Let's check in with our fund friends: 3 Arrows Capital, Polychain, and Jump Trading.

How did they react to the strong dip in BTC and ETH? Did they buy anything? Sell anything?

Let's take a look 👇

How did they react to the strong dip in BTC and ETH? Did they buy anything? Sell anything?

Let's take a look 👇

3AC (1/5):

3AC made sure their Aave and Compound loans were healthy.

Through their main address, Three Chads deposited over $20m in stables (some from sales of WBTC) into Aave to maintain the health ratios of their account.

3AC's Aave health factor = 2.06 - pretty safe!

3AC made sure their Aave and Compound loans were healthy.

Through their main address, Three Chads deposited over $20m in stables (some from sales of WBTC) into Aave to maintain the health ratios of their account.

3AC's Aave health factor = 2.06 - pretty safe!

3AC (2/5):

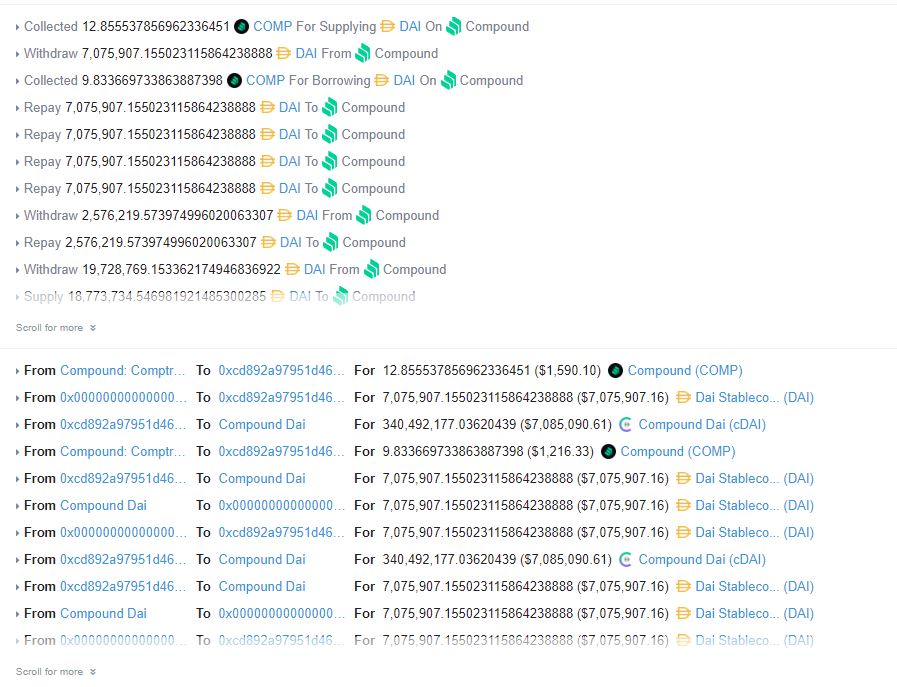

3AC deposited over $40m into Compound over the past day, paying back an outstanding stables loan.

3AC proceeded to withdraw a large amount of ETH ($66,000,000), WBTC, AAVE, and LINK to a secondary address.

3AC deposited over $40m into Compound over the past day, paying back an outstanding stables loan.

3AC proceeded to withdraw a large amount of ETH ($66,000,000), WBTC, AAVE, and LINK to a secondary address.

3AC (3/5):

Some WBTC was sent back to 3AC's WBTC merchant deposit address, suggesting a withdrawal.

I tracked at least $6m worth of LINK to an empty address.

Another $10m worth of USDC was sent to another empty address.

Lots of coins scattered all over the place.

Some WBTC was sent back to 3AC's WBTC merchant deposit address, suggesting a withdrawal.

I tracked at least $6m worth of LINK to an empty address.

Another $10m worth of USDC was sent to another empty address.

Lots of coins scattered all over the place.

3AC (4/5):

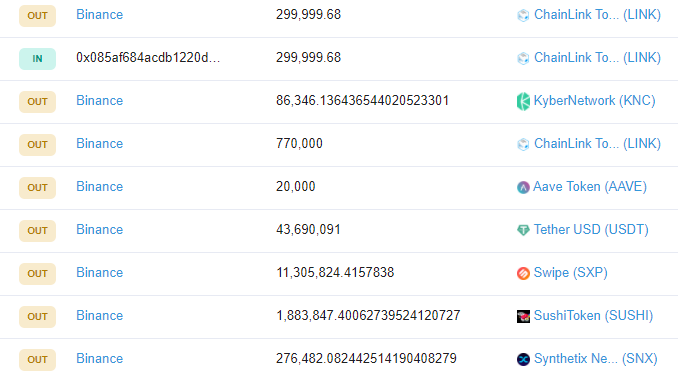

More recently (past 12 hrs), a large chunk of alts (1m LINK, 20,000 AAVE, 43m USDT, & more) was sent from Three Arrows addresses to Binance.

More recently (past 12 hrs), a large chunk of alts (1m LINK, 20,000 AAVE, 43m USDT, & more) was sent from Three Arrows addresses to Binance.

3AC (5/5):

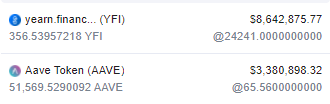

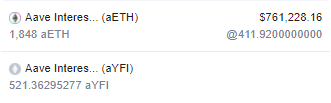

3AC may or may not own over 1,000 YFI.

3AC currently has 350 YFI in one address that is 99% them, then has over 650 YFI (520 in Aave) in addresses 3AC sent YFI to via a proxy address.

Is this the Chief Psyops Officer playing tricks on me?

Send help.

3AC may or may not own over 1,000 YFI.

3AC currently has 350 YFI in one address that is 99% them, then has over 650 YFI (520 in Aave) in addresses 3AC sent YFI to via a proxy address.

Is this the Chief Psyops Officer playing tricks on me?

Send help.

Jump Trading (1/1):

It appears Jump is in BTFD mode. As the market began its descent, Jump traded hundreds of thousands in USDT to Bittrex, Binance, and Huobi.

This picked up dramatically over the past day. I tally $5m sent to exchanges over past day.

$11m in USDT remains.

It appears Jump is in BTFD mode. As the market began its descent, Jump traded hundreds of thousands in USDT to Bittrex, Binance, and Huobi.

This picked up dramatically over the past day. I tally $5m sent to exchanges over past day.

$11m in USDT remains.

Polychain (1/1):

Polychain seems to be sticking with its guns: no transactions made since it received 100 YFI two weeks ago.

Its YFI position is now valued at $13,800,000 — approximately double the acquisition cost.

Polychain seems to be sticking with its guns: no transactions made since it received 100 YFI two weeks ago.

Its YFI position is now valued at $13,800,000 — approximately double the acquisition cost.

• • •

Missing some Tweet in this thread? You can try to

force a refresh