Position sizing is most important aspect of system development, which makes a big difference in your returns.

Thread on Position sizing strategies-

Thread on Position sizing strategies-

Money management is not any of the following-

• It does not tell you how much you will lose on a trade.

• It does not tell you when to exit.

• It is not risk control.

• It is not risk avoidance.

• It does not tell you how much you will lose on a trade.

• It does not tell you when to exit.

• It is not risk control.

• It is not risk avoidance.

What is Position sizing-

1. Position sizing is that par of your trading system that answers the question "HOW MUCH" throughout the course of the trade,

• It tells you how big a position you should have at a given time when you are in a trade.

1. Position sizing is that par of your trading system that answers the question "HOW MUCH" throughout the course of the trade,

• It tells you how big a position you should have at a given time when you are in a trade.

• This 'How much' makes a whole lot of difference in a trader's performance.

* Position sizing strategies-

* There are two basic position sizing strategies -

• Martingale

• Anti-Martingale.

1. Martingale strategies increase one's bet when equity decreases.

* Position sizing strategies-

* There are two basic position sizing strategies -

• Martingale

• Anti-Martingale.

1. Martingale strategies increase one's bet when equity decreases.

2. Anti-martingale strategies increase one's bet when equity increases.

Casinos love people who uses Martingale strategies.

Lets see an example of Roulette where one uses the martingale strategy and double the bet every time he loses-

Casinos love people who uses Martingale strategies.

Lets see an example of Roulette where one uses the martingale strategy and double the bet every time he loses-

1. Any game of chance will have losing streaks , and when the probability of winning is less then 50%, the losing streaks could be quite significant.

2. Lets assume that you have a streak of 10 losses, if you had started betting $1, then you will have lost $2047, over the streak

2. Lets assume that you have a streak of 10 losses, if you had started betting $1, then you will have lost $2047, over the streak

3. You will now be betting $2048 to get your original amount back, thus your win-loss ratio at this point for less than a 50:50 bet is 1 to 4095.

4. You will be risking $4000 to get 1$.

5. Since some people might have unlimited bankrolls, the casinos have betting limits.

4. You will be risking $4000 to get 1$.

5. Since some people might have unlimited bankrolls, the casinos have betting limits.

6. A table allows a minimum bet of $1 and not more then $100.

As a result Martingale strategies neither work in casinos nor in Markets.

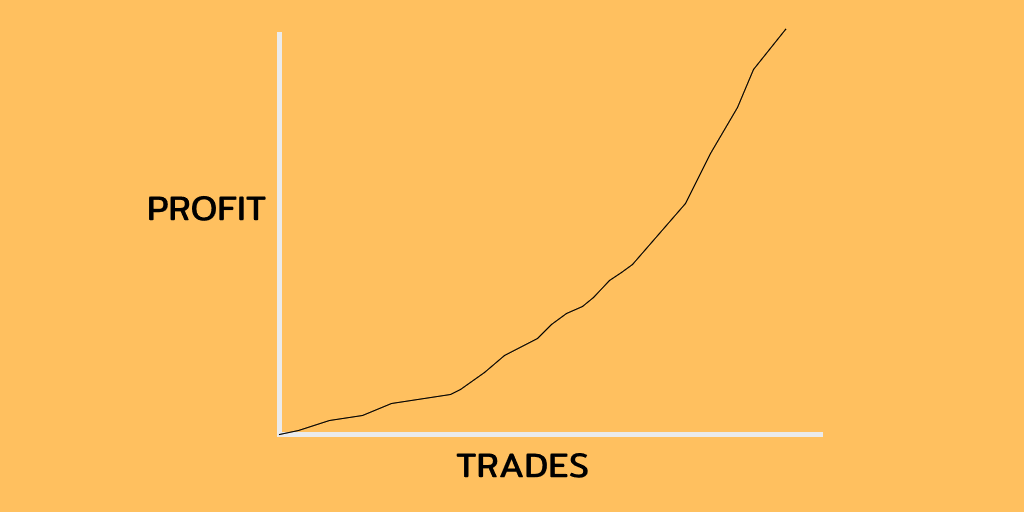

Anti-Martingale strategies , which risk more in a winning streaks, do work both in gambling and trading.

As a result Martingale strategies neither work in casinos nor in Markets.

Anti-Martingale strategies , which risk more in a winning streaks, do work both in gambling and trading.

The purpose of position sizing is to tell you how many shares you are going to buy or sell, given the size of your account.

* Type of Anti- Martingale strategies-

1. One unit per fixed amount of money.

2. Equal value units for stocks-

3. The percent risk model.

* Type of Anti- Martingale strategies-

1. One unit per fixed amount of money.

2. Equal value units for stocks-

3. The percent risk model.

4. The percent volatility model.

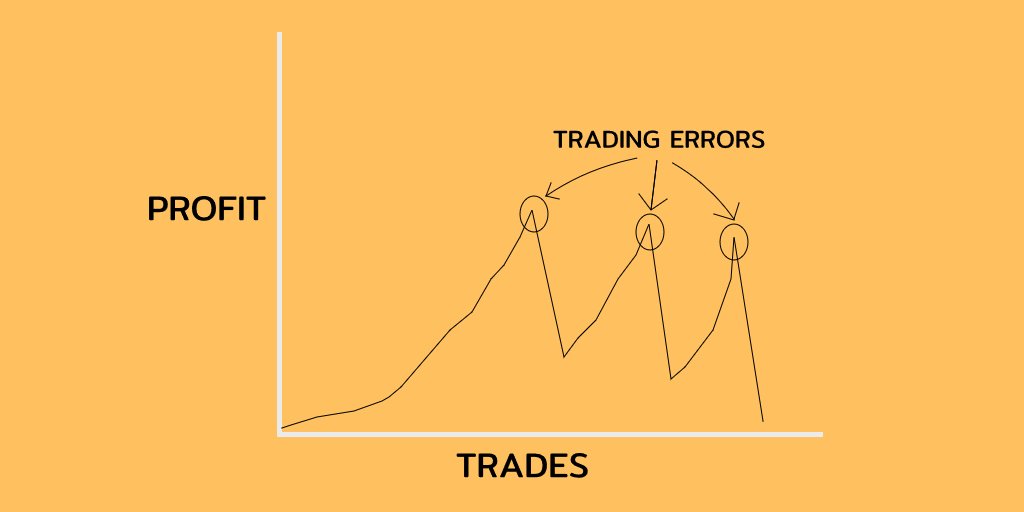

The Ones that are important are The percent risk model and the percent risk volatility model. So will be explaining them a little briefly-

* The percent risk model-

1. Suppose you want to buy gold at $1800 per ounce.

The Ones that are important are The percent risk model and the percent risk volatility model. So will be explaining them a little briefly-

* The percent risk model-

1. Suppose you want to buy gold at $1800 per ounce.

2. Your system suggest that if gold drop as low as $1790, you need to get out.

3. Thus your worst case risk per gold contract is 10 points times $100 per point, or $1000.

4. You have a $250,000 account. You want to limit your risk on your gold position to 2.5% of that equity.

3. Thus your worst case risk per gold contract is 10 points times $100 per point, or $1000.

4. You have a $250,000 account. You want to limit your risk on your gold position to 2.5% of that equity.

5. If you divide your $5000 risk per contract into your total allowable risk of $6560, you get $1.25 contracts.

This , your percent risk position sizing will only allow you to purchase one contract.

So this method rejects some traders because they are too risky .

This , your percent risk position sizing will only allow you to purchase one contract.

So this method rejects some traders because they are too risky .

This method is used when you are trading Futures or options market.

* The percent volatility model-

1. Volatility refers to the amount of daily price movement of the underlying instrument over an arbitrary period of time.

* The percent volatility model-

1. Volatility refers to the amount of daily price movement of the underlying instrument over an arbitrary period of time.

2. It’s the direct measurement of the price change that you are likely to be exposed to for or against you on any given position.

3. Volatility , In most cases is simply the difference between the high and the low of day.

3. Volatility , In most cases is simply the difference between the high and the low of day.

4. If Gold varies between 2000 and 2040 then its volatility is 20 points. But we also have to add gap up or down points to get the correct volatility.

5. Suppose that you have $250000 account and you want to buy gold .lets say that gold is at $2000 per ounce and during

5. Suppose that you have $250000 account and you want to buy gold .lets say that gold is at $2000 per ounce and during

the last 10 days the daily range is $20 .

6. Since the day range is $10 and a point is worth $100. that gives the daily volatility a value of $1000 per contract.

7. Lets say that we are going to allow volatility to be a maximum of 2 % of our equity which will be $5000

6. Since the day range is $10 and a point is worth $100. that gives the daily volatility a value of $1000 per contract.

7. Lets say that we are going to allow volatility to be a maximum of 2 % of our equity which will be $5000

for a $250000 account, If we divide our $2000 per contract fluctuation into our allowable limit of $1000. we get 2 contract.

8. Thus this Volatility based model would allow us to purchase 2 contracts.

Thanks for reading till here.

8. Thus this Volatility based model would allow us to purchase 2 contracts.

Thanks for reading till here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh