We're now eight months into this crisis - what has it done to family budgets? A thread.

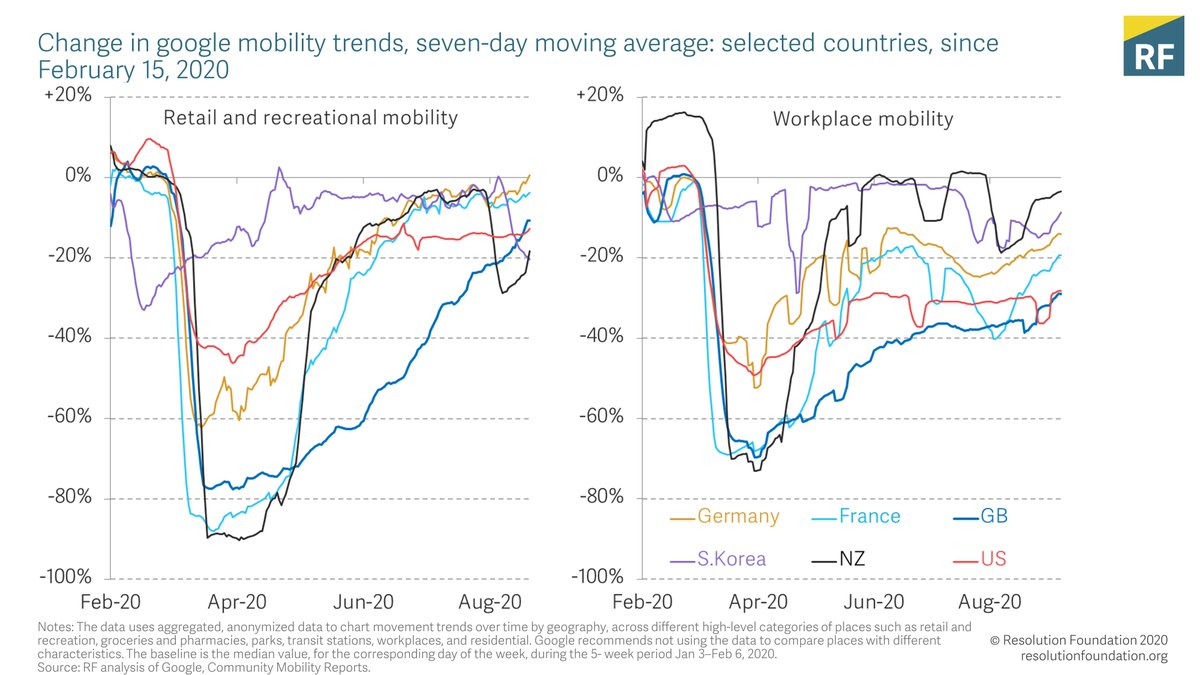

The economy reopening over the summer only saw small reductions in income falls (partly because unemployment also rose, and partly because policy protected families from depths of initial GDP falls)

Income hits have been quite persistent ie over 80% of those who had lower incomes recently had also had lower incomes during the first lockdown. This matters - bigger income hits are harder to deal with, but so are longer lasting ones

The labour market shock to households is largest for lower (but not the lowest, where fewer people work) income households. However...

...the overall income hit has been fairly even across different income groups - this reflects that policy has helped lower income households

Does that mean the crisis has been felt equally? Nope.

If you missed out on support (ie lost work but werent furloughed or didnt qualify for Self-Employed Income Support Scheme) the income hits are huge - the same is true for those newly relying on benefits

While income hits have been evenly shared, it is MUCH easier for higher income families to reduce spending (in fact the economic side of this crisis is all about better off families no longer spending on services that = lower earners jobs). Result? Bottom is squeezed + top saves

This shows up in who is most likely to be drawing down on savings to cope (=those with the lowest savings) or to be borrowing (those on lower incomes)

Last chart (I promise) - but an important one... the impact on families is about how long an income hit lasts not just how deep it is. 1-in-3 adults whose incomes have been persistently lower during this crisis cannot now afford basic items (e.g fresh fruit/veg or heating)

All this and more is in today's @resfoundation report from @karlhandscomb and Lindsay Judge - which is kindly supported by @HealthFdn resolutionfoundation.org/publications/c…

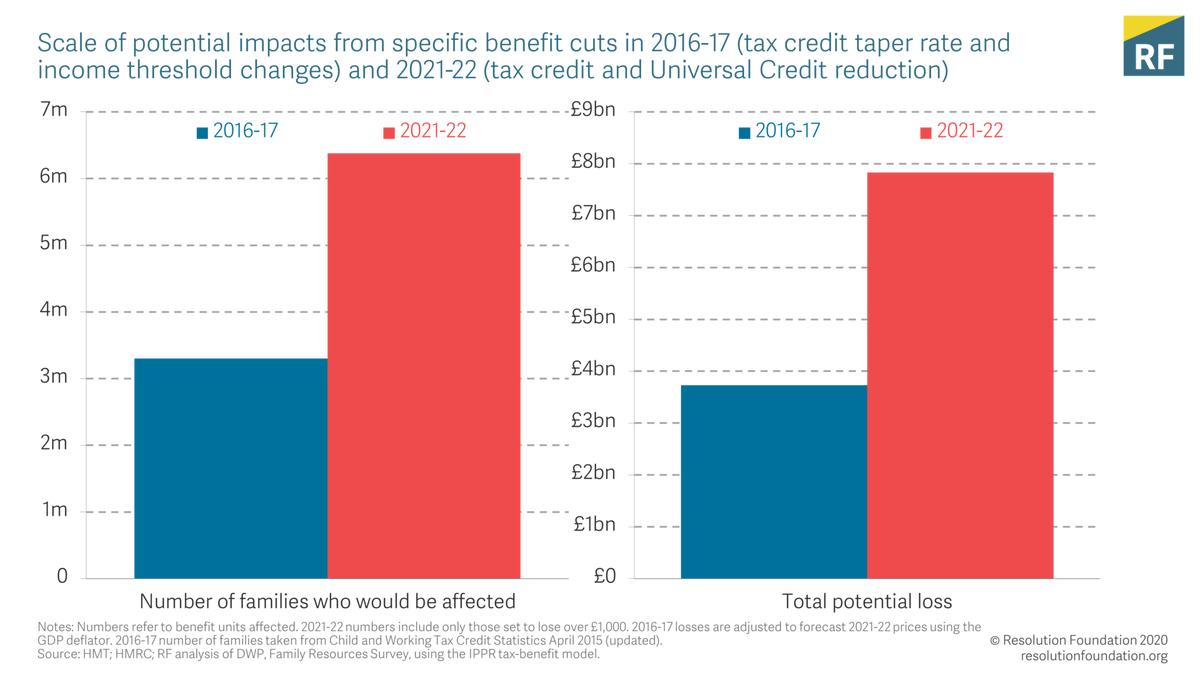

You can watch this morning's launch event with @OfficeGSBrown and @BethRigby - which got into what government needs to do about this (short version: we can't be cutting benefits this April from families already struggling with persistent income falls) resolutionfoundation.org/events/coping-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh