A few charts from the @ecb Financial Stability Review.

1. Total net funding of euro area households, firms and sovereigns, including various EU support schemes

ecb.europa.eu/pub/pdf/fsr/ec…

1. Total net funding of euro area households, firms and sovereigns, including various EU support schemes

ecb.europa.eu/pub/pdf/fsr/ec…

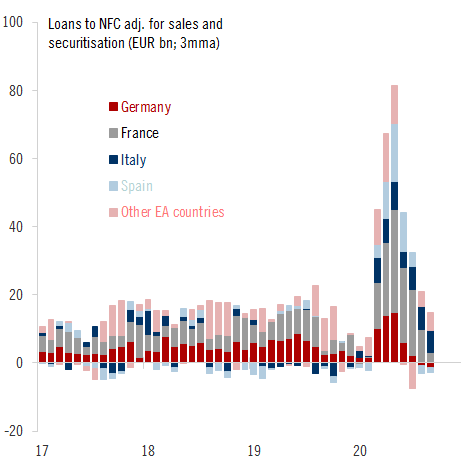

2. Bank loans to euro area corporates: more than 7% are affected by state guarantees, and 14% by moratoria.

3. Banks' Net Interest Income contracting due to margin compression. Overall profitability markedly lower due to loan loss provisioning too (though lower than predicted).

5. Public debt (bis): it's about the interest burden and flows more than the stock, and the EU package will help in NPV terms.

6. Public debt (ter): it's about contingent liabilities, too. Another reason to do whatever it takes to support the recovery.

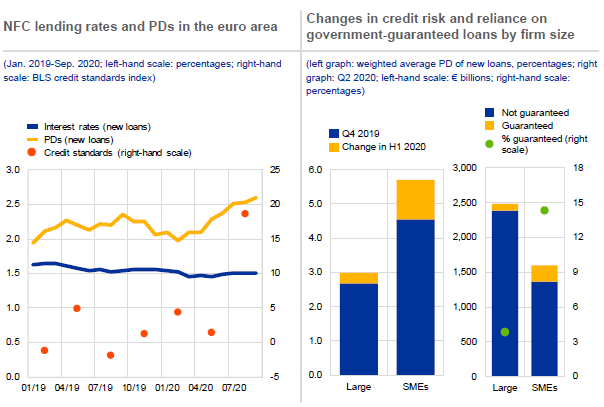

7. Corporates and SMEs: one of the @ecb's key messages is to avoid a premature withdrawal of loan guarantee schemes which could cause banks to tighten credit standards further and result in a credit crunch.

8. Corporates and SMEs: composite vulnerability indicator, insolvencies and GDP collapse. An extraordinary chart as pointed out by @jeuasommenulle.

9. Sovereign bond markets: the ECB was here to c̶l̶o̶s̶e̶ ̶t̶h̶e̶ ̶s̶p̶r̶e̶a̶d̶ eliminate fragmentation. Mission accomplished.

10. Section 3 on the banking sector. NII down on higher cash holdings, lower rates, state guarantees. Profitability unlikely to recover fully before 2022. Higher credit risk. Stronger sovereign-bank nexus. Apart from that, all fine.

• • •

Missing some Tweet in this thread? You can try to

force a refresh