According to S3 Partners, $TSLA shorts have lost $35B in 2020. I talk with many TSLA shorts, and have been on the other side of their trade all year. Here is where $TSLAQ got it wrong: Way under-estimating TSLA TAM, and in thinking ICE-branded EV launches would hurt TSLA.

2/ Street estimates are soaring. $TSLA 2020 and 2021 EPS ests have almost doubled this year, as Y has quickly become TSLA ‘s best selling model with less than 20% cannibaliz’n of M3. Model Y is now being taken global. Meanwhile, China volumes will be 50% of TSLA volume in 2021.

3/ When I argued with shorts about Model Y, they missed that Y was a small SUV and M3 was a small sedan. The two don’t compete. And yet, shorts would argue Y would massively cannibalize M3. Y more than doubled $TSLA ‘s US TAM, from 25% to 66%, and will do the same globally.

4/ From my $TSLAQ discussions, I gathered that few had taken the time to drive the various TSLA models, esp the new Y. None did focus groups with TSLA owners, or very few discussed TSLA with rival dealers, all which shocked me. Their research consisted mainly of current year...

5/ ...and backward-looking financials, and their best materials were charts comparing $TSLA mkt value to ICE mkt values - mindless since going forward TSLA’s competitors are AMZN, GOOG, AAPL, NIO, and RIVN. $TSLAQ would make fun of my forecasts to 2025, saying it was impossible.

6/ The second worst mistake $TSLAQ made was in thinking ICE competitors could just launch their own EVs, and like magic TSLA would lose share. The opposite happened: ICE competitors launched EVs, got non-EV customers interested in EVs, and after comparing, many bought Teslas.

7/ But the worst $TSLAQ mistake was in thinking $TSLA could be valued like an auto company at 7-8x EPS, even though TSLA was posting 40%+ volume growth and 50%+ EPS growth. Basic finance dictates how multiples are derived, and no company growing vols at 40%+ is valued at 7-8x.

8/ So here we are entering 2021, with the same $TSLA setup as 2020:

1/ 40%+ vol growth for next 5 yrs, as global EV adoption soars from 3% today to 20% by 2025 (6x).

2/ TSLA EV share continues to grow as new EV buyers choose TSLA’s superior range, power, FSD, and #1 brand.

1/ 40%+ vol growth for next 5 yrs, as global EV adoption soars from 3% today to 20% by 2025 (6x).

2/ TSLA EV share continues to grow as new EV buyers choose TSLA’s superior range, power, FSD, and #1 brand.

9/ President-elect Biden will make clean energy a focus of his Presidency, and restore the $7,500 tax credit for $TSLA buyers. This trend is repeating all over the world, with leaders passing new regs that ban or penalize those making gas-powered cars that harm our environment.

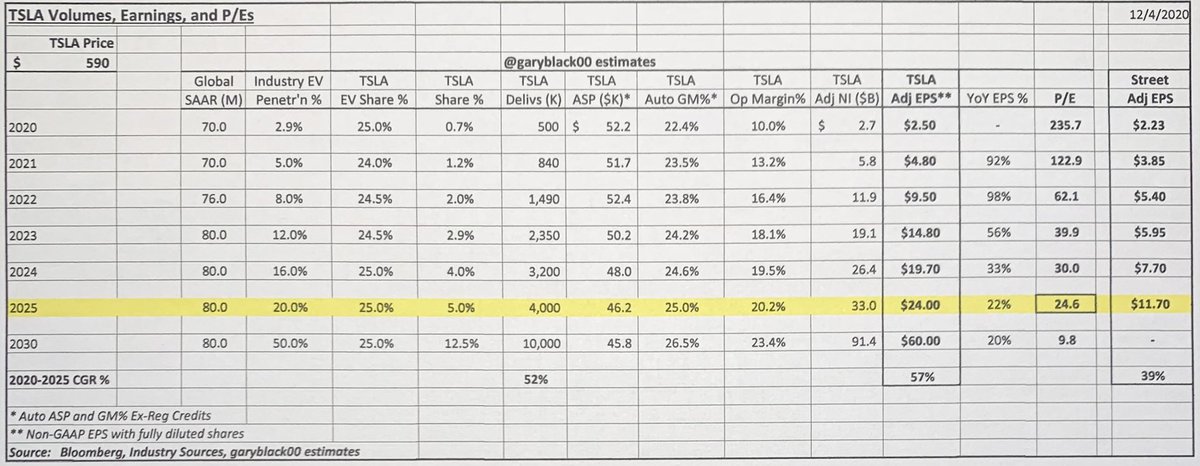

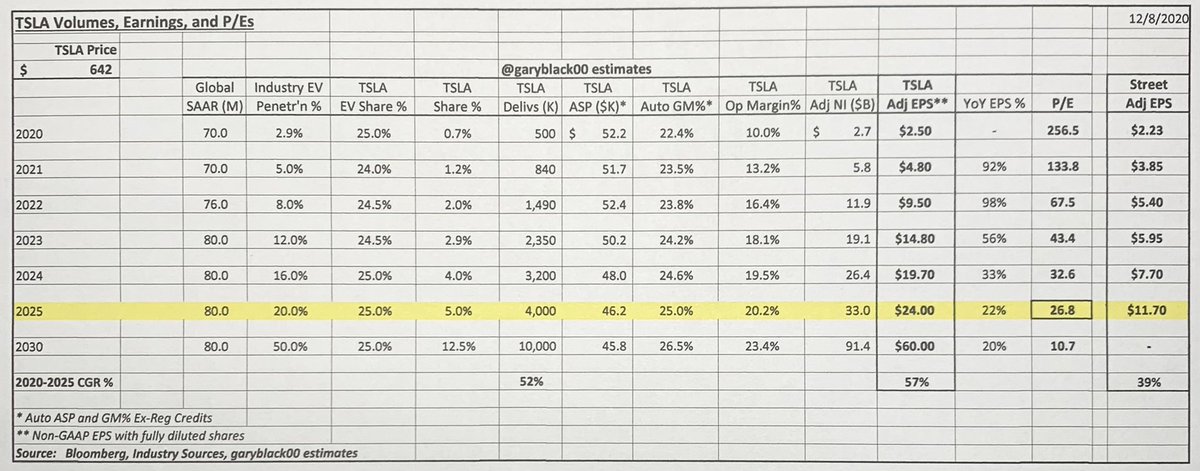

10/ On valuation, $TSLA looks crazy cheap if we go out 3-4 years. I forecast FY’25 EPS of $24, which implies a 2025 P/E of 27x, assuming zero reg credits, an -11% ASP drop vs now, and flat TSLA EV share. At a 2025 P/E of 50x (2x 2025-30 growth), that’s $1,200 ~$830 present value.

• • •

Missing some Tweet in this thread? You can try to

force a refresh