🛰A short thread about @mynaric $M0Y🛰

📌Mynaric is a laser communication company which develops and manufactures laser products for space, air and ground applications

📌 Laser communication can be thought of as optical fiber for the skies

mynaric.com

1/x

📌Mynaric is a laser communication company which develops and manufactures laser products for space, air and ground applications

📌 Laser communication can be thought of as optical fiber for the skies

mynaric.com

1/x

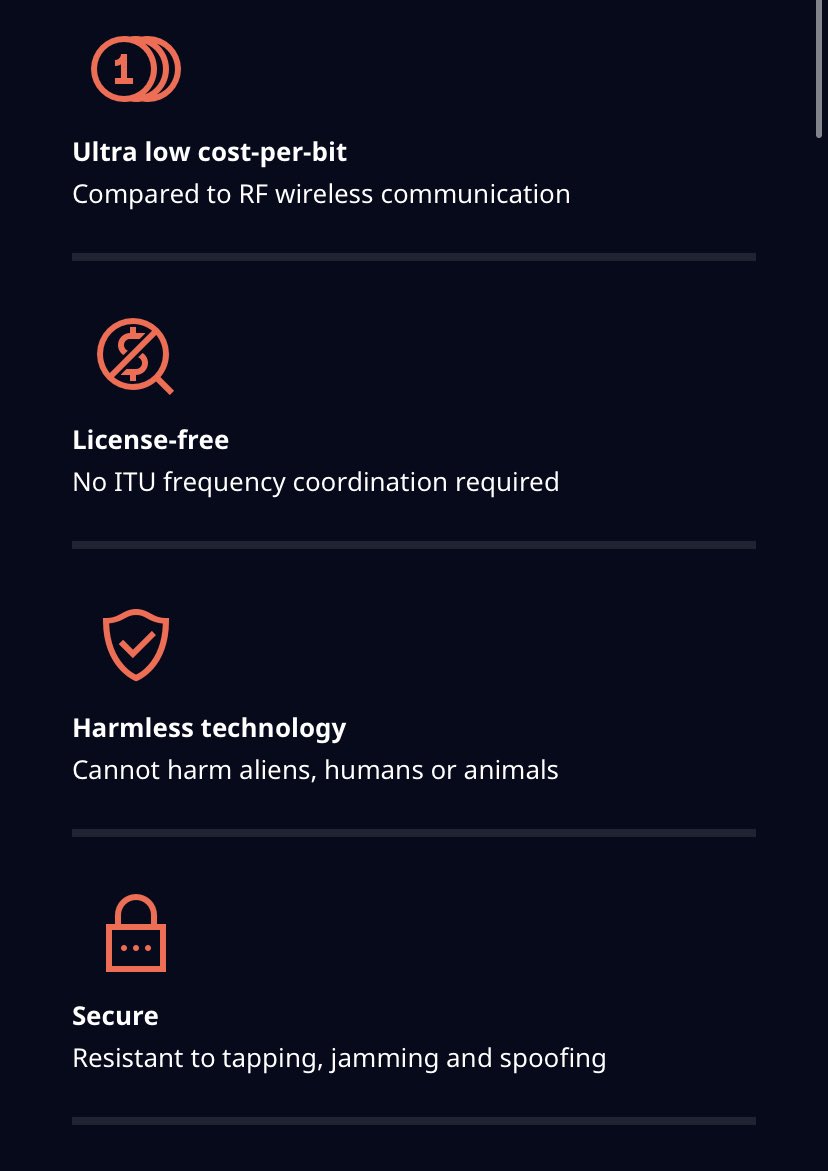

🛰What are the advantages of laser communications (Optical-inter-satellite-links / OISLs) vs. RF communication? 🛰

🚀 Faster

💸 Lower cost-per-bit

📡 Licence Free

🔒 Secure

✌🏻 Harmless Technology

2/x

🚀 Faster

💸 Lower cost-per-bit

📡 Licence Free

🔒 Secure

✌🏻 Harmless Technology

2/x

🛰What are the advantages of mynaric vs competitors?🛰

🧑🔬 as a spin-off mynaric owns licences of the german institute of aerospace (DLR) which is leading in terms of lasercom

🛰 Laser terminals (LCTs) are designed for serial production

💸 lower costs

📌 One-stop-shop

3/x

🧑🔬 as a spin-off mynaric owns licences of the german institute of aerospace (DLR) which is leading in terms of lasercom

🛰 Laser terminals (LCTs) are designed for serial production

💸 lower costs

📌 One-stop-shop

3/x

🛰Who needs laser communication?🛰

📌 Satellite networks or high-altitude-platforms needs to communicate with each other

📌 To provide low-latency broadband internet via these networks lasercom is a crucial technology

👇🏻 examples for satellite constellations or HAPS

4/x

📌 Satellite networks or high-altitude-platforms needs to communicate with each other

📌 To provide low-latency broadband internet via these networks lasercom is a crucial technology

👇🏻 examples for satellite constellations or HAPS

4/x

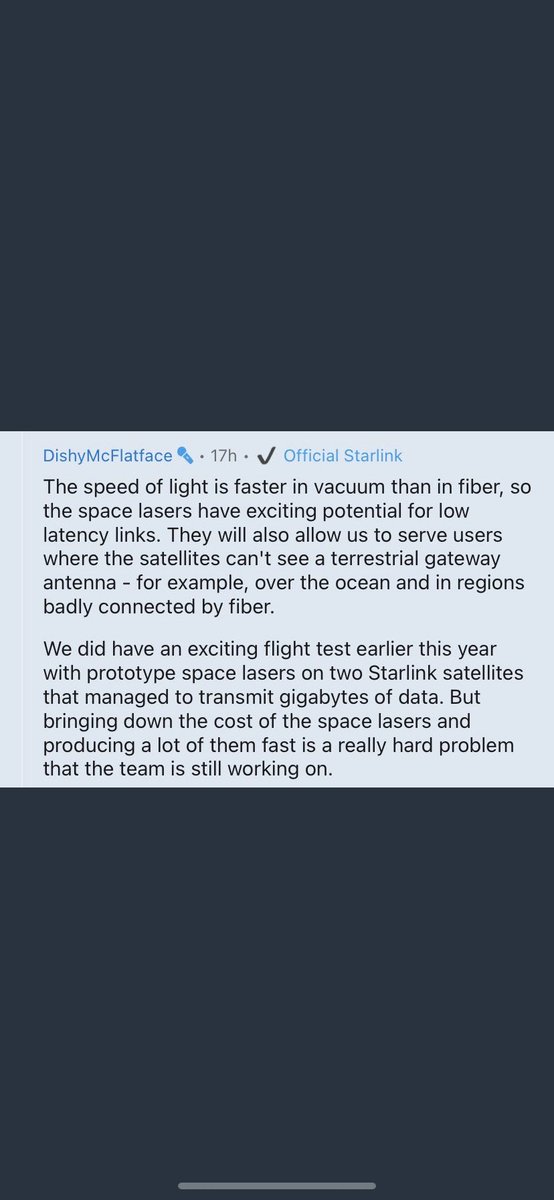

🛰@SpaceXStarlink🛰

📌 most famous megaconstellation

📌hundreds of satellites already launched

📌just 2 of them are equipped with OISLs

📌 Engineers are still working on lowering the costs for the OISLs

📌 trying to manufacture all in-house

📌beta tests started

5/x

📌 most famous megaconstellation

📌hundreds of satellites already launched

📌just 2 of them are equipped with OISLs

📌 Engineers are still working on lowering the costs for the OISLs

📌 trying to manufacture all in-house

📌beta tests started

5/x

🛰@Telesat🛰

📌 298 satellites planned to launch

📌 each equipped with 4 OISLs —> 1.192 in total

📌 becomes a public company through agreement with Loral & PSP —> finally funding and ownership structure should be clarified

📌 vendors to be announced later this year

6/x

📌 298 satellites planned to launch

📌 each equipped with 4 OISLs —> 1.192 in total

📌 becomes a public company through agreement with Loral & PSP —> finally funding and ownership structure should be clarified

📌 vendors to be announced later this year

6/x

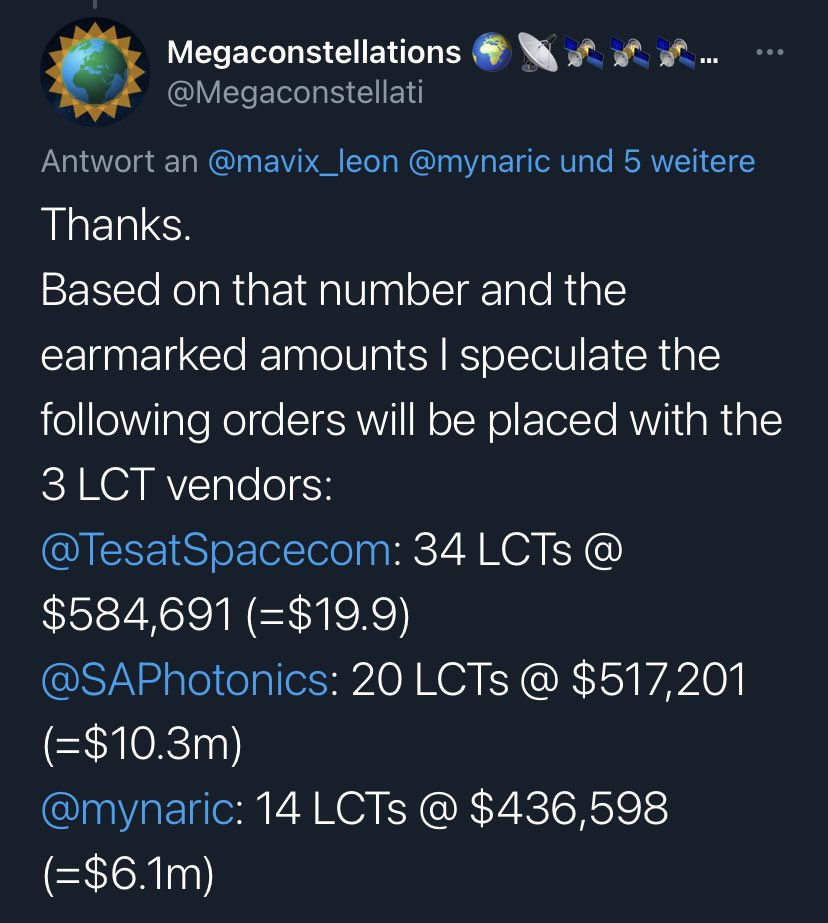

🛰Space Dev. Agency🛰

📌transport layer with hundreds of satellites

📌equipped with OISLs from different vendors —> interoperability

📌orders for the first 20 satellites already placed

📌@mynaric received an order for approx. 14 LCTs for 6.1m $

📌further orders possible

7/x

📌transport layer with hundreds of satellites

📌equipped with OISLs from different vendors —> interoperability

📌orders for the first 20 satellites already placed

📌@mynaric received an order for approx. 14 LCTs for 6.1m $

📌further orders possible

7/x

🛰@DARPA🛰

📌Project Blackjack —> capitalice commercial advances in LEO for military utility

📌@DARPA awarded @Telesat for 2 satellite buses and @Telesat awarded @mynaricusa for the LCTs

📌inter-vendor operability will be tested in mynarics lab

8/x

📌Project Blackjack —> capitalice commercial advances in LEO for military utility

📌@DARPA awarded @Telesat for 2 satellite buses and @Telesat awarded @mynaricusa for the LCTs

📌inter-vendor operability will be tested in mynarics lab

8/x

🛰Others🛰

📌@amazon's project kuiper; 3.236 satellites planned

📌@Loon4all; already provides internet via balloons in Kenya

📌 HAPS Alliance with prominent members like @Airbus @Telekom @ATT @nokia

📌@OneWeb recently exited bankruptcy through investment of UK / Bharti

9/x

📌@amazon's project kuiper; 3.236 satellites planned

📌@Loon4all; already provides internet via balloons in Kenya

📌 HAPS Alliance with prominent members like @Airbus @Telekom @ATT @nokia

📌@OneWeb recently exited bankruptcy through investment of UK / Bharti

9/x

🛰My investment thesis for @mynaric🛰

📌just one big contract needed to achieve sales that exceeds the whole market cap

📌@Telesat will announce vendors for LCTs soon

📌they already chose mynaric as LCT vendor for the DARPA contract and highlighted mynarics technology

10/x

📌just one big contract needed to achieve sales that exceeds the whole market cap

📌@Telesat will announce vendors for LCTs soon

📌they already chose mynaric as LCT vendor for the DARPA contract and highlighted mynarics technology

10/x

📌1.192 LCTs needed for the whole constellation

📌Price for 1 LCT ~300.000-500.000€ (depends on order size)

📌1.192 x 300.000€ = ~357m €

📌Market cap of mynaric: ~266m €

📌This is just one possible contract

📌Other constellations also need LCTs in a large volume

11/x

📌Price for 1 LCT ~300.000-500.000€ (depends on order size)

📌1.192 x 300.000€ = ~357m €

📌Market cap of mynaric: ~266m €

📌This is just one possible contract

📌Other constellations also need LCTs in a large volume

11/x

📌 there are few other companies that offer LCTs

📌 None of these ever build LCTs in a large volume

📌 @mynaric's products are designed for serial production

📌 mynaric recently raised 52.8m € to prepare for large volume product deployment

12/x

📌 None of these ever build LCTs in a large volume

📌 @mynaric's products are designed for serial production

📌 mynaric recently raised 52.8m € to prepare for large volume product deployment

12/x

🛰Summary🛰

The whole #NewSpace segment is growing fast driven by private companies like @SpaceX. The number of satellites in space are growing rapidly and @mynaric offers the products for their fast, secure and license free communication. Mynaric is a profiteer of these trends.

The whole #NewSpace segment is growing fast driven by private companies like @SpaceX. The number of satellites in space are growing rapidly and @mynaric offers the products for their fast, secure and license free communication. Mynaric is a profiteer of these trends.

I think I forgot a lot of infos I read in the last 2 years about the satellite market an especially mynaric. I‘ve got a lot of info from these accounts I can really recommend to follow! @Megaconstellati @usp3t @elleryinsights @CHenry_QA @smf852 @thesheetztweetz @indievestments

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh