What happened on Thanksgiving 2020?

(Alameda edition -- a thread about maximizing)

(Alameda edition -- a thread about maximizing)

https://twitter.com/AlamedaTrabucco/status/1332036760939896832?s=20

I'm sure it's no surprise that the threads I post here are "delayed" a bit -- the sorts of insights I'm sharing tend to be about what *happened*, but at Alameda we're trying to figure out what is *about to* happen. How did we do that today?

This tweet *sort of* describes Alameda's game plan headed into the day. We thought it was probably more likely to keep going down just based on Thanksgiving = no U.S. people to buy again -- but mostly? We expected momentum.

https://twitter.com/AlamedaTrabucco/status/1332036794305576960?s=20

All week we've been expecting momentum -- every time there's a move, it triggers liquidations and things are likely to keep going in the same direction. So, we've changed a bunch of our trading strategies to anticipate that.

One example change: we're hedging a lot of the trades we're picking up "by accident" a lot faster. We're making lots of markets, and typically when someone trades against us we hedge in X time. If there's momentum, though, if someone e.g. buys from us, more often than not, ...

the market will keep going up. For instance, take a look at one of our PNL charts from a recent 3hr period for all XRP trading. t1 PNL (marked to 1m after trades happen) is markedly / consistently better than t5 -- this suggests the market consistently moves against our trades.

So after that period, we used this chart as evidence we need to hedge XRP faster -- and that got rid of the issue. We did this across a lot of parts of our systems, and also introduced some new signals into our trading -- e.g. one-way flow in X product -> go the same direction.

Most important, though: if we don't know direction a priori but do feel we know there will be momentum, we adopted the strategy of: when markets move, put on deltas in the same direction, wait til liquidations stall for X seconds, and start hedging out. This worked really well!

We made those kinds of bets all day and hedged accidental deltas fast -- this mostly just went well. We did a lot of tracking OIs, watching liquidations, and trying to guess what would get liquidated next and when they were over -- all amidst REALLY low liquidity.

OK, now, what is "maximizing" and why did I claim that's what this thread is about?

Maximizing is the practice of taking pains to seal up every bit of EV you can. That's a little dumb since of course we're trying to maximize EV, but it's typically applied to spots where a 50% job is good and where many would stop -- but a 100% job is worth WAY more than 2x.

Crazy days are days where maximizing is critical -- doing a good job will make a lot of money, but doing an outstanding job will make a LOT of money. What are some things we did to make sure we were maximizing? Here are just a few of them which made an otherwise good day great.

As I've mentioned, today alts mostly moved with BTC, but their low liquidity + insane OIs often made them move with >1 beta -> so, when BTC moved 1%, often they'd move 1.3% or something (depending on the coin, and also how much got liquidated, it varied).

If BTC starts moving (say, down) and I know there's gonna be momentum, I *could* sell a bunch of BTC before the bulk of the down move and do a good job. But if ETH is likely gonna move the same way but *more* ... why not just sell a bunch of ETH? And also every other major alt?

Well there's less liquidity so you've gotta be a little careful, but, yeah, this works and it turns out is better than just selling BTC! Of course you can also do both, which is truly maximizing, and also what we did -- trade in the momentum-y direction with the *best* coins.

What else? Trading in the momentum-y direction is really only half the battle -- you've also gotta exit, since we know that post-liquidation moves tend to revert. Sure, they don't really revert all the way, so it's not *critical* to nail this -- but you're leaving $ on the table.

So, how to improve? Turns out there are patterns here that, if you put in time to a) get the fastest data b) record it c) spend time thinking about it, you can deduce. So, we did that! And it let us get a *lot* better at determining when to try to buy back after a big crash.

... and also how to size that. Turns out knowing *when* isn't all you need, either -- you've also gotta know how aggressive to be, which is dependent on liquidity, which, as we discussed, was super low today. So studying all these things in real-time is needed to maximize too!

(And that's not even to discuss figuring out what prices to try to send at, whether to do it all at once or staggered, and how all this varies per coin -- all of which we either studied or gained reps / intuition in throughout the day, because today was so fucking weird).

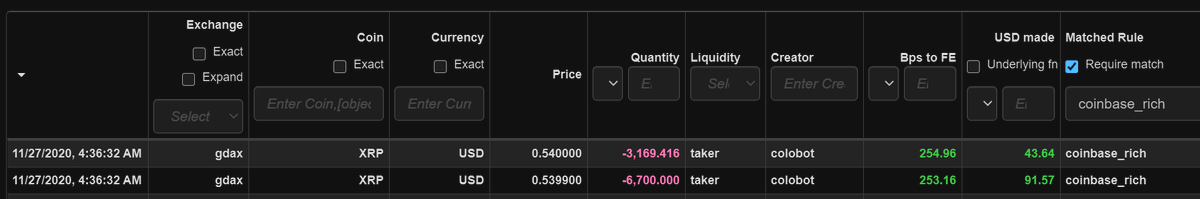

So many other examples! These alerts told us XRP was trading SUPER rich on Coinbase (XRP was *crazy* today) -- level one would be to send there and sell. But that runs the risk of crushing the premium -- to maximize, we added extra edge to improve our average price.

With low liquidity, where your capital is matters a ton. With all that was going on, it would have been easy to leave $ be and try to optimize around that -- but we put in the annoying work of manually freeing capital from bad spreads / places, making our great returns on more $.

We realized that one product we make markets for was losing $ consistently. It was *really* busy, but someone dug in anyway, and it turned out *this* was the key to realizing how low liquidity was -- we were losing because we hadn't sized down and others could take advantage.

(So we sized down a lot of our quotes, not just for the original product, solving problems we hadn't even found yet, and also letting us know that there'd probably be even more momentum than we were originally expecting.)

And so on. In all cases, the pieces for a *good* trade were easy, and the pieces for a *great* one were hard -- when our time is well-spent going for the latter, we're *always* gonna do it, and that's part of what makes us so consistently successful at chasing (and realizing) EV.

For the market, this week was dense. For Alameda, this week was *exhausting*. We're a small team, and we PUSH during periods like this -- it's fine when it lasts a day, but a week? It tests all of us.

Thankful on this Thanksgiving Day to be part of such an incredible team.

Thankful on this Thanksgiving Day to be part of such an incredible team.

Almost included something about "choosing to not sleep this week and sleep a lot next week is maximizing because this week matters more" but that felt "unrelatable."

• • •

Missing some Tweet in this thread? You can try to

force a refresh