1/8

In my last research, I look at data storage on the Ethereum and Bitcoin blockchains. This could become a series of researches related to decentralized storage solutions. Check out this topic superficially here or deeper on @TheBlockRes. theblockcrypto.com/genesis/87043/…

In my last research, I look at data storage on the Ethereum and Bitcoin blockchains. This could become a series of researches related to decentralized storage solutions. Check out this topic superficially here or deeper on @TheBlockRes. theblockcrypto.com/genesis/87043/…

2/8

Blockchain size growth leads to an increase in the cost of running a node. 256 GB HDD was enough for a node 3 years ago, but today it is better to use at least a 1TB SSD. For this reason, storing data directly on the blockchain is expensive.

Blockchain size growth leads to an increase in the cost of running a node. 256 GB HDD was enough for a node 3 years ago, but today it is better to use at least a 1TB SSD. For this reason, storing data directly on the blockchain is expensive.

3/8

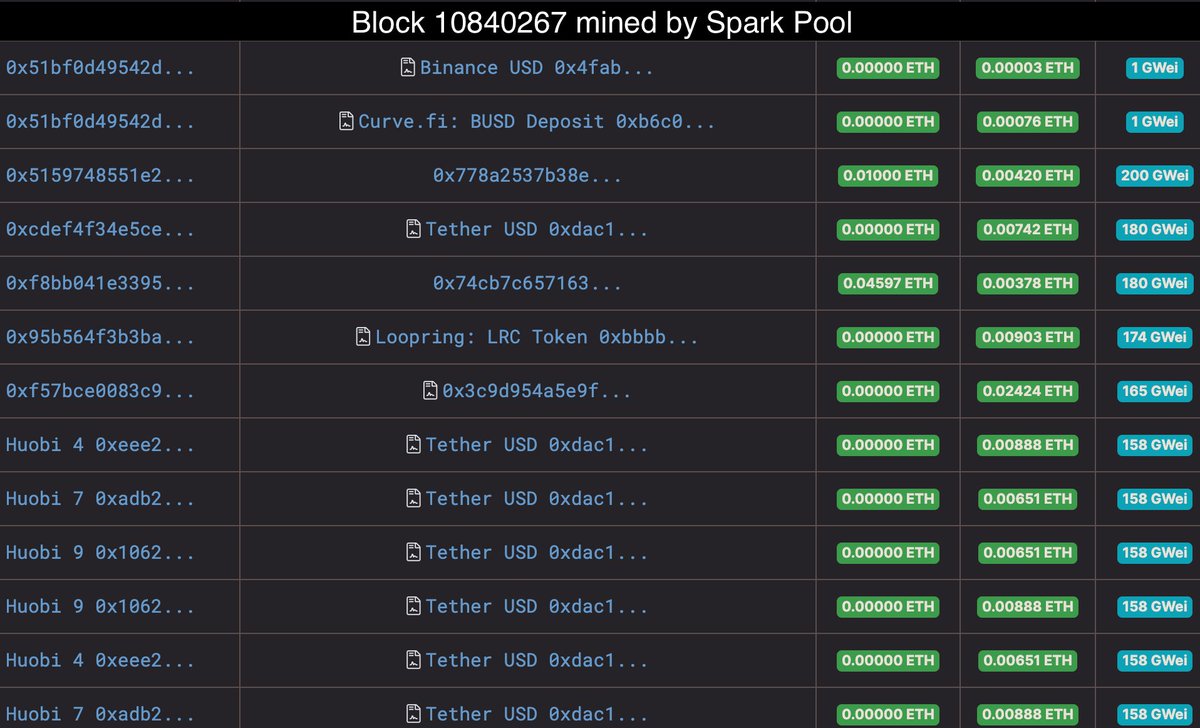

The average block size in Bitcoin and Ethereum has increased by 2 and 100 times since 2015, respectively. Bitcoin blocks are 26 times larger than Ethereum blocks, but because of the shorter creation time, 25% more information is written every day due to blocks in Ethereum.

The average block size in Bitcoin and Ethereum has increased by 2 and 100 times since 2015, respectively. Bitcoin blocks are 26 times larger than Ethereum blocks, but because of the shorter creation time, 25% more information is written every day due to blocks in Ethereum.

4/8

The most popular solution for storing data in Bitcoin is OP_RETURN. About 8% of bitcoin txs have data as one of the outputs. 90% of them are from Veriblock and Omni. OP_RETURN usage has dropped significantly compared to last year, which has a positive impact on Bitcoin.

The most popular solution for storing data in Bitcoin is OP_RETURN. About 8% of bitcoin txs have data as one of the outputs. 90% of them are from Veriblock and Omni. OP_RETURN usage has dropped significantly compared to last year, which has a positive impact on Bitcoin.

5/8

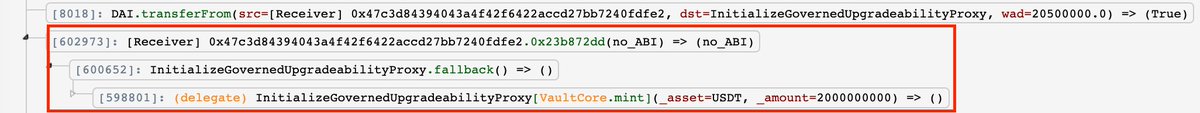

In turn, Ethereum has a lot of ways for data storage. But only writing to contract storage give the ability to access them from contracts at any time. However, this is a very costly data storage, 1GB writing to $20M now.

In turn, Ethereum has a lot of ways for data storage. But only writing to contract storage give the ability to access them from contracts at any time. However, this is a very costly data storage, 1GB writing to $20M now.

6/8

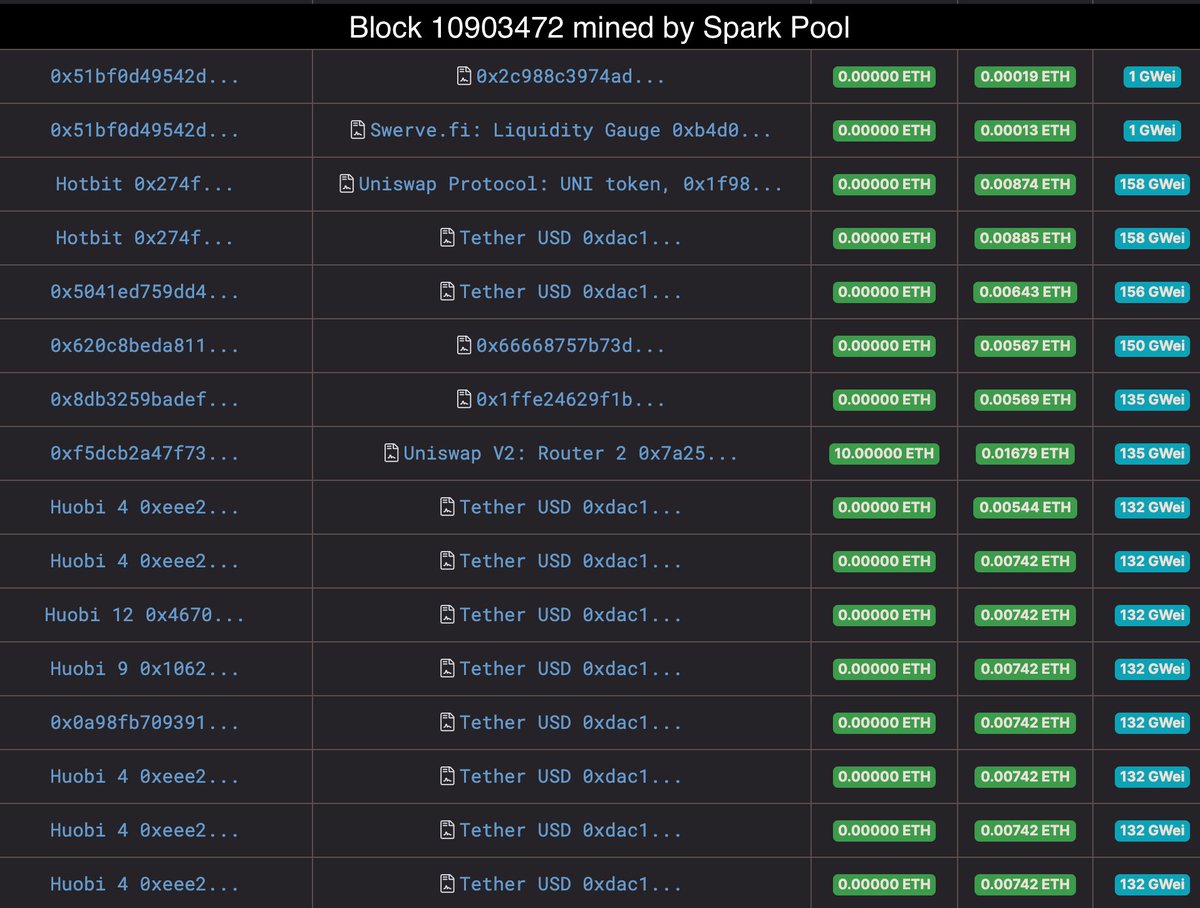

Further growth in blockchain size is inevitable as the number of deployed contracts on Ethereum grows. However, every second contract is destroyed due to the use of gas tokens. There is no production-ready solution that would allow contracts to use decentralized storage.

Further growth in blockchain size is inevitable as the number of deployed contracts on Ethereum grows. However, every second contract is destroyed due to the use of gas tokens. There is no production-ready solution that would allow contracts to use decentralized storage.

7/8

Wow, you’ve got to this point so that you can read about two of the most interesting facts I found while writing this piece:

- Bitcoin blocks with Segwit transaction have OP_RETURN, which starts from 0x6a24aa21a9ed, in coinbase transaction.

Wow, you’ve got to this point so that you can read about two of the most interesting facts I found while writing this piece:

- Bitcoin blocks with Segwit transaction have OP_RETURN, which starts from 0x6a24aa21a9ed, in coinbase transaction.

8/8

- ATH of SELFDESTRUCT calls was in Oct. 2016. It was part of a DDoS attack on Ethereum, where the same contracts were destroyed thousands of times. Tangerine Dream hard fork stopped this attack by increasing the cost of calling SELFDESTRUCT from 0 to 5000 gas.

- ATH of SELFDESTRUCT calls was in Oct. 2016. It was part of a DDoS attack on Ethereum, where the same contracts were destroyed thousands of times. Tangerine Dream hard fork stopped this attack by increasing the cost of calling SELFDESTRUCT from 0 to 5000 gas.

• • •

Missing some Tweet in this thread? You can try to

force a refresh