1) Portfolio summary - Nov-end

$ADYEY $AFTPY $CRWD $DAO $DDOG $DKNG $DOCU $FUBO $LSPD $MELI $OKTA $PINS $PLTR $ROKU $SE $SHOP $SNAP $SNOW $SQ $STNE $TWLO $U $UBER $VRM

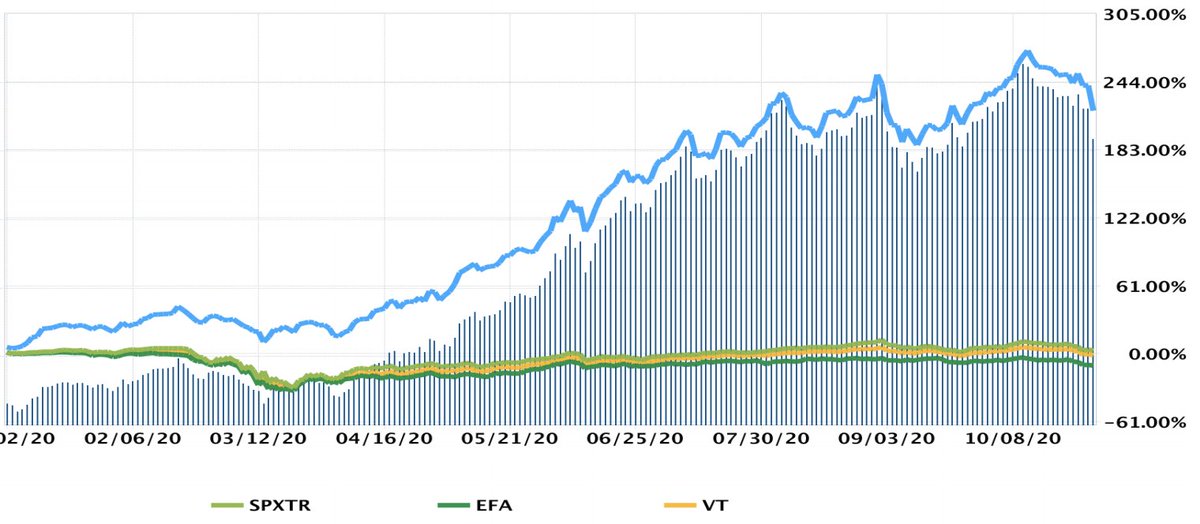

Return since 1 Sept 2016 -

Portfolio +471.83%

$ACWI +50.46%

$SPX +67.46%

$ADYEY $AFTPY $CRWD $DAO $DDOG $DKNG $DOCU $FUBO $LSPD $MELI $OKTA $PINS $PLTR $ROKU $SE $SHOP $SNAP $SNOW $SQ $STNE $TWLO $U $UBER $VRM

Return since 1 Sept 2016 -

Portfolio +471.83%

$ACWI +50.46%

$SPX +67.46%

2) CAGR since inception (1 Sept 2016) -

Portfolio +51.91%

$ACWI +10.29%

$SPX +13.18%

YTD return -

Portfolio +311.08%

$ACWI +10.25%

$SPX +12.10%

Contd...

Portfolio +51.91%

$ACWI +10.29%

$SPX +13.18%

YTD return -

Portfolio +311.08%

$ACWI +10.25%

$SPX +12.10%

Contd...

3) Biggest positions -

1) $MELI 2) $ROKU 3) $PLTR 4) $SE 5) $PINS

Buys - $AFTPY $FUBO $LSPD $SNAP $STNE $UBER

Sells - $AYX $BABA $FROG $FVRR $GDRX $ZM

Contd...

1) $MELI 2) $ROKU 3) $PLTR 4) $SE 5) $PINS

Buys - $AFTPY $FUBO $LSPD $SNAP $STNE $UBER

Sells - $AYX $BABA $FROG $FVRR $GDRX $ZM

Contd...

4) Note -

When calculating the custom portfolio return (1 Sept '16 onwards), my broker's new software works with a day's lag so the above performance and portfolio CAGR is from 1 Sept '16 until 27 Nov' 2020).

The YTD performance shown above is until the end of the month....

When calculating the custom portfolio return (1 Sept '16 onwards), my broker's new software works with a day's lag so the above performance and portfolio CAGR is from 1 Sept '16 until 27 Nov' 2020).

The YTD performance shown above is until the end of the month....

5) Moving onto my portfolio, November turned out to be a very strong month and my a/c appreciated by 29.33%.

During the month, a few COVID-19 vaccines were announced which prompted me to make several changes to benefit from the re-opening of the economy.

Accordingly, I sold...

During the month, a few COVID-19 vaccines were announced which prompted me to make several changes to benefit from the re-opening of the economy.

Accordingly, I sold...

6) my positions in some of the over-extended "work from home" companies and grabbed shares in a few promising businesses which were temporarily hurt by the pandemic.

Elsewhere, after the Ant IPO fiasco and China's proposed anti-trust regulation, I decided to sell my $BABA ...

Elsewhere, after the Ant IPO fiasco and China's proposed anti-trust regulation, I decided to sell my $BABA ...

7) shares and after $AMZN entry into the pharmacy space, also sold my position in $GDRX at a loss.

Elsewhere, I booked a tidy profit in my $VXX short position (which I sold when $VIX was around 40 and covered a few days ago)....

Elsewhere, I booked a tidy profit in my $VXX short position (which I sold when $VIX was around 40 and covered a few days ago)....

8) Turning to the broad market, I am of the opinion that the Fed's easy monetary policy, COVID-19 vaccine and the re-opening of the economy are likely to be positive for stocks and we should see a sustained rally until at least spring.

This is just my opinion though and it...

This is just my opinion though and it...

9) could very well be wrong; so nobody should rely on it.

In terms of my holdings, I am of the view that my remaining "work from home" stocks will continue to underperform for a while as they consolidate/digest their massive gains and those companies which benefit from the...

In terms of my holdings, I am of the view that my remaining "work from home" stocks will continue to underperform for a while as they consolidate/digest their massive gains and those companies which benefit from the...

10) re-opening of the economy are likely to shine in '21.

Once again, this is just my educated guess which could prove to be wrong, so nobody should rely on it.

In summary, 2020 has been a mind-blowing year, both for the real-world and my portfolio and I'm fairly certain...

Once again, this is just my educated guess which could prove to be wrong, so nobody should rely on it.

In summary, 2020 has been a mind-blowing year, both for the real-world and my portfolio and I'm fairly certain...

11) that things will become more boring in 2021 and beyond. Furthermore, I am 99.99% certain that my entire portfolio will probably never quadruple again within a single year!

So, in terms of my prowess, you are probably witnessing "Peak Puru" and my performance...

So, in terms of my prowess, you are probably witnessing "Peak Puru" and my performance...

12) (in terms of YTD growth) will only go downhill from here.

During these crazy times, worth remembering that the GOAT (Druckenmiller) compounded at 30%pa over his entire career, so this year's returns are an anomaly.

On this sobering note, onwards and upwards.

THE END.

During these crazy times, worth remembering that the GOAT (Druckenmiller) compounded at 30%pa over his entire career, so this year's returns are an anomaly.

On this sobering note, onwards and upwards.

THE END.

* During the month, I also took tiny/starter positions in $FVRR and $PGNY which were held for just a few days. However, due to different reasons, I closed these promptly.

Often, when I want to track a company closely, I pick up a few shares (< 0.3% of a/c equity).

Often, when I want to track a company closely, I pick up a few shares (< 0.3% of a/c equity).

• • •

Missing some Tweet in this thread? You can try to

force a refresh