risk/reward perception created by SBC can create incentives for executives to boost short-term earnings at the expense of long-term results.

For example, it can lead to taking on too much debt, making over-priced acquisitions and share repurchases, etc.

33/

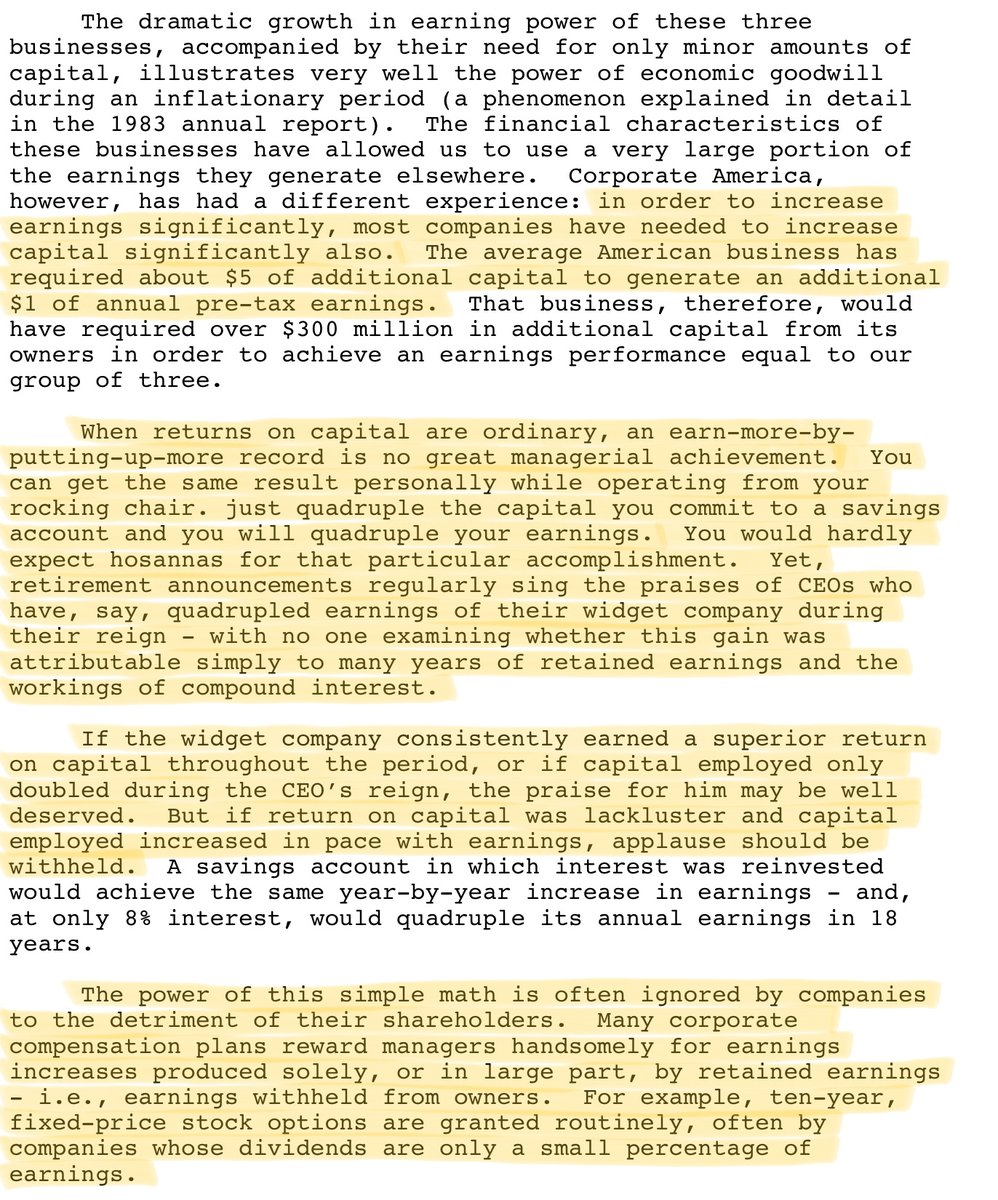

Also, large stock grants whose vesting is conditional on meeting EPS targets can incentivize executives to retain and reinvest earnings in low-return projects -- even though owners may have been better served had those earnings been distributed as dividends.

Also, large stock grants whose vesting is conditional on meeting EPS targets can incentivize executives to retain and reinvest earnings in low-return projects -- even though owners may have been better served had those earnings been distributed as dividends.

34/

For example, here's a snippet from Buffett's 1985 letter arguing that *return on capital* is a far better yardstick for determining executive compensation than *earnings per share*.

Link: berkshirehathaway.com/letters/1985.h…

For example, here's a snippet from Buffett's 1985 letter arguing that *return on capital* is a far better yardstick for determining executive compensation than *earnings per share*.

Link: berkshirehathaway.com/letters/1985.h…

35/

I also very much recommend @ChrisBloomstran's 2019 Semper Augustus letter.

The section "Don't Fear The Repo" (beginning Pg. 47) covers the history of SBC -- options, RSUs, the evolution of accounting rules around them, etc.

Link: static.fmgsuite.com/media/document…

I also very much recommend @ChrisBloomstran's 2019 Semper Augustus letter.

The section "Don't Fear The Repo" (beginning Pg. 47) covers the history of SBC -- options, RSUs, the evolution of accounting rules around them, etc.

Link: static.fmgsuite.com/media/document…

36/

Many managements tell you to ignore SBC, as it's "not a real cost".

They prepare "non-GAAP" financials that add back SBC (and other expenses) to net income to arrive at "adjusted earnings".

When you see such antics, I hope you'll think of this graphic:

Many managements tell you to ignore SBC, as it's "not a real cost".

They prepare "non-GAAP" financials that add back SBC (and other expenses) to net income to arrive at "adjusted earnings".

When you see such antics, I hope you'll think of this graphic:

37/

Speaking of GAAP vs non-GAAP measures, I'd also like to recommend this wonderful (~1 hour) podcast episode by my friend @TreyHenninger.

You may disagree with his conclusions about Amazon, but his thought process is super valuable. diyinvesting.org/gaap-vs-non-ga…

Speaking of GAAP vs non-GAAP measures, I'd also like to recommend this wonderful (~1 hour) podcast episode by my friend @TreyHenninger.

You may disagree with his conclusions about Amazon, but his thought process is super valuable. diyinvesting.org/gaap-vs-non-ga…

38/

Also, to learn more about a company's executive compensation (including its SBC policies), reading its proxy statements can be very useful.

Here's a great article by @rationalwalk to get you started: rationalwalk.com/how-to-review-…

Also, to learn more about a company's executive compensation (including its SBC policies), reading its proxy statements can be very useful.

Here's a great article by @rationalwalk to get you started: rationalwalk.com/how-to-review-…

39/

And you may also want to learn more about corporate governance, board room dynamics, compensation committees, etc.

For this, I recommend following @NonGaap. His "corporate governance dark arts" series is excellent: nongaap.substack.com/p/profiting-fr…

And you may also want to learn more about corporate governance, board room dynamics, compensation committees, etc.

For this, I recommend following @NonGaap. His "corporate governance dark arts" series is excellent: nongaap.substack.com/p/profiting-fr…

40/

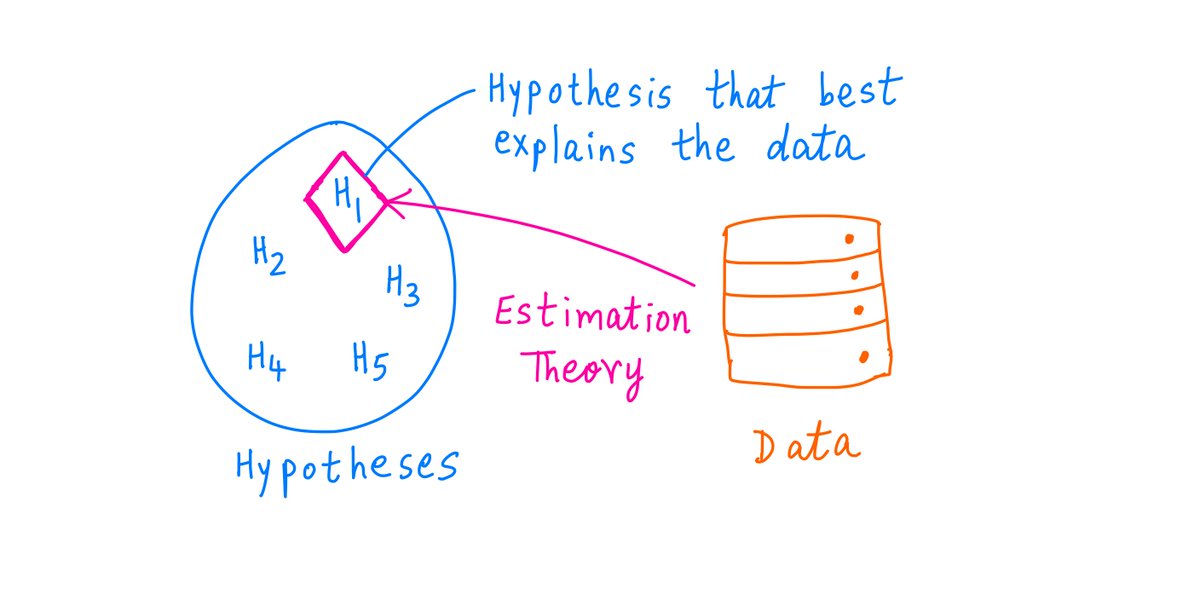

Finally, SBC is just one special case of a broader problem: designing a system of incentives.

When it comes to thinking about incentives, you can't beat Charlie Munger.

This book about him has many wonderful tidbits on incentive design: amazon.com/Poor-Charlies-…

Finally, SBC is just one special case of a broader problem: designing a system of incentives.

When it comes to thinking about incentives, you can't beat Charlie Munger.

This book about him has many wonderful tidbits on incentive design: amazon.com/Poor-Charlies-…

41/

Thanks for reading all the way through another one of my long threads. What would I do without you!

Have a great weekend!

/End

Thanks for reading all the way through another one of my long threads. What would I do without you!

Have a great weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh