@AlphaFinanceLab team is excited to announce that our perpetual swap product called #AlphaX is live on beta private testnet! 🚀🔥

Read on to learn more! 👇

blog.alphafinance.io/the-new-alpha-…

Read on to learn more! 👇

blog.alphafinance.io/the-new-alpha-…

1) What is #AlphaX?

#AlphaX is a decentralized non-orderbook perpetual swap product. $ALPHA team has come up with a unique engineering and implementation design that will make #AlphaX uniquely different from other perpetual swap products in the market.

#AlphaX is a decentralized non-orderbook perpetual swap product. $ALPHA team has come up with a unique engineering and implementation design that will make #AlphaX uniquely different from other perpetual swap products in the market.

2) Notable features include:

👉Non-orderbook markets on any asset that has a non-manipulatable price feed

👉Up to 10x leverage

👉Funding rate baked into the quoted spot price

👉Tokenized long and short position tokens

👉Bot-less, automatic on-chain liquidation mechanic

👉Non-orderbook markets on any asset that has a non-manipulatable price feed

👉Up to 10x leverage

👉Funding rate baked into the quoted spot price

👉Tokenized long and short position tokens

👉Bot-less, automatic on-chain liquidation mechanic

3) What is beta private testnet?

$ALPHA team is actively testing #AlphaX and iterating on making the product as user friendly as possible.

We'll be releasing the current iteration of #AlphaX to a selected group of community members to test and give feedback on!

$ALPHA team is actively testing #AlphaX and iterating on making the product as user friendly as possible.

We'll be releasing the current iteration of #AlphaX to a selected group of community members to test and give feedback on!

4) How do you get access to #AlphaX beta private testnet?

Simply fill out the form here: forms.gle/USgX6yMEQtm8VB…

Simply fill out the form here: forms.gle/USgX6yMEQtm8VB…

5) Why are we building #AlphaX?

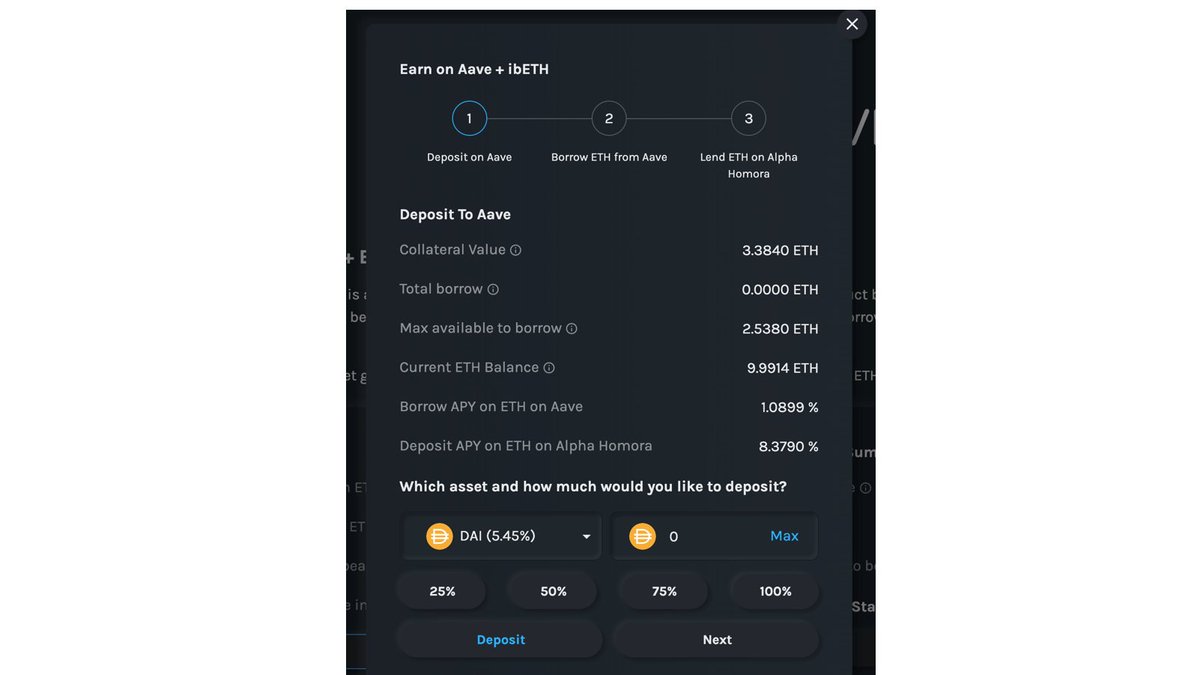

While #AlphaX will capture its own target users in the perpetual swap trading sector, it'll also bring clear synergy to #AlphaHomora by enabling leveraged yield farmers/liquidity providers to hedge their leveraged positions

While #AlphaX will capture its own target users in the perpetual swap trading sector, it'll also bring clear synergy to #AlphaHomora by enabling leveraged yield farmers/liquidity providers to hedge their leveraged positions

6) When is #AlphaX going to be ready for public use?

#AlphaX is in a proof-of-concept stage for us to test the viability of our perpetual swap market design. Like any other $ALPHA products, we'll make sure that our product solves users' pain points before releasing to the public

#AlphaX is in a proof-of-concept stage for us to test the viability of our perpetual swap market design. Like any other $ALPHA products, we'll make sure that our product solves users' pain points before releasing to the public

7) What is the mission of @AlphaFinanceLab?

We're building a number of innovative #DeFi products to capture market gaps. While each product captures its own market, all $ALPHA products will work together to maximize returns while minimizing downside risk for our users.

We're building a number of innovative #DeFi products to capture market gaps. While each product captures its own market, all $ALPHA products will work together to maximize returns while minimizing downside risk for our users.

8) We are also looking for passionate community members who are looking to contribute to the $ALPHA ecosystem. If you are interested, please feel free to reach out to @tascha_panpan on Twitter 🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh