SaaS growth investing is on 🔥 the last few quarters. If you are a SaaS founder in the market to raise a growth round, here’s a quick summary of what to expect & how to prepare for these conversations, based on chats we’ve had w/ a bunch of growth funds in US and SEA recently👇

Some highlights:

+ SaaS public mkt multiples are, for the 1st time, ahead of private mkts; we are seeing >20x NTM rev, 30-40x ARR, pretty regularly

+ Y/Y rev growth & mkt leadership valued a lot

+ 1st check DD down from 90d to 2wks!

+ Clear post-covid narrative v. imp to raise

+ SaaS public mkt multiples are, for the 1st time, ahead of private mkts; we are seeing >20x NTM rev, 30-40x ARR, pretty regularly

+ Y/Y rev growth & mkt leadership valued a lot

+ 1st check DD down from 90d to 2wks!

+ Clear post-covid narrative v. imp to raise

Before the raise 1/2:

+ Educate the market on your long-term story; PR/AR, 3rd party sources talking you up, etc. You want data points others can search & find.

+ Get customers prepped to talk and offer a few up front once the funds are looking to dig in. Why?

+ Educate the market on your long-term story; PR/AR, 3rd party sources talking you up, etc. You want data points others can search & find.

+ Get customers prepped to talk and offer a few up front once the funds are looking to dig in. Why?

Growth funds often spend >$1M/yr building/maintaining networks and will find their way to your customers any which way. Better to offer a few you know will talk you up.

Before the raise 2/2:

+ Try to enter into some SaaS quadrant; e.g. G2, Gartner etc.

+ US domicile better; highlight NA customer logos in deck.

+ If India based SaaS, check if the fund has done anything in India before (those move faster).

+ Try to enter into some SaaS quadrant; e.g. G2, Gartner etc.

+ US domicile better; highlight NA customer logos in deck.

+ If India based SaaS, check if the fund has done anything in India before (those move faster).

How to prepare 1/3:

+ Talk to your board members re: your raise plan

+ Narrow down top of funnel based on fund’s focus areas, partners you like, check sizes, etc

+ Check which partners are most active lately; where in deployment cycle is fund at.

+ Talk to your board members re: your raise plan

+ Narrow down top of funnel based on fund’s focus areas, partners you like, check sizes, etc

+ Check which partners are most active lately; where in deployment cycle is fund at.

We are seeing mid-sized 25-40M checks moving fastest (2wks or less). Large checks of 50-75M, or mega checks of 100M+ take much longer. YMMV.

How to prepare 2/3:

+ Many funds have a cold-calling strategy (i.e. call everyone) - keep those light-touch or it’ll suck bandwidth.

+ Start the convos 3-6mos in advance!

+ Prep a data room: PnL, projections, customer names, pipeline, key contracts, prior raise docs, board decks

+ Many funds have a cold-calling strategy (i.e. call everyone) - keep those light-touch or it’ll suck bandwidth.

+ Start the convos 3-6mos in advance!

+ Prep a data room: PnL, projections, customer names, pipeline, key contracts, prior raise docs, board decks

How to prepare 3/3:

+ I’d advise NOT sharing all data en masse; release slowly: it allows you to gauge continued interest & helps you save the most important customer intros for the most interested funds.

+ Do dry run w/ your board + other founders who’ve raised growth rounds.

+ I’d advise NOT sharing all data en masse; release slowly: it allows you to gauge continued interest & helps you save the most important customer intros for the most interested funds.

+ Do dry run w/ your board + other founders who’ve raised growth rounds.

What are funds looking for? Data, data, data of course. Lots to cover here but:

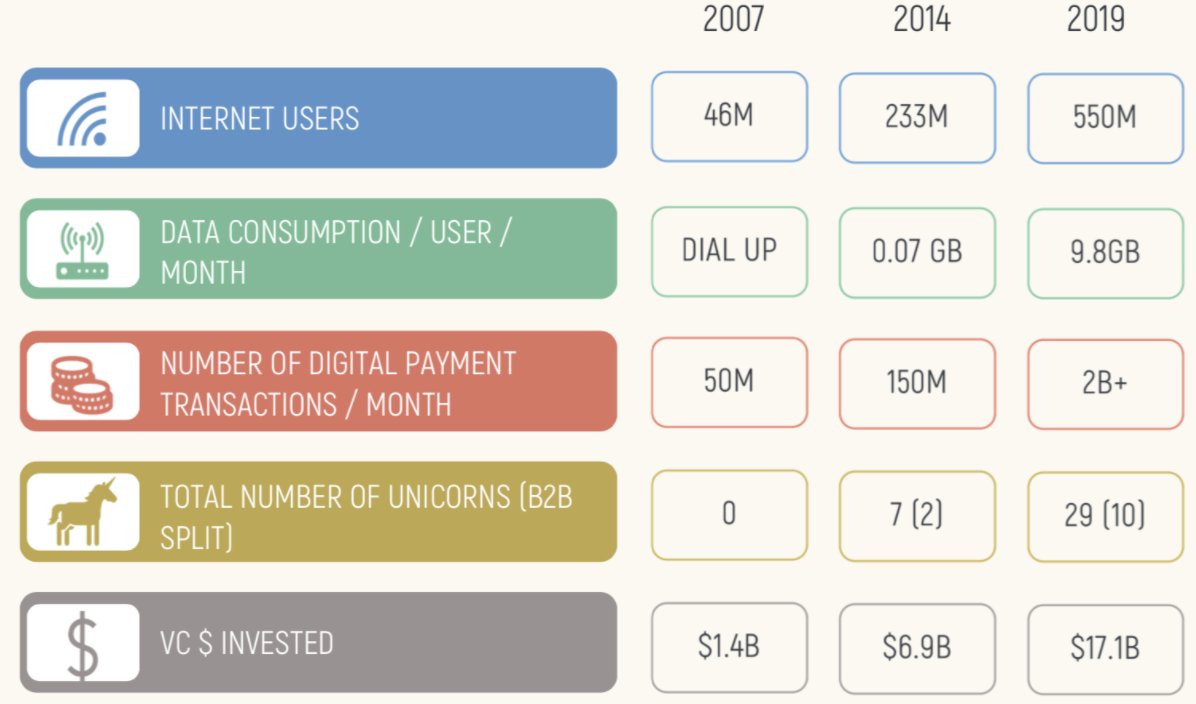

E.g-1. For consumery SaaS, highlight (1) consumery KPIs: $s / eyeballs, engagement, DAU/MAU, Txn (e.g. API call) vol etc. (2) Pace of growth - are you leading / can become a leading player in mkt?

E.g-1. For consumery SaaS, highlight (1) consumery KPIs: $s / eyeballs, engagement, DAU/MAU, Txn (e.g. API call) vol etc. (2) Pace of growth - are you leading / can become a leading player in mkt?

E.g.-2 For SaaS-enabled marketplaces: (1) GMV (2) how much of client's overall biz flows through you (3) have you been able to slowly raise take-rates as usefulness of your platform was proven? (4) stickiness on supply/demand side: are large contracts leaking from the platform?

Finally, on team 1/2:

+ Important to have the financial side of your team figured out (CFO/FP&A)

+ Layered experienced talent since series A/B - who’s seen the $20-50M journey before? Grey haired execs needed at this point.

+ VP & CxOs (CRO etc) in critical areas.

+ Important to have the financial side of your team figured out (CFO/FP&A)

+ Layered experienced talent since series A/B - who’s seen the $20-50M journey before? Grey haired execs needed at this point.

+ VP & CxOs (CRO etc) in critical areas.

Often teams have strong engg/product at this stage but not good enough GTM talent. That’s a mistake!

Finally, on team 2/2:

+ If India SaaS, demonstrate strong GTM in US/NA if raising from US funds.

+ Line up calls with your sales & GTM leadership - they need to be ready to speak to investors!

+ If India SaaS, demonstrate strong GTM in US/NA if raising from US funds.

+ Line up calls with your sales & GTM leadership - they need to be ready to speak to investors!

There has never been a better time to raise growth capital. If you are building a fast-growing SaaS company anywhere in the world and are looking for growth capital, feel free to DM me 🚀🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh