Techno Funda: Potential Multibaggers!

We have Screened 4500+ Bse companies based on Techno funda (ath sales & share price).

And have found some Potential Multibaggers.

@dmuthuk @nooreshtech @rohanmehta_99 @Prashanth_Krish @gvkreddi

#investing

🧵

We have Screened 4500+ Bse companies based on Techno funda (ath sales & share price).

And have found some Potential Multibaggers.

@dmuthuk @nooreshtech @rohanmehta_99 @Prashanth_Krish @gvkreddi

#investing

🧵

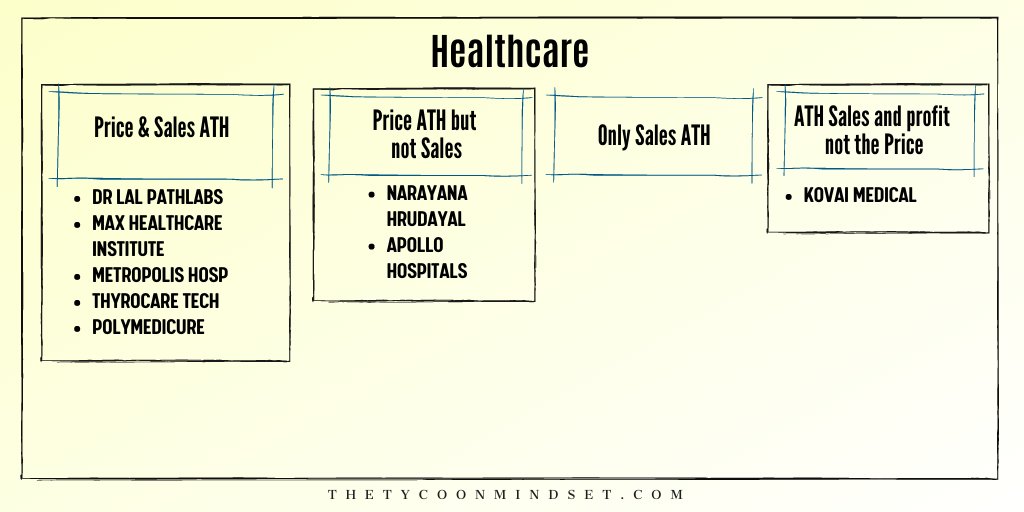

Techno Funda Stocks - Part 1

@unseenvalue @drprashantmish6 @punitbansal14 @vivbajaj @AnishA_Moonka @nid_rockz

Pharma Sector has seen a huge boost in sales and profits. There are still many companies which have ath sales and profits & are heading towards ath share

@unseenvalue @drprashantmish6 @punitbansal14 @vivbajaj @AnishA_Moonka @nid_rockz

Pharma Sector has seen a huge boost in sales and profits. There are still many companies which have ath sales and profits & are heading towards ath share

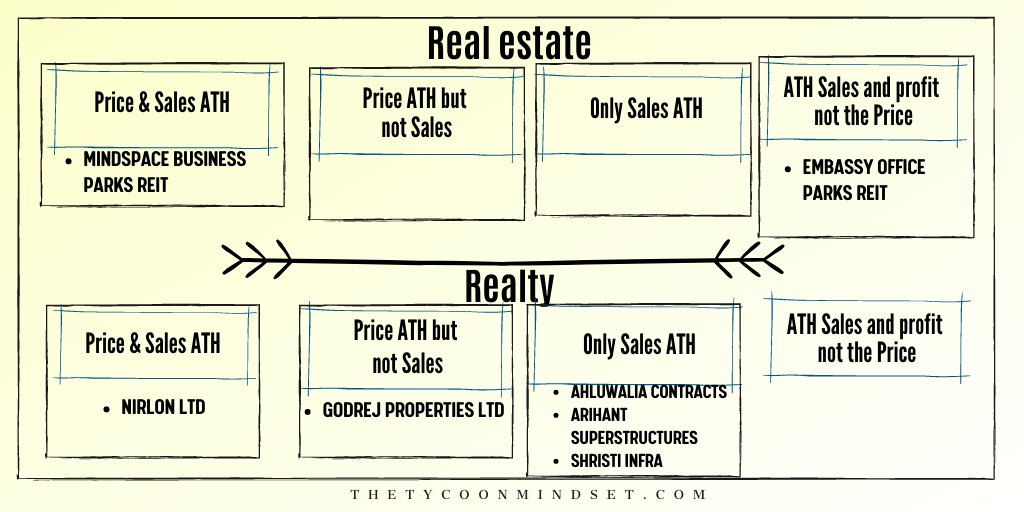

Techno Funda - part 2

Auto ancilliary sector has not been performing well. however, there is an increase in sales and if there is an increase in sales and profit in next 2-3 quaters then many stocks in these sectors can become multibagger.

@FI_InvestIndia @AdityaD_Shah

Auto ancilliary sector has not been performing well. however, there is an increase in sales and if there is an increase in sales and profit in next 2-3 quaters then many stocks in these sectors can become multibagger.

@FI_InvestIndia @AdityaD_Shah

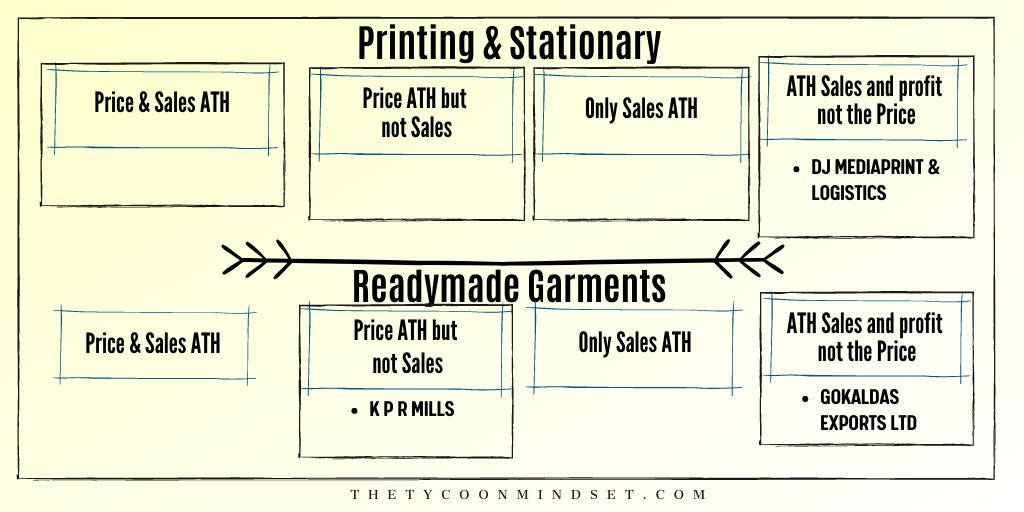

Techno funda Part 3

Speciality Chemical companies segement has produces some great multibagger but some of them have shown reduced sales & profits.

@omkaracap @Capital_Artist @varinder_bansal @VRtrendfollower @krishnblue @Stockstudy8 @arpit_goel_ @SwarnashishC @sonalbhutra

Speciality Chemical companies segement has produces some great multibagger but some of them have shown reduced sales & profits.

@omkaracap @Capital_Artist @varinder_bansal @VRtrendfollower @krishnblue @Stockstudy8 @arpit_goel_ @SwarnashishC @sonalbhutra

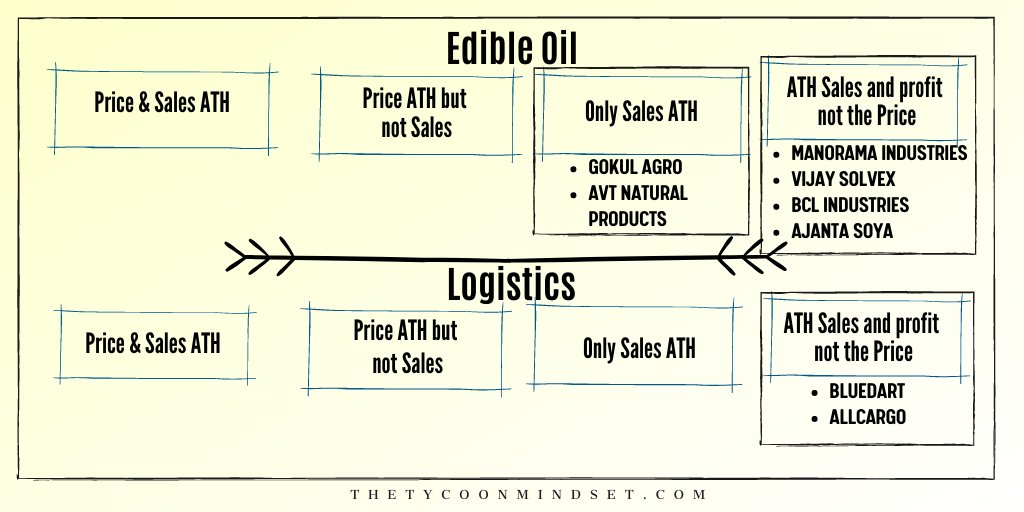

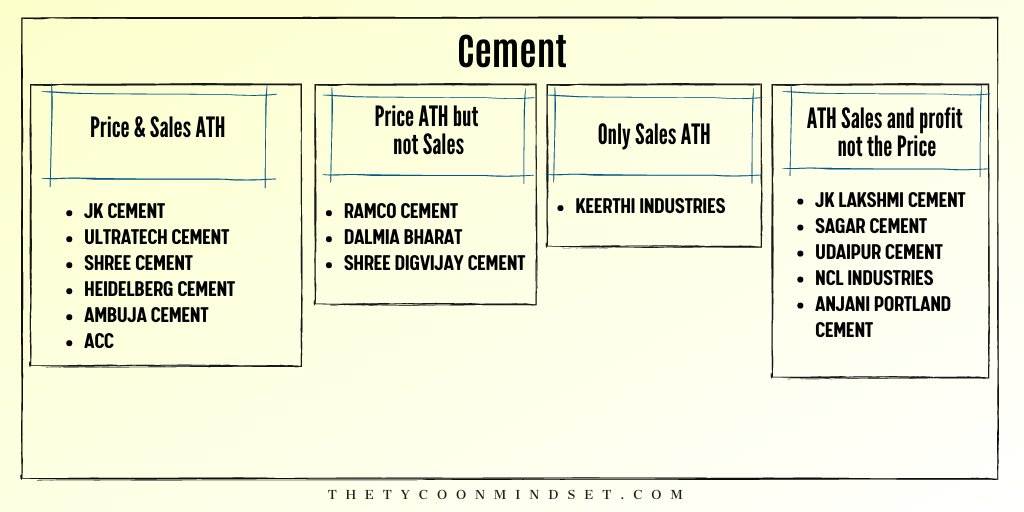

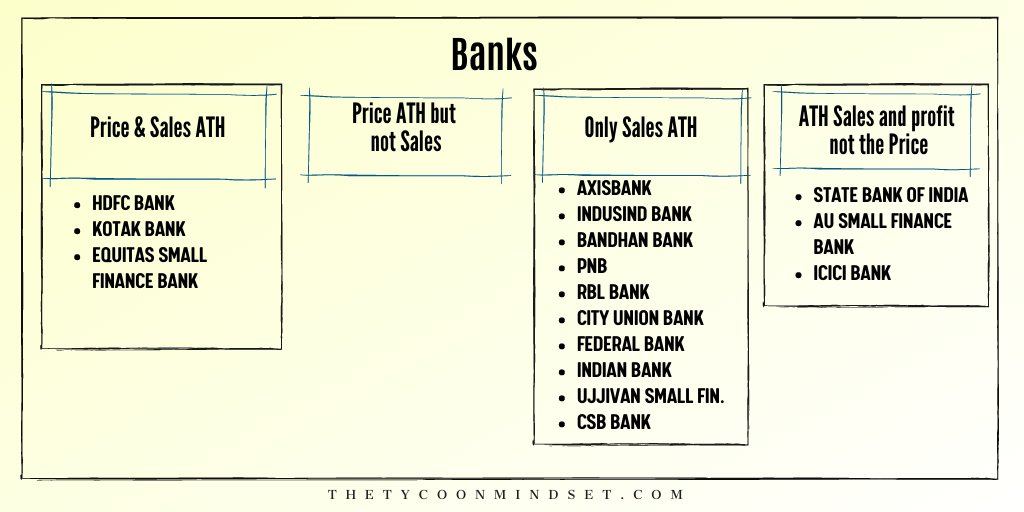

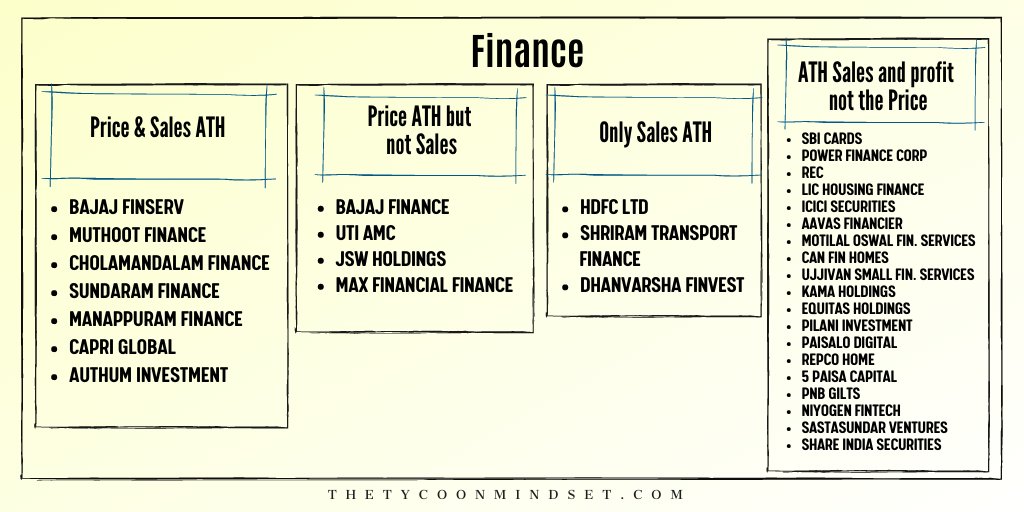

Techno Funda - Part 4

@caniravkaria @SandeepKrJainTS @mysticfuture @niftywizard @nareshbahrain @_Manishh_

@caniravkaria @SandeepKrJainTS @mysticfuture @niftywizard @nareshbahrain @_Manishh_

These are the potential multibagger companies

Excel sheet of these techno funda companies is uploaded on our

telegram channel: t.me/thetycoonminds…

Excel sheet of these techno funda companies is uploaded on our

telegram channel: t.me/thetycoonminds…

• • •

Missing some Tweet in this thread? You can try to

force a refresh