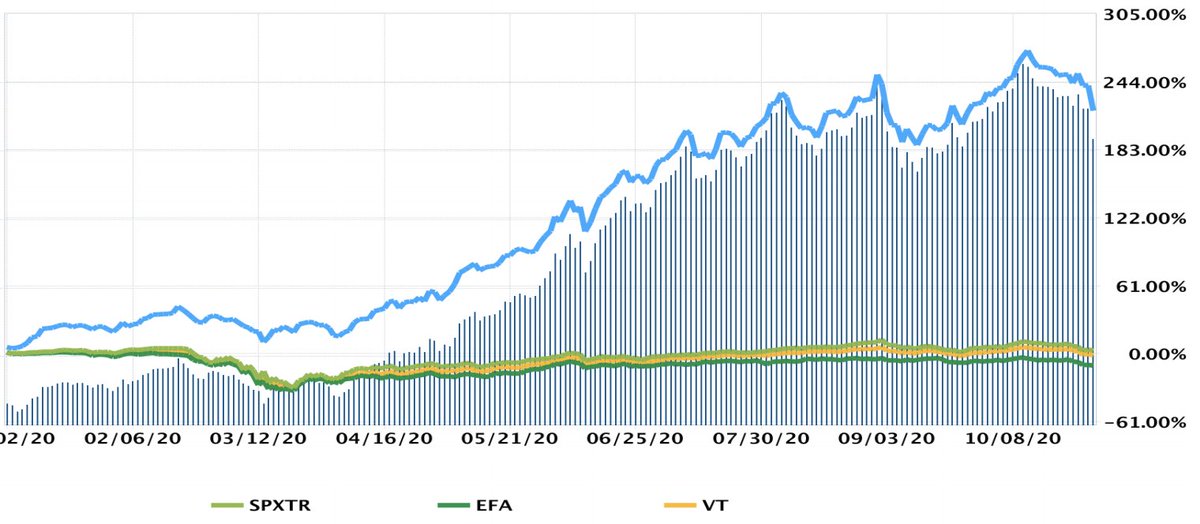

Narrative - Rising 10-yr UST yield is bad for growth stocks

Reality - $IWO positively correlated with 10-yr UST yield

Reality - $IWO positively correlated with 10-yr UST yield

History shows that rising long-term rates from such low levels are POSITIVE for growth stocks/risk assets.

Conversely, falling long-term rates are NEGATIVE for growth stocks/risk assets.

Rising rates imply the bond market is becoming less worried about the economic outlook.

Conversely, falling long-term rates are NEGATIVE for growth stocks/risk assets.

Rising rates imply the bond market is becoming less worried about the economic outlook.

This chart goes back ***20 YEARS***

$IWO = positive correlation with 10-yr UST yield

Facts/reality > narratives

$IWO = positive correlation with 10-yr UST yield

Facts/reality > narratives

$SPX and yields = positive correlation when rates are low

$SPX and yields = negative correlation when rates are high

H/T @jam_croissant for highlighting the research paper

$SPX and yields = negative correlation when rates are high

H/T @jam_croissant for highlighting the research paper

• • •

Missing some Tweet in this thread? You can try to

force a refresh