Livechat Software $LVC $LVCP 💬

@LiveChat

▫️SaaS company under the radar

▫️unbelievable profit margins

▫️Revenue growth 45 %

▫️Rule of 40 > 90

▫️31.000 customers in over 150 countries

▫️management with skin in the game

▫️still cheap

🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥

A Thread 👇🏻

@LiveChat

▫️SaaS company under the radar

▫️unbelievable profit margins

▫️Revenue growth 45 %

▫️Rule of 40 > 90

▫️31.000 customers in over 150 countries

▫️management with skin in the game

▫️still cheap

🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥

A Thread 👇🏻

The company:

▫️based in Poland 🇵🇱

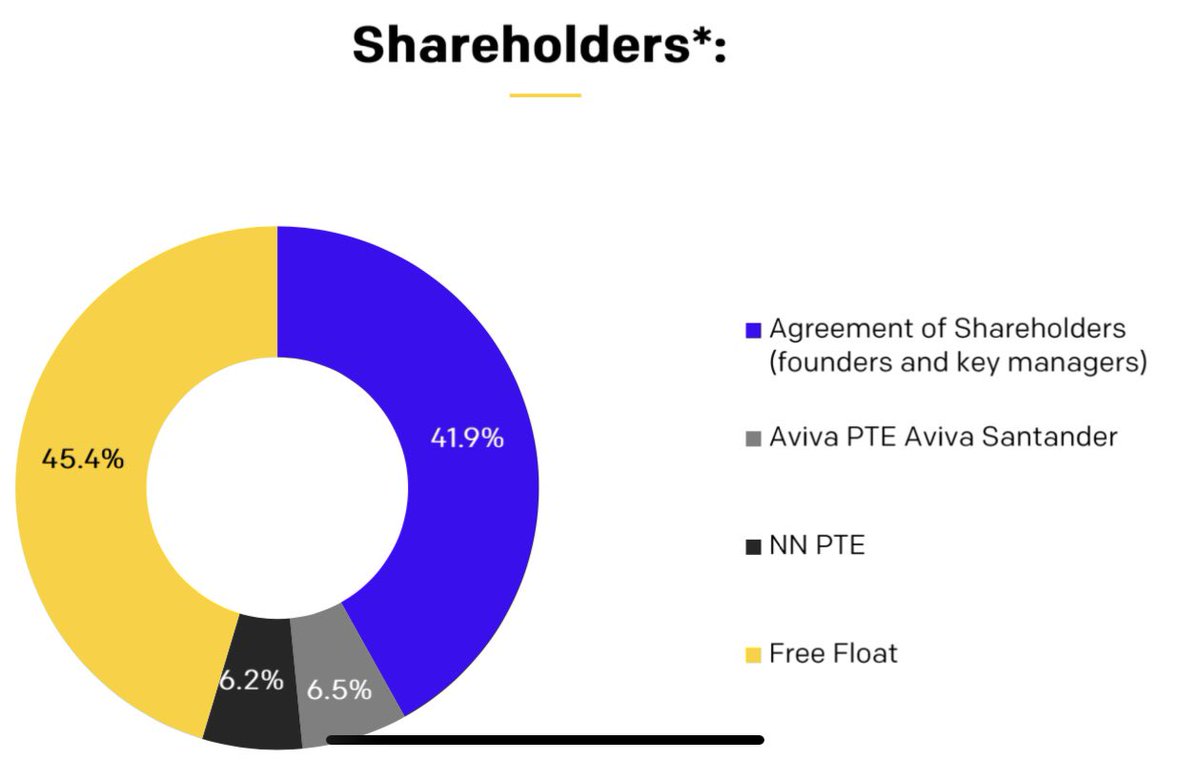

▫️Founder-operator management with ~ 41% of shares

▫️Market cap ~ $800m USD

▫️went public on Warsaw stock exchange in 2014

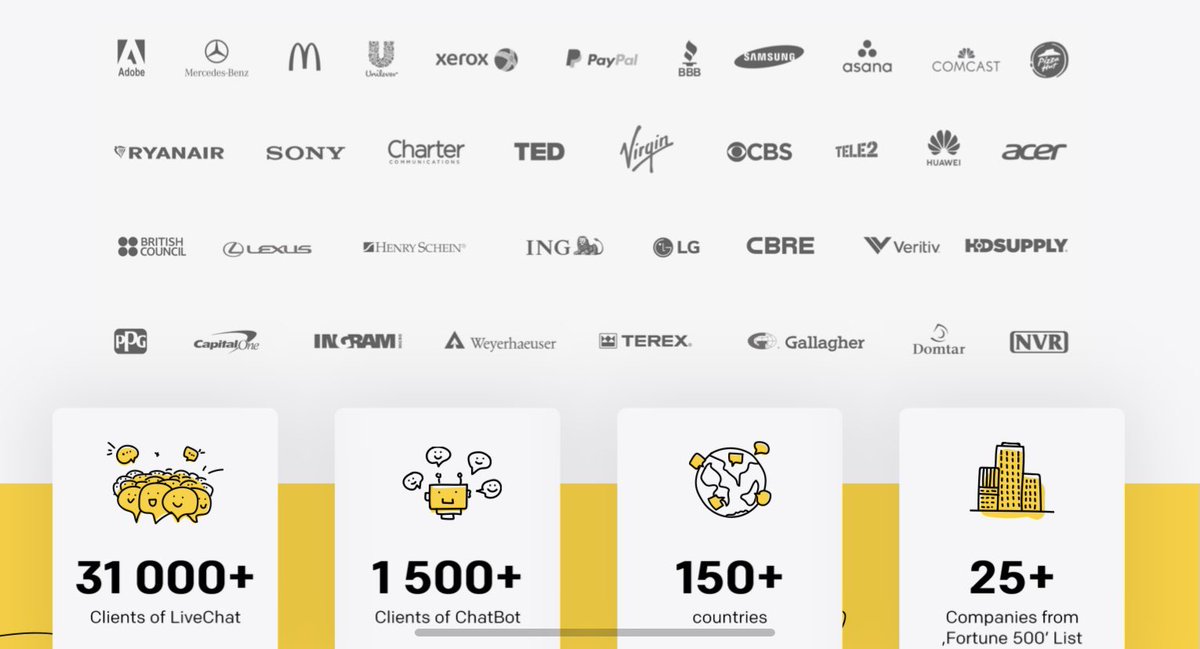

▫️25+ customers from Fortune 500 list: Unilever, McDonalds, Adobe, Samsung, Paypal, Sony, Mercedes...

Next Products ➡️

▫️based in Poland 🇵🇱

▫️Founder-operator management with ~ 41% of shares

▫️Market cap ~ $800m USD

▫️went public on Warsaw stock exchange in 2014

▫️25+ customers from Fortune 500 list: Unilever, McDonalds, Adobe, Samsung, Paypal, Sony, Mercedes...

Next Products ➡️

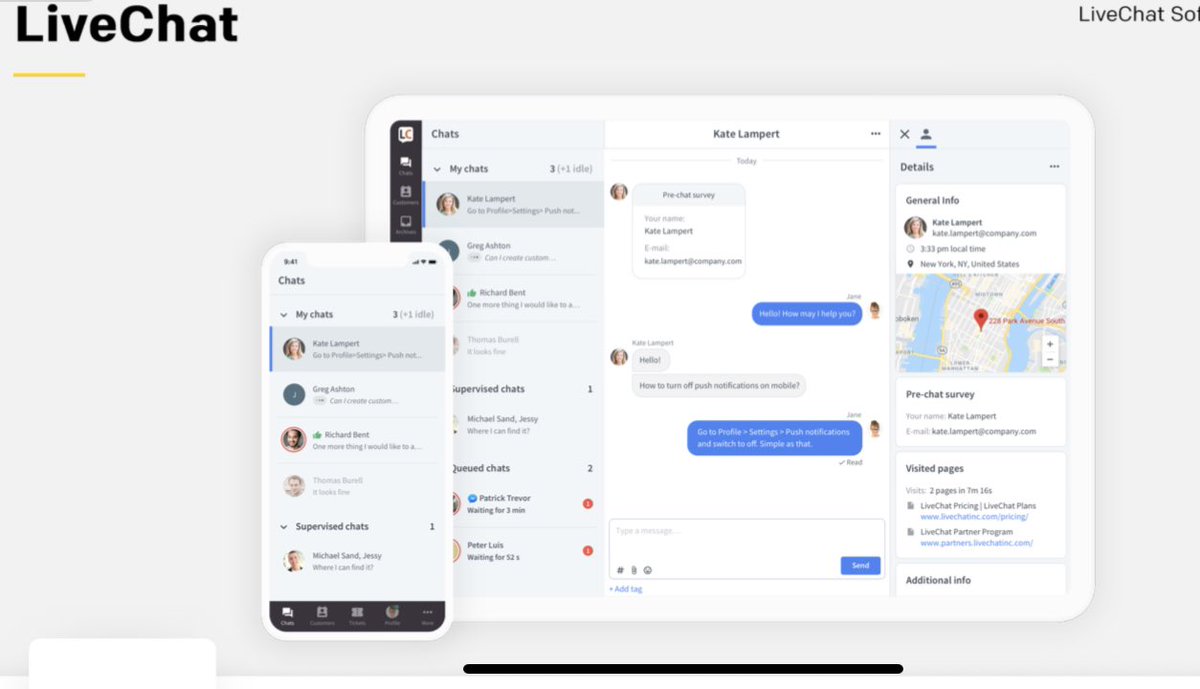

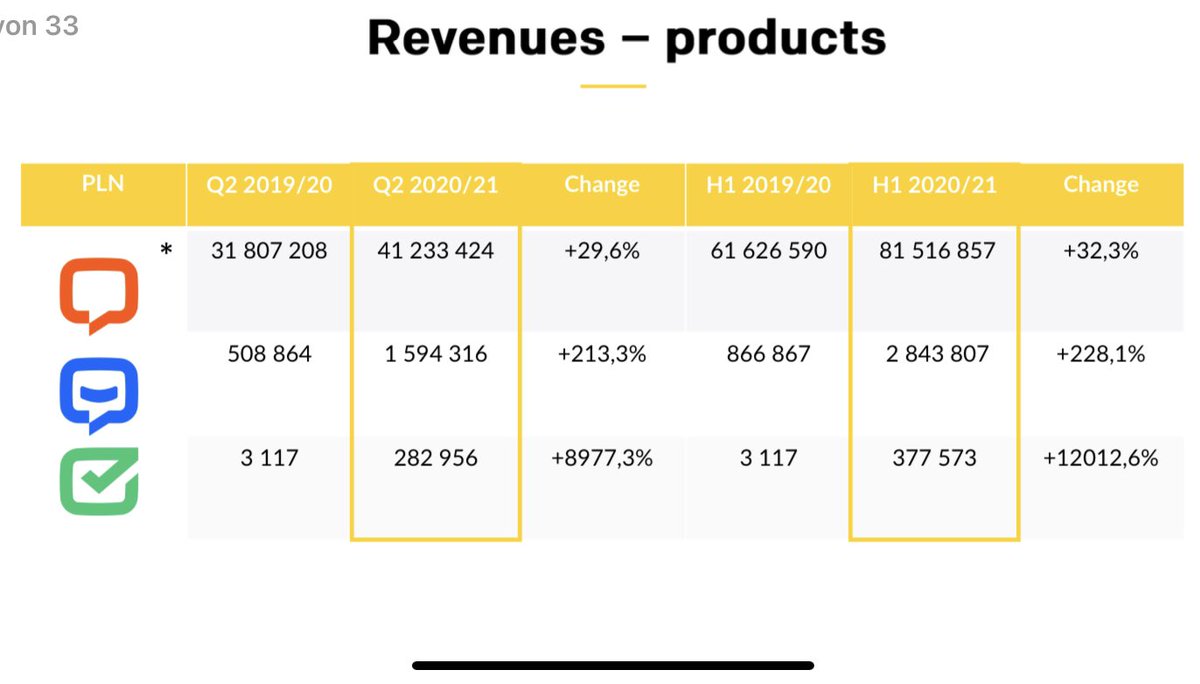

Live Chat 💬

▫️a tool for quick contact between clients and the company

▫️using chat application

▫️embedded on the companies website

▫️for customer service or online sales

▫️companies flagship product

▫️a tool for quick contact between clients and the company

▫️using chat application

▫️embedded on the companies website

▫️for customer service or online sales

▫️companies flagship product

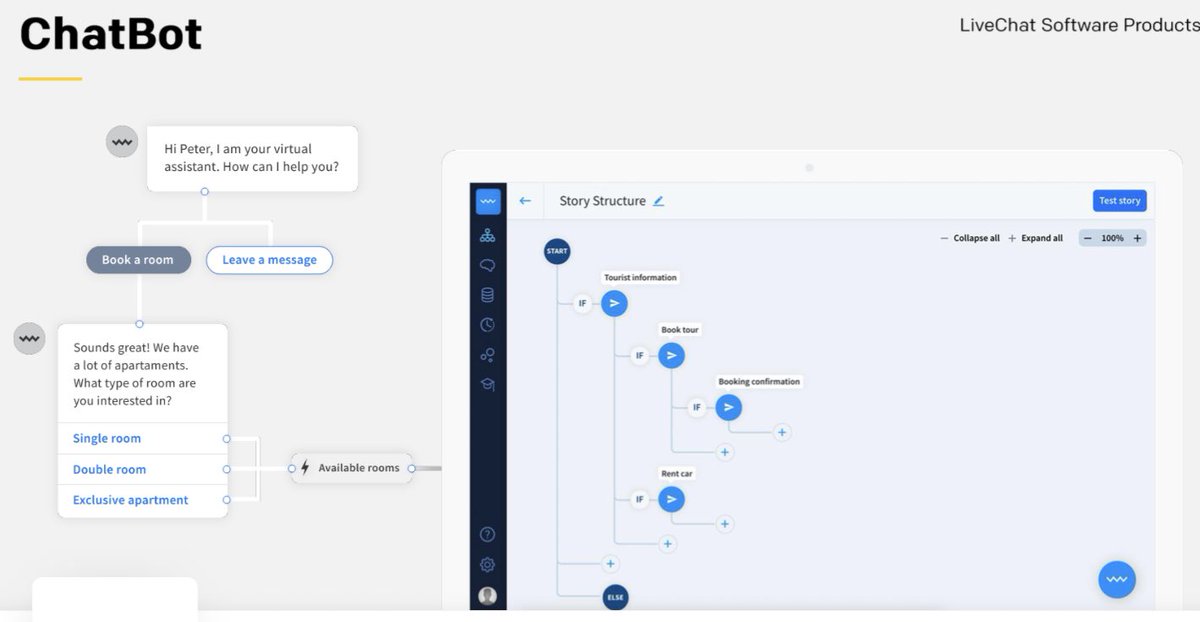

ChatBot 🤖

▫️a product which allows the creation of conversational chatbots

▫️to handle various business scenarios

▫️integrated with LiveChat but also other tools like Facebook Messenger

▫️growing exponentially off a small base

▫️a product which allows the creation of conversational chatbots

▫️to handle various business scenarios

▫️integrated with LiveChat but also other tools like Facebook Messenger

▫️growing exponentially off a small base

Knowledge Base 💭

▫️platform that allows companies to create their own knowledge bases

▫️which can accessed by employees and clients

▫️to organize and quickly retrieve information that require more explanation

▫️platform that allows companies to create their own knowledge bases

▫️which can accessed by employees and clients

▫️to organize and quickly retrieve information that require more explanation

Help Desk 🆘

▫️ticketing system

▫️helps to solve all customer cases in an easy way

So LiveChat Software offers different products for text based business communication tools. And in this market there is a well known competitor with @Zendesk

▫️ticketing system

▫️helps to solve all customer cases in an easy way

So LiveChat Software offers different products for text based business communication tools. And in this market there is a well known competitor with @Zendesk

▫️Zendesk is the market leader for live chat products

▫️But @LiveChat is growing faster than Zendesk and is capturing market share

▫️In the last quarter LiveChat grew with 45% in revenues while the livechat segment of zendesk decreased

⬇️

▫️But @LiveChat is growing faster than Zendesk and is capturing market share

▫️In the last quarter LiveChat grew with 45% in revenues while the livechat segment of zendesk decreased

⬇️

▫️ Zendesk is a good company but also highly valued right now

▫️While the EV/Sales of Zendesk and Livechat is nearly the same, LiveChat is already highly profitable and Zendesk reports losses

So let‘s take a look at the margins and financials of LiveChat 💰

⬇️

▫️While the EV/Sales of Zendesk and Livechat is nearly the same, LiveChat is already highly profitable and Zendesk reports losses

So let‘s take a look at the margins and financials of LiveChat 💰

⬇️

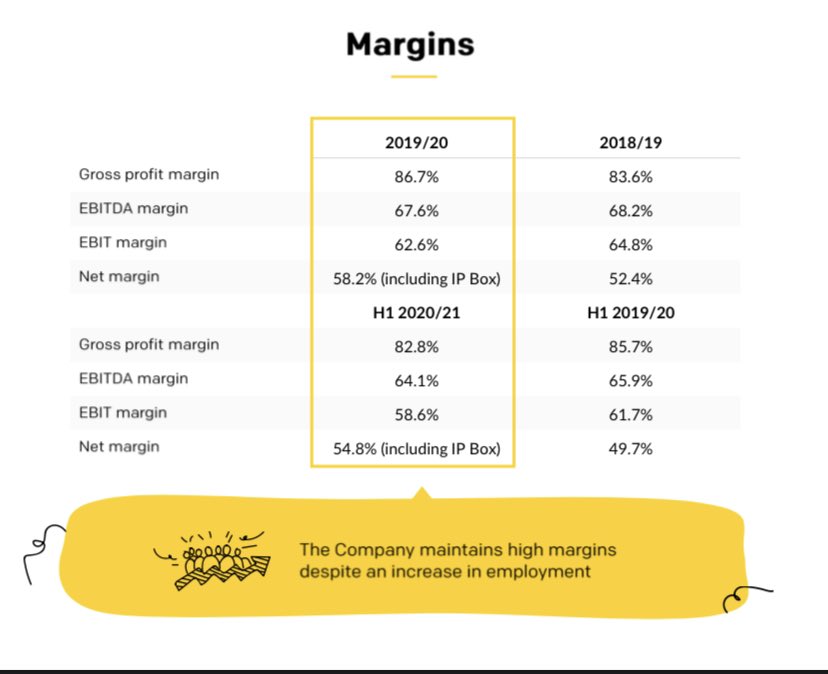

Margins 🤯

▫️Gross Profit 82.8 %

▫️EBITDA 64.1 %

▫️EBIT 58.6 %

▫️Net Income 54.8 %*

*incl. tax benefits; without these benefits the net income margin would be 47% 🚀

▫️Gross Profit 82.8 %

▫️EBITDA 64.1 %

▫️EBIT 58.6 %

▫️Net Income 54.8 %*

*incl. tax benefits; without these benefits the net income margin would be 47% 🚀

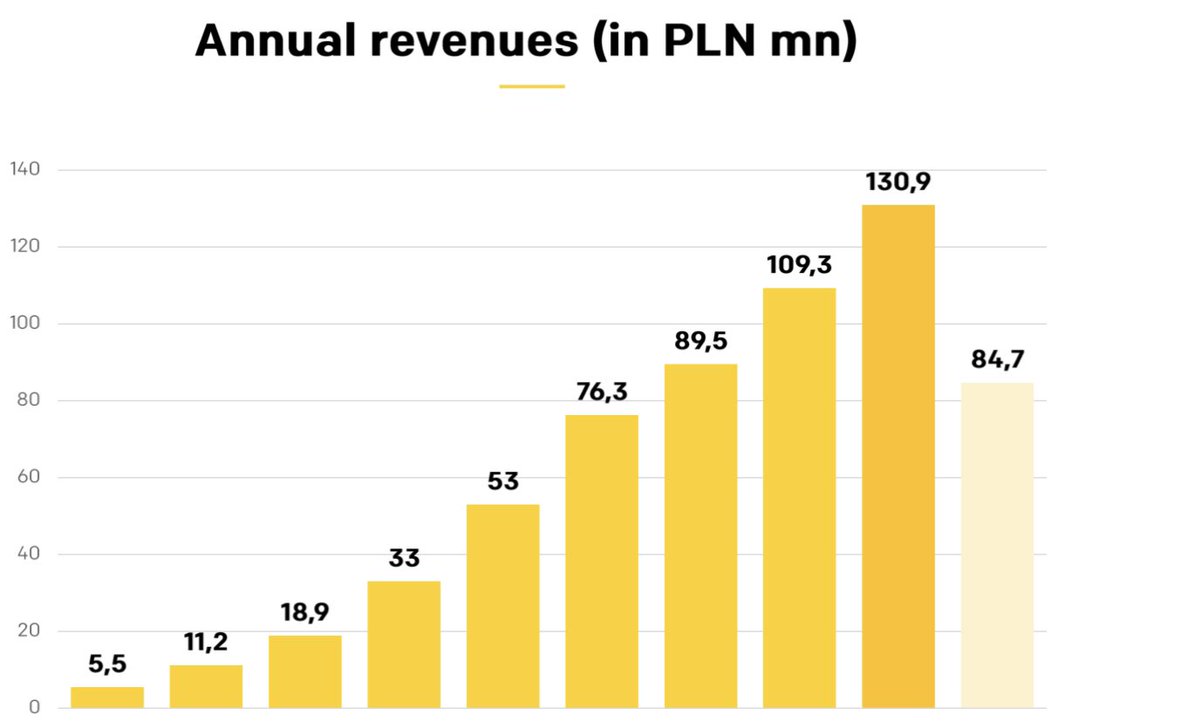

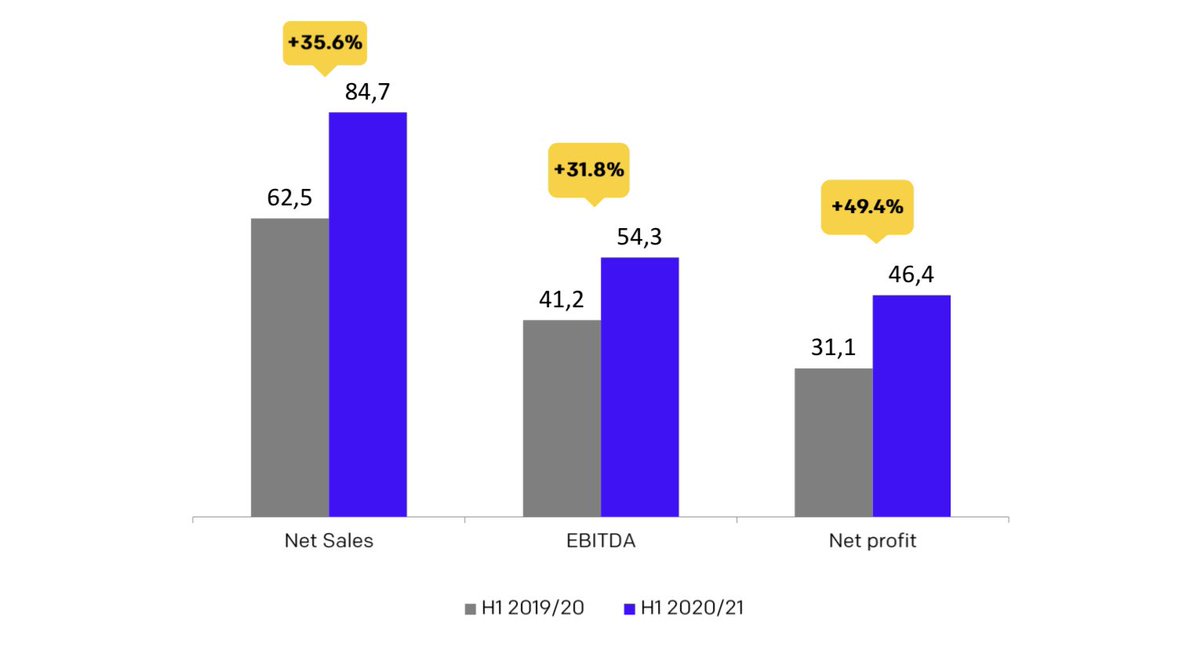

Financial Results H1 20/21

▫️Revenue +35.6 %, in Q3 20/21 even 45 % ➡️ growth is accelerating due to Covid

▫️EBITDA +31.8 %

▫️Net Profit +49.4 % *

*incl. tax benefits; without it ~30%

▫️Revenue +35.6 %, in Q3 20/21 even 45 % ➡️ growth is accelerating due to Covid

▫️EBITDA +31.8 %

▫️Net Profit +49.4 % *

*incl. tax benefits; without it ~30%

Valuation (TTM) 💎

▫️EV/Sales 17

▫️PE 28

▫️PEG < 1

▫️ Rule of 40 > 90

💎💎💎

You get a highly profitable company for 28x net earnings a clean balance sheet (no debt), growing with 45 % in top line and over 30 % bottom line, over 60 % operating margin and 120 % ROC

💎💎💎

▫️EV/Sales 17

▫️PE 28

▫️PEG < 1

▫️ Rule of 40 > 90

💎💎💎

You get a highly profitable company for 28x net earnings a clean balance sheet (no debt), growing with 45 % in top line and over 30 % bottom line, over 60 % operating margin and 120 % ROC

💎💎💎

@GetBenchmarkCo i recognized you have this great company also on your list. I hope you guys are also taking a look at this under-the-radar stock @LiveChat_IR. It deserves more attention 🤩

For further information here is a great SA article

LiveChat Software: Overlooked European SaaS Story With A Rare Combination Of Growth And Profitability seekingalpha.com/article/437111…

LiveChat Software: Overlooked European SaaS Story With A Rare Combination Of Growth And Profitability seekingalpha.com/article/437111…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh