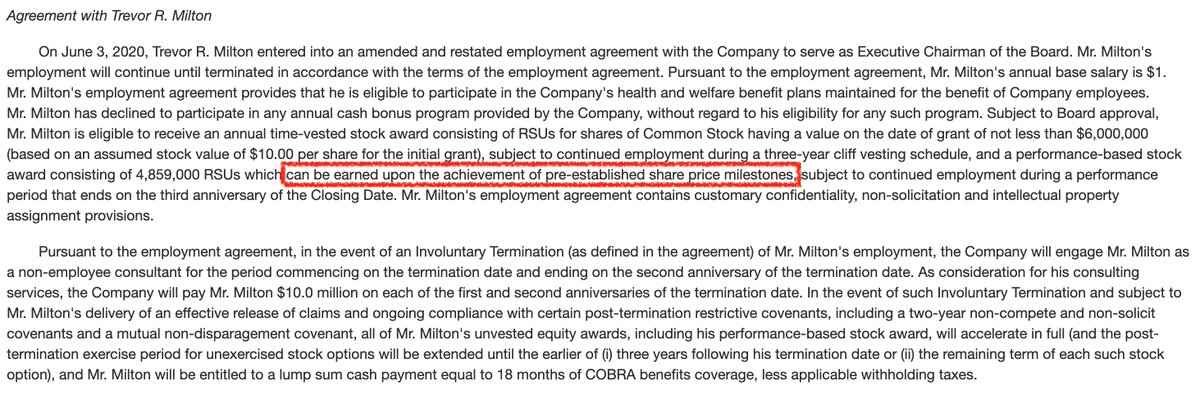

/1 As reported by the @HindenburgRes report in September, $NKLA founder and now ex-chairman Trevor Milton admitted in a July 2020 interview with me that they have not produced any Hydrogen at their Phoenix, AZ facility. #thread #hydrogen #Nikola

linkedin.com/pulse/intervie…

linkedin.com/pulse/intervie…

/2 Many $NKLA bulls have contacted me in the meantime calling me a liar and worse so I decided to put the record straight and show you exactly what Trevor told me back in early July 2020.

3/ The main topic is Trevor admitting for the first time that they have NOT produced any hydrogen despite claiming earlier that they’ve been doing so for a while, allegedly misleading their investors.

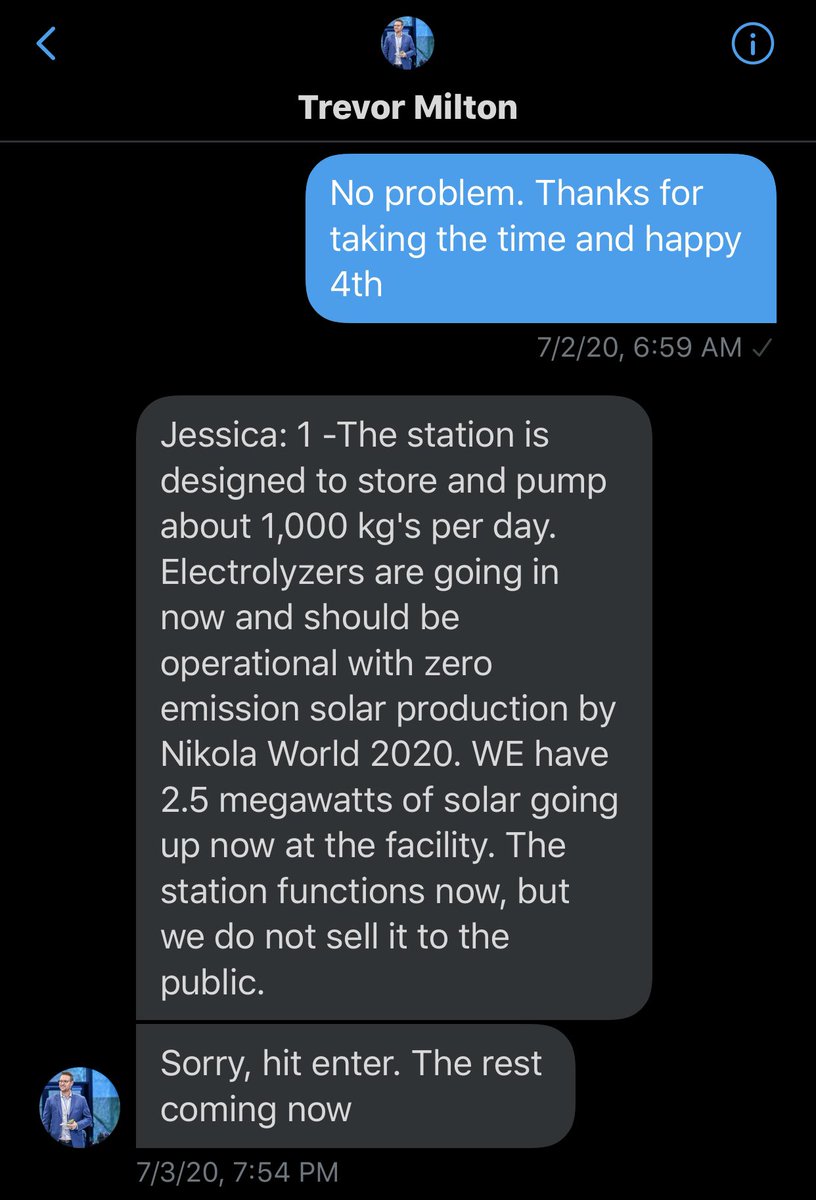

4/ This is what i asked him. We did the interview using Twitter DM. I saved all messages before Trevor deleted hits Twitter account.

5/ And this is how he responded. BTW: Nikola World was scheduled for next week so I’m wondering if they actually completed the installation of those electrolyzers and have started producing hydrogen. $NKLA

/6 I wanted to be sure that he indeed admitted to no hydrogen production so I asked again in a follow up question.

/7 and this was his answer. Obviously they didn’t even have the permits yet back in July to produce hydrogen. To my knowledge, nobody has asked Mark Russell recently about the state of hydrogen production or if they have the permits available now.

8/ these were my last interactions with Trevor. Shortly after he told me that it was a good interview, he blocked me on Twitter. That’s why the remark at the bottom of the message and yeah, that Nikola World interview is most likely not going to happen... 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh