I'm long $HEGIC, but I've never said why

Let me do so now

$HEGIC = an options protocol

[Notice the word "protocol"]

More 👇

Let me do so now

$HEGIC = an options protocol

[Notice the word "protocol"]

More 👇

<

annoying definition time:

options are a way to hedge or protect your investments in things like $BTC and $ETH

or to make leveraged bets on big price moves...

translation, they are advanced tools for chads-squared

/>

2/x

annoying definition time:

options are a way to hedge or protect your investments in things like $BTC and $ETH

or to make leveraged bets on big price moves...

translation, they are advanced tools for chads-squared

/>

2/x

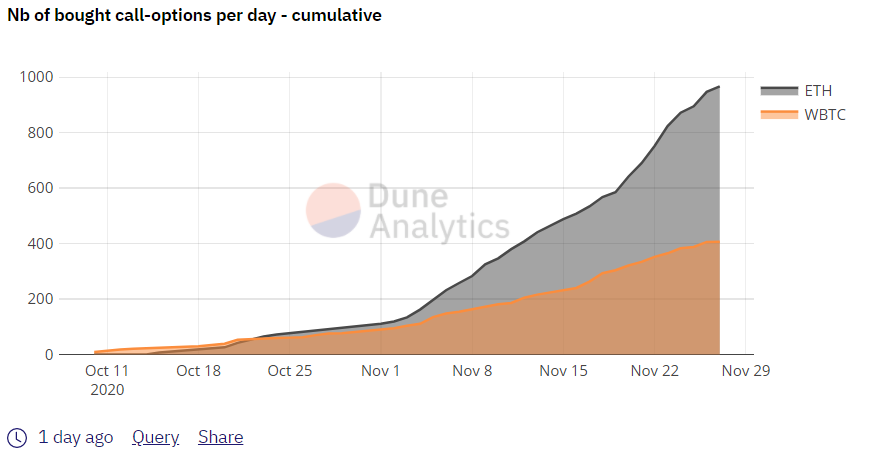

$HEGIC offers options on $ETH and $wBTC atm

What excites me about it is this word: protocol

$HEGIC = a set of rules that enables the construction of an entirely new options ecosystem

It = scaffolding that other devs can build different financial tools and products on

3/x

What excites me about it is this word: protocol

$HEGIC = a set of rules that enables the construction of an entirely new options ecosystem

It = scaffolding that other devs can build different financial tools and products on

3/x

When I think of $HEGIC, I think of how Uniswap $UNI has revolutionized decentralized trading

& if you don't think Uniswap has revolutionized decentralized trading, read this:

4/x

& if you don't think Uniswap has revolutionized decentralized trading, read this:

https://twitter.com/redphonecrypto/status/1328074950465495044?s=20

4/x

People call Uniswap a peer-to-peer trading platform, but that's not really accurate

When you route a trade through Uniswap, you're not trading directly with another peer

You're trading against a pool of liquidity that's locked into a smart contract

5/x

When you route a trade through Uniswap, you're not trading directly with another peer

You're trading against a pool of liquidity that's locked into a smart contract

5/x

That's why people call it a peer-to-contract or peer-to-pool protocol

When you trade against a pool, you solve a lot of problems

you don't have an annoying ass orderbook

you don't have to wait for another bloke to be on the other side of your trade

6/x

When you trade against a pool, you solve a lot of problems

you don't have an annoying ass orderbook

you don't have to wait for another bloke to be on the other side of your trade

6/x

you can trade against the pool whenever tf you want

That's spawned all sorts of innovations

(to name a few: LP tokens that can be lent out or used for farming... liquidity migration... dex aggregation, etc)

7/x

That's spawned all sorts of innovations

(to name a few: LP tokens that can be lent out or used for farming... liquidity migration... dex aggregation, etc)

7/x

Basically, Uniswap makes it possible to trade whatever token you want at any time

$HEGIC = the same for options

It's a protocol that makes it possible to trade options instantly... no KYC, no orderbook, no waiting for another trader to take the other side of your bet

8/x

$HEGIC = the same for options

It's a protocol that makes it possible to trade options instantly... no KYC, no orderbook, no waiting for another trader to take the other side of your bet

8/x

Once you have that, you have a scaffolding for innovative products in options

In order to be useful, $HEGIC needs deep liquidity. It gets it through incentives

Again, Uniswap is a good example (this is all grossly simplified, but it does the job):

9/x

In order to be useful, $HEGIC needs deep liquidity. It gets it through incentives

Again, Uniswap is a good example (this is all grossly simplified, but it does the job):

9/x

People deposit cryptos into Uniswap pools because they can earn trading fees on them

People deposit cryptos into $HEGIC pools because they can earn fees on them

10x

People deposit cryptos into $HEGIC pools because they can earn fees on them

10x

Now, we all suspect that eventually Uniswap will begin charging a fee to traders, and it will distribute that fee to $UNI holders

Hegic is already doing that, kicking out fees to $HEGIC stakers

11/x

Hegic is already doing that, kicking out fees to $HEGIC stakers

11/x

You buy $HEGIC, you stake it on the website or through something like $zLOT @zLOTFinance and you start collecting $ETH or $wBTC as other trade options on the protocol

Tons of other reasons to be bullish on $HEGIC's growth:

- Adding more tokens beyond $ETH and $wBTC

12/x

Tons of other reasons to be bullish on $HEGIC's growth:

- Adding more tokens beyond $ETH and $wBTC

12/x

- A secondary market for Hegic's options

13/x

https://twitter.com/HegicOptions/status/1329853100845314054?s=20

13/x

- Secondary use cases for pooled liquidity?

- Sweet teasers from Molly

14/x

- Sweet teasers from Molly

https://twitter.com/0mllwntrmt3/status/1332677238651817985?s=20

14/x

- Already big signs of product market fit (a $5 million order anyone?)

15/x

https://twitter.com/HegicOptions/status/1330973366342340615?s=20

15/x

- And most tantalizing... a possible (likely?) integration with Yearn / $YFI

17/x

https://twitter.com/defislate/status/1329429888206577666?s=20

17/x

tldr if you look at $HEGIC like one of many VC-funded "options platforms" out there, you're thinking too small

it will not be a cute little walled garden

it will not be a reinvention of centralized options

it is hunting out tradfi options solutions + crushing bones

it will not be a cute little walled garden

it will not be a reinvention of centralized options

it is hunting out tradfi options solutions + crushing bones

• • •

Missing some Tweet in this thread? You can try to

force a refresh