In these tweets i already made some assumptions why i think that the business development of $AMZN in the early years is in some kind of comparable to the present development of $U

I kept thinking about this and the book „100 Baggers“ by Christopher Mayer came to my mind

⬇️

1/x

I kept thinking about this and the book „100 Baggers“ by Christopher Mayer came to my mind

⬇️

1/x

https://twitter.com/mavix_leon/status/1367510798973689857

The book is about how to find stocks that return 100-to-1 and there‘s also a chapter about $AMZN and the question you could have come up with a sound argument to buy $AMZN based on fundamentals before it became a 100-bagger.

The consensus opinion in the early years of $AMZN was that they don‘t make money because they reported neg. or pretty low operating margins from 1996-2014. Today we know that these low margins results from the high investments in R&D. So they added back R&D to get adj. op margins

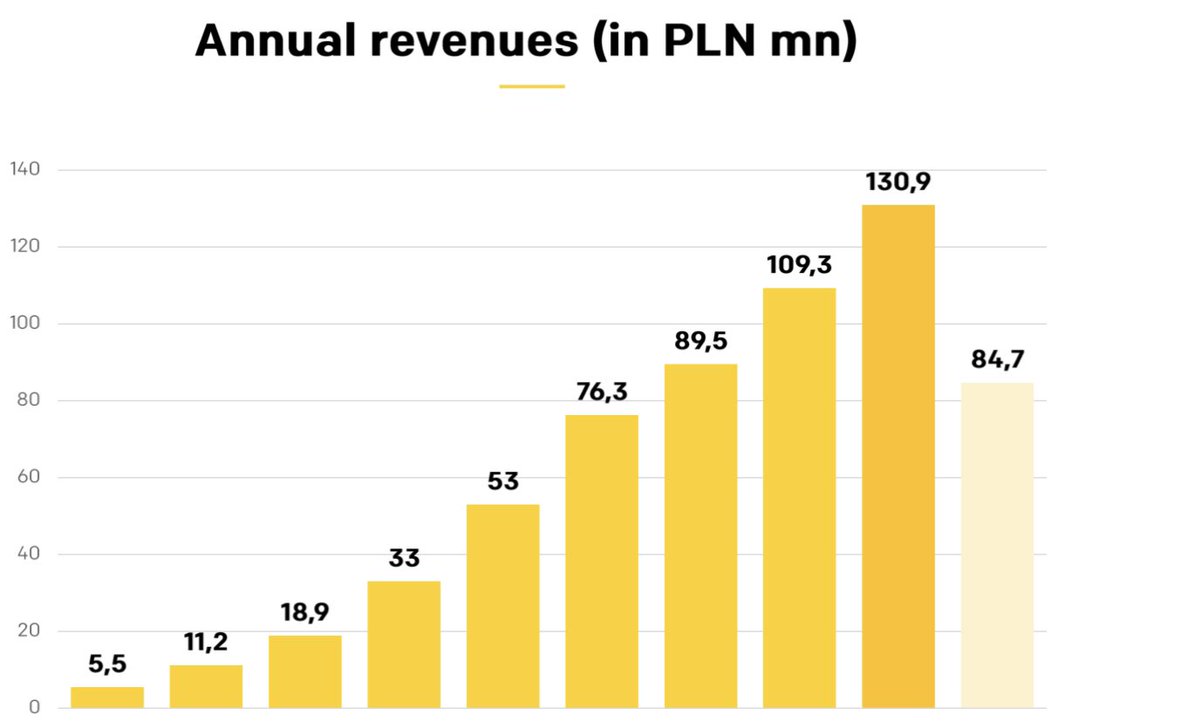

I also did this with the numbers of $U. The results are below. Unfortunately there are just 3 years but i think one can see the point. $U is also investing heavily in R&D that helps generate future sales. Without these investments they could already be profitable.

Probably you could do this with many growth stocks but imo $U is different. Why?

▫️The huge TAM $U addresses. Besides the 2D/3D, AR/VR gaming market their software is also used by the industry (autonomous driving, robotics etc.)

▫️$U is already market leader in mobile and AR/VR

▫️The huge TAM $U addresses. Besides the 2D/3D, AR/VR gaming market their software is also used by the industry (autonomous driving, robotics etc.)

▫️$U is already market leader in mobile and AR/VR

I think these two aspects enable $U to grow with 30-40% p.a. for the next years smililiar to $AMZN since 1997.

Maybe the TAM (eCommerce) of $AMZN in 1997 was much bigger than the TAM of $U is today, but the margins of the $U business are also much higher than in eCommerce.

Maybe the TAM (eCommerce) of $AMZN in 1997 was much bigger than the TAM of $U is today, but the margins of the $U business are also much higher than in eCommerce.

I‘m curious how i will think about these assumptions in 10 years 😄 Any thoughts about this @aadhansen? 🤔

• • •

Missing some Tweet in this thread? You can try to

force a refresh