Here we go- Chancellor is on his feet, so we're off Spending Review wise. Expect:

- grim economic news

- more spending (lots of it)

- warnings of tax rises/spending restraint to come (but almost none of it set out - unless it largely affects people in other countries)

- grim economic news

- more spending (lots of it)

- warnings of tax rises/spending restraint to come (but almost none of it set out - unless it largely affects people in other countries)

Chancellors wants to save "lives and livelihoods" - we know because he told us twice in about ten seconds

First announcement: extra spending needed to tackle covid next year = £55bn. This isnt a one year hit

GDP hit this year 11.3% - worst for 300 years (catastrophic but not as catastrophic as OBR previously feared)

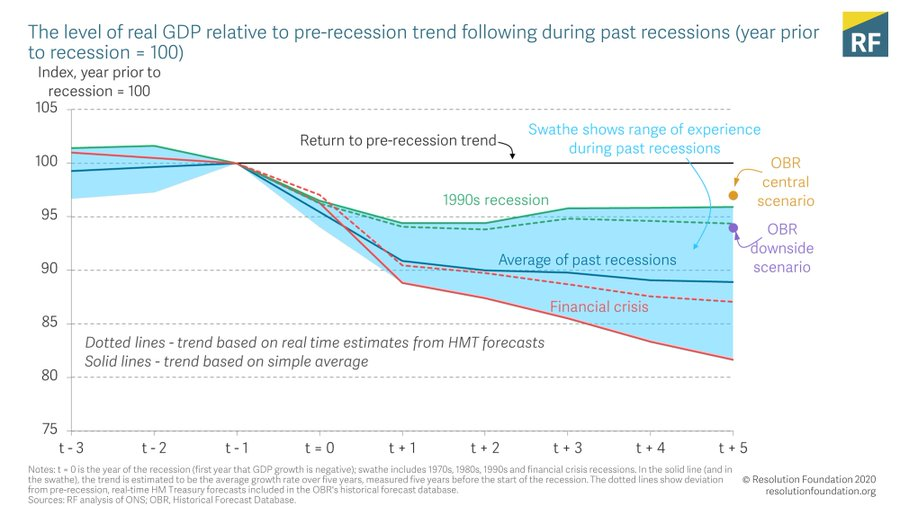

Economic hit lasts: takes until end of 2022 to get back to pre-crisis size of economy and 3% permanent hit to GDP (bad, but smaller than almost any previous recession)

Borrowing to be £394bn this year - more than twice the peak of the financial crisis. Borrowing comes down but remains elevated - and debt on a rising trajectory

It’s the policy response rather than the economic hit itself that is driving this (rightfully) huge level of borrowing

Unemployment forecast is for the peak to be lower and later (7.5% in middle of next year - 2.6m people). Remains above pre-crisis levels in middle of this decade (would still be much faster decline than previous recessions).

NHS pay rise but public sector pay freeze for rest of public sector - those earning below £24k get £250 pay rise (I think they are meant to be grateful after expectation management over last few days)

National Living Wage up 18p to £8.90/hr. Well below the 50p expected pre-crisis but reflects lower wage growth and leaves us on track for abolishing low pay in middle of decade

We’ll have to dig into details of next years spending - lots on covid but less clear on normal spending (technical point but our measurement of public sector costs/output is playing haywire with ‘real terms’ rise figures for this year and next)

Lots of promises on schools, police, prisons - reflects govt holding on to its pre-crisis political strategy: we’ve ended austerity we promise (doing so has got A LOT harder = tax rises to come)

Overseas aid cut (around £3bn) is about having a proof point of tough choices that doesn’t actually affect people in the UK (at least in short term)

£4bn levelling up fund - areas bid for cash. No way this is going to be doled out without political shenanigans(Chancellor explicitly says MPs must support schemes - obviously would only be an accidental side effect if that made MPs grateful)

All done: as expected headlines are 1) economy down 2) spending and borrowing up 3) softish warnings of tougher choices to come

• • •

Missing some Tweet in this thread? You can try to

force a refresh