This convo is entertaining but painful to watch.

1) Oil traded in CNY does not change everything.

2) What Luke says here about why Kyle was short CNY is... wrong.

cc @LukeGromen, @JKyleBass - both have me blocked and @SantiagoAuFund, @_animal_spirits b/c they're here.

1) Oil traded in CNY does not change everything.

2) What Luke says here about why Kyle was short CNY is... wrong.

cc @LukeGromen, @JKyleBass - both have me blocked and @SantiagoAuFund, @_animal_spirits b/c they're here.

1) Aramco sells oil. Others do too but Luke has used the KSA selling oil in CNY example for a while so I'll use it.

Helpfully, we have the accounts from end-Sep.

Aramco sold SAR 930bn of oil+svcs in 12m to Sep20. Let's imagine for a second EVERY drop/service went to China.

Helpfully, we have the accounts from end-Sep.

Aramco sold SAR 930bn of oil+svcs in 12m to Sep20. Let's imagine for a second EVERY drop/service went to China.

Let's imagine China paid in CNH. If they did, then KSA would have to get the FX changed back to USD and SAR immediately. Why?

a) Aramco had SAR 372bn of costs - none of which were in RMB. And none of the cost basis wanted to receive CNH.

b) Aramco had operating expense and

a) Aramco had SAR 372bn of costs - none of which were in RMB. And none of the cost basis wanted to receive CNH.

b) Aramco had operating expense and

interest expense of another SAR 124bn in those 12 months, effectively none of which were in CNY. That left SAR 498bn of cash profit before depreciation, but SAR 113bn of non-CNY capex cash out the door brings cash earnings down to SAR 385bn (and EBT of SAR 434bn).

Aramco paid SAR 218.6bn of income taxes to the KSA - also not in CNY.

That left Aramco with cash earnings of SAR 166bn and Net Income of SAR 206bn before Minority Interest.

So maybe it could have kept that SAR 166bn in CNH/CNY.

But no...

That left Aramco with cash earnings of SAR 166bn and Net Income of SAR 206bn before Minority Interest.

So maybe it could have kept that SAR 166bn in CNH/CNY.

But no...

Aramco has to pay out dividends. They have a promise they made pre-IPO. That dividend obligation cost them SAR 241bn.

So on a cash basis they were net negative. They were not accumulating CNY/CNH as "reserves" and the dollar did not become less important relative to crude.

So on a cash basis they were net negative. They were not accumulating CNY/CNH as "reserves" and the dollar did not become less important relative to crude.

But what about the KSA? They get almost all those income taxes and 98% of the dividend, and even get a chunk of the COGS and OPEX revenue.

Yes, but....

That COGS literally has costs behind it. People, power, expenses, royalties, etc.

And even if the sovereign, KSA, takes in

Yes, but....

That COGS literally has costs behind it. People, power, expenses, royalties, etc.

And even if the sovereign, KSA, takes in

all that revenue, KSA is still running a very large budget deficit. The KSA Finance Ministry pre-budget statement published in Sep said they expected a budget deficit of 12% in 2020, 5.1% in 2021, and 3% in 2022.

Even if the KSA has some costs in CNY in its govt budget,

Even if the KSA has some costs in CNY in its govt budget,

they are minimal, and in effect, if Chinese exports to the KSA govt (computers, defense spending, anything else) are invoiced and paid in CNH, the enormous portion of Saudi oil revenue still has a direct AND indirect cost base in non-CNY currencies.

As to #2 - Kyle Bass' comment that USD-denom oil is a cost to China. Yes. It is. But that wasn't the base case of the argument (or at least I did not read it that way) and oil for importing nations is effectively a variable tax on GDP. However, it is also basically an input cost

to everything else. It goes into fuel for airlines, trucking and transport businesses, household consumption, etc. It can even go into energy. But all of these which are not consumer purchases go into COGS which is then more or less passed on as a cost basis for GDP.

Oil is bought in USD (because of the above Aramco/KSA problem - KSA ties the SAR to the USD), burned, creating USD cost on top of the CNY cost, and "product" is then exported in USD terms leading to net USD inflow to China.

If China exports and oil imports are priced in CNY,

If China exports and oil imports are priced in CNY,

effectively the same thing happens. In the end, foreign importers of Chinese products will need to spend their USD to buy CNY to pay CNY for the products. Roughly the same as pricing it in USD. The flow legs change a bit but in the end, you have the same result.

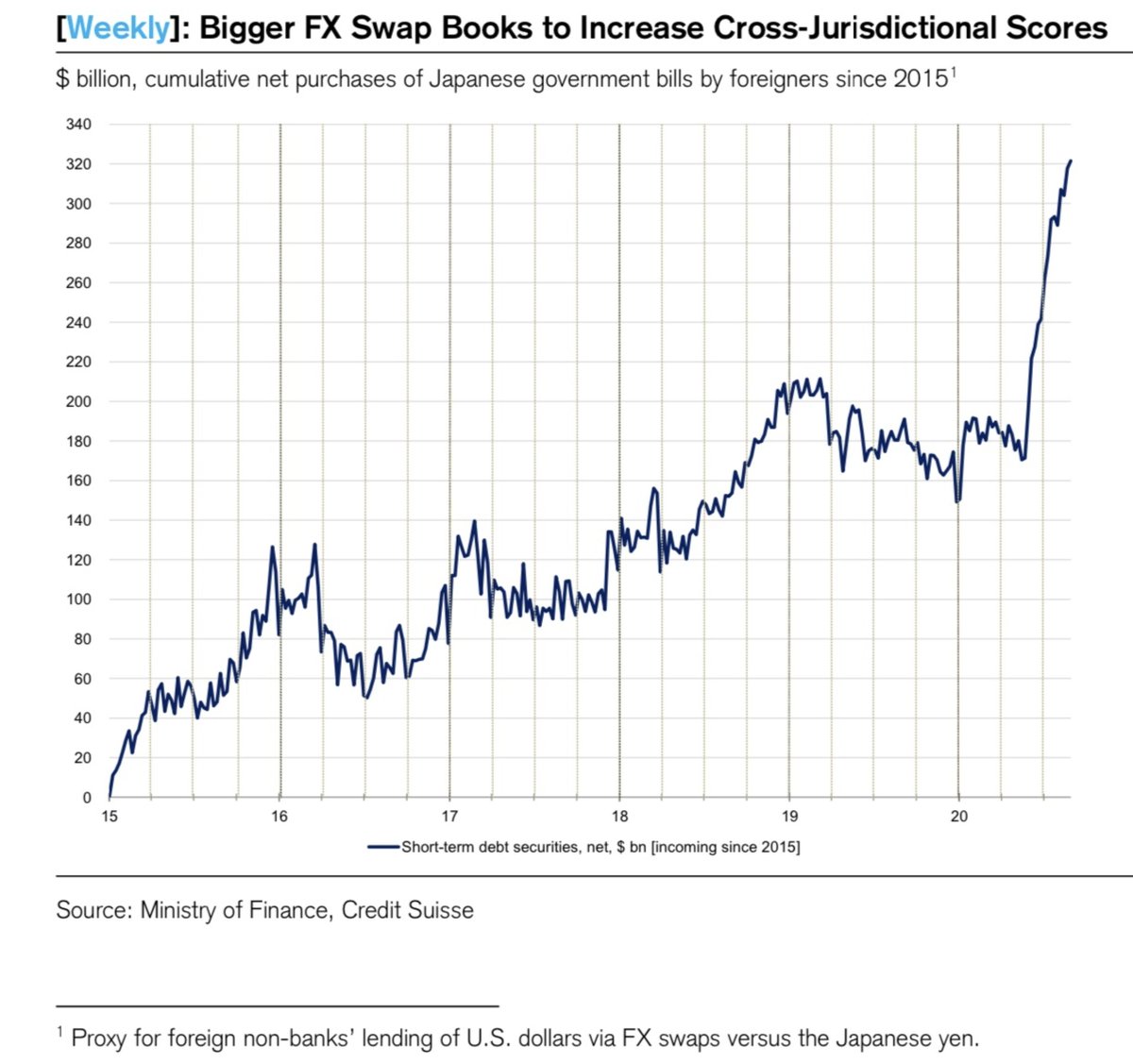

China has taken advantage of the price of oil dropping post-2014 to build up an SPR of many hundreds of millions of bbls and it continues to build. As the world's biggest importer, an SPR can help manage marginal supply/demand on its side, helping to reduce oil price volatility.

Over time, for China, oil is either an export COGS or a domestic consumption factor. And because business and consumption which uses oil basically operates on a cost-plus basis, it just shows up in PPI and CPI, but will likely not mean the difference btwn being able to service

its USD debt or not.

That is going to be much more contingent on corporate issuers (mostly developers) being able to monetize their land bank (i.e. no real estate crash) and financial issuers not seeing their global USD-denom assets not crashing below loan value.

So...

That is going to be much more contingent on corporate issuers (mostly developers) being able to monetize their land bank (i.e. no real estate crash) and financial issuers not seeing their global USD-denom assets not crashing below loan value.

So...

Like my response to Novogratz yesterday linked below, trade denomination is effectively meaningless. SAVINGS matter.

https://twitter.com/bauhiniacapital/status/1335980549526102028?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh