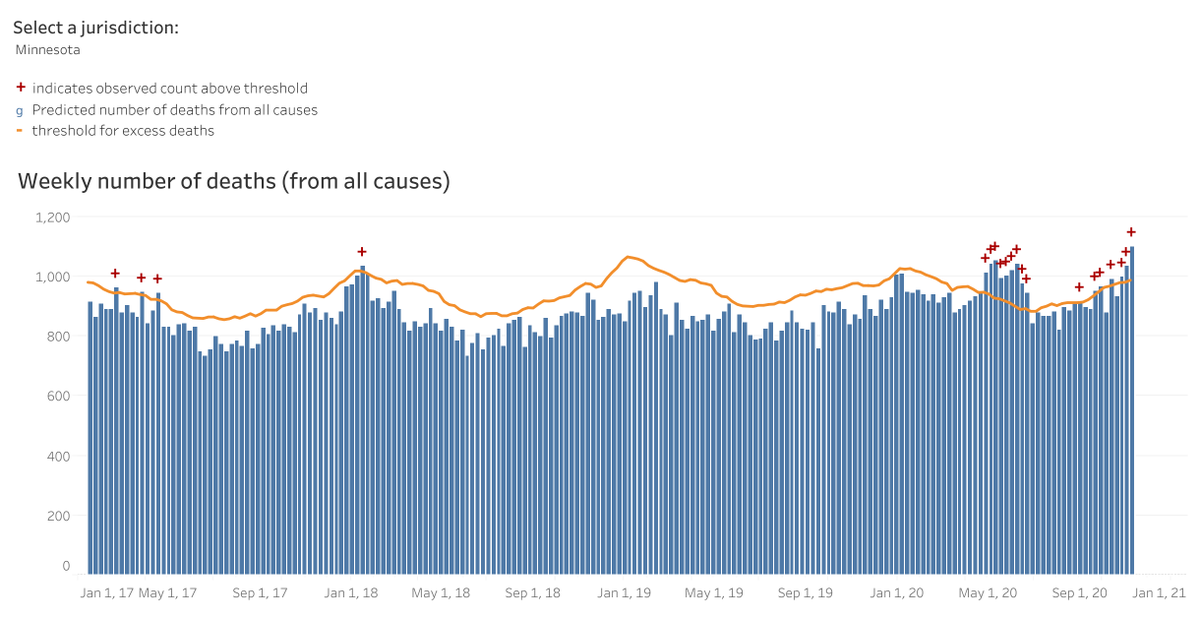

Excess Deaths Associated with COVID-19 through November 7th (Yellow line). Red circles are mortality for 2017-18 flu and 2020 Covid.

Infection spikes lead mortality by 2-3 weeks. This is going to get very ugly for the next months...

cdc.gov/nchs/nvss/vsrr…

Infection spikes lead mortality by 2-3 weeks. This is going to get very ugly for the next months...

cdc.gov/nchs/nvss/vsrr…

Note first wave locales like New York (April/May) and Florida (August/September) had their big spikes earlier this year (through November 7th)

The current spike in the Midwest has yet to show the bigger up on these charts but local reporting suggests they are very large.

Iowa and Minnesota are bad, Wisconsin even worse

(through November 7th)

Iowa and Minnesota are bad, Wisconsin even worse

(through November 7th)

North Dakota was spiking the week of November 7th, and has gotten worse since then; South Dakota is a few weeks behind their neighbor to the north.

South Dakota, which hosted Sturgis Motorcycle Rally Aug 6-15, may be SuperSpreader seed event for the entire midwest

South Dakota, which hosted Sturgis Motorcycle Rally Aug 6-15, may be SuperSpreader seed event for the entire midwest

West coast states Washington and California spiked early in the pandemic, as of Nov 7, have yet to see increases . . . but they are coming.

Bottom line: Covid infections are spreading dramatically + at the worst possible time - during the Thanksgiving travel season.

I go to Chicago for turkey day, but not this year. By this time next year life will be much closer to normal.

Stay home, be safe + enjoy your holiday.

I go to Chicago for turkey day, but not this year. By this time next year life will be much closer to normal.

Stay home, be safe + enjoy your holiday.

• • •

Missing some Tweet in this thread? You can try to

force a refresh