Zurich axioms - A book on Risk taking, by Max Gunther

@safiranand @jposhaughnessy @Vivek_Investor @BalakrishnanR @Covel @shyamsek @_anshulkhare

#investing

#Bookthread 👇🧵

@safiranand @jposhaughnessy @Vivek_Investor @BalakrishnanR @Covel @shyamsek @_anshulkhare

#investing

#Bookthread 👇🧵

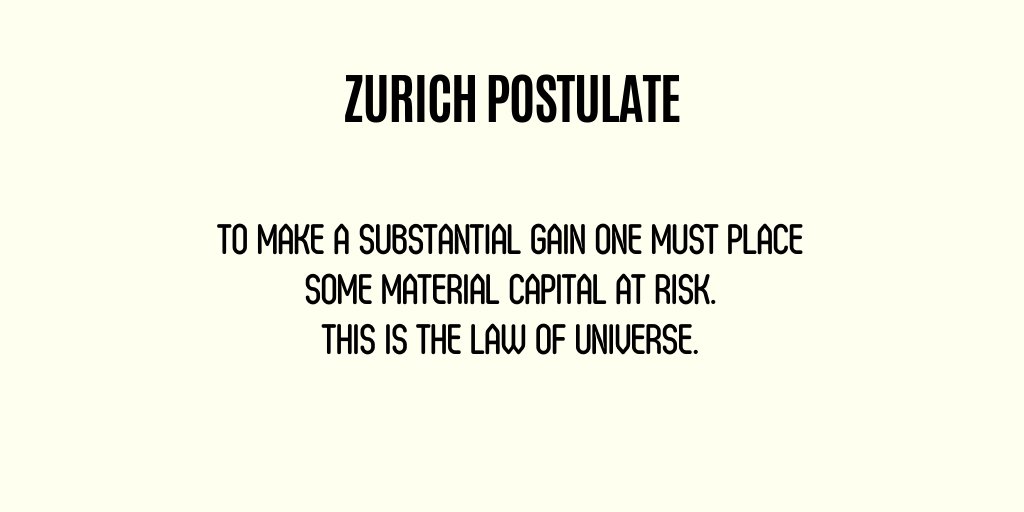

Switzerland, a country with no strategic or geographical advantage, became the world’s banker by learning how to manage risk and facing it head on.

Zurich axioms are simple rules in order to learn about betting to win.

Zurich axioms are simple rules in order to learn about betting to win.

The First Major Axiom:

ON RISK

- Life is an adventure. In order to experience life to its full potential one has to take meaningful risk.. All Investments are speculation. Some people accept it. some don’t.

Always play for meaningful stakes.

ON RISK

- Life is an adventure. In order to experience life to its full potential one has to take meaningful risk.. All Investments are speculation. Some people accept it. some don’t.

Always play for meaningful stakes.

- An investment with a small stake would not incur significant loss but will not generate any significant gain too. It should also not be so huge that loss would bankrupt a person.

- Resist the allure of diversification. The more one diversifies, the smaller the speculation gets. Through diversification all the losses and gains are likely to cancel out and no sizable difference is made.

The Second Major Axiom

ON GREED

- One must take profits soon. Long winning streaks are rare and short ones are vastly common One doesn’t know how long a winning streak will continue. Averages overwhelmingly favor the ones who quit early.

ON GREED

- One must take profits soon. Long winning streaks are rare and short ones are vastly common One doesn’t know how long a winning streak will continue. Averages overwhelmingly favor the ones who quit early.

- By reducing greed one improves the chances of winning.

- One must decide in advance how much gain one wants from a venture & when one gets it, square off the position.

- One way to reinforce the ending of a streak is to buy some kind of a reward from the gain.

- One must decide in advance how much gain one wants from a venture & when one gets it, square off the position.

- One way to reinforce the ending of a streak is to buy some kind of a reward from the gain.

The Third Major Axiom

ON HOPE

- When the ship starts to sink, don't pray. Jump.

- Knowing how to get out of the bad situation takes courage and a sense of honesty. A Professional speculator studies how he will save himself when things fall.

ON HOPE

- When the ship starts to sink, don't pray. Jump.

- Knowing how to get out of the bad situation takes courage and a sense of honesty. A Professional speculator studies how he will save himself when things fall.

- Many great traders have a rule of thumb of selling their position when it falls about 15-20% from the highest price at which they held.

- Accept small losses cheerfully. Taking small losses is a much better way to protect oneself from the big one. Don’t sit on a sinking ship.

- Accept small losses cheerfully. Taking small losses is a much better way to protect oneself from the big one. Don’t sit on a sinking ship.

- There are some obstacles, one of which is the fear that the losing stock will turn into a winner when one sells off. However, once a situation goes bad, it stays bad for a while.

The Fourth Major Axiom

ON FORECAST

- Human behavior cannot be predicted. Distrust anyone who claims to know the future, however dimly.

- No one knows what's gonna happen in the future, great speculators don't listen to the forecasts.

ON FORECAST

- Human behavior cannot be predicted. Distrust anyone who claims to know the future, however dimly.

- No one knows what's gonna happen in the future, great speculators don't listen to the forecasts.

- As all the forecasts are affected by the human bias, none should be taken seriously. A strategy built on forecasts never works.

The Fifth Major Axiom

On PATTERNS

- Chaos is not dangerous until it begins to look orderly.

World of money is a patternless disorder and utter chaos. Humans have a nature of keeping things in order, eg. unwarranted belief that history repeats itself.

On PATTERNS

- Chaos is not dangerous until it begins to look orderly.

World of money is a patternless disorder and utter chaos. Humans have a nature of keeping things in order, eg. unwarranted belief that history repeats itself.

- Beware of such a Historian's Trap. The stock market has no patterns, A chart line always has a comfortingly orderly look, even when what it depicts is chaos. Beware of the Chartist's Illusion.

- Such lovely illusion of order might be comforting and full of promises. A person who gets rich on such an illusion was because he got lucky. The fact is that no formula can be trusted that ignores the dominant role of luck.

The Sixth Major Axiom

ON MOBILITY

- Avoid putting down Roots. They impede motion. Do not become trapped in a souring venture because of sentiments like loyalty and nostalgia. It is a mistake to let oneself get too attached to businesses in which capital is invested.

ON MOBILITY

- Avoid putting down Roots. They impede motion. Do not become trapped in a souring venture because of sentiments like loyalty and nostalgia. It is a mistake to let oneself get too attached to businesses in which capital is invested.

- Get attached to the People not to companies.

- Never hesitate to abandon a venture if something more attractive comes into view.

- Preserve mobility, be ready to jump away from trouble and seize the opportunities quickly.

- Never hesitate to abandon a venture if something more attractive comes into view.

- Preserve mobility, be ready to jump away from trouble and seize the opportunities quickly.

- This doesn’t mean that one has to bounce from one speculation to another.

- All the moves should be made only after careful assessment of the odds for and odds against. When a venture is clearly souring one must sever those roots and go.

- All the moves should be made only after careful assessment of the odds for and odds against. When a venture is clearly souring one must sever those roots and go.

The Seventh Major Axiom

ON INTUITION

- A hunch can be trusted if it can be explained. A hunch is a mental event that feels something like knowledge but doesn't feel perfectly trustworthy.

- One is likely to be hit by hunches frequently. Learn to use them.

ON INTUITION

- A hunch can be trusted if it can be explained. A hunch is a mental event that feels something like knowledge but doesn't feel perfectly trustworthy.

- One is likely to be hit by hunches frequently. Learn to use them.

- A good hunch is something that one knows, but does not know how he knows. A hunch can be trusted if it can be explained.

- When a hunch hits, ask whether a big enough library of data could exist in mind to have generated that hunch. Never lean on hunches too hard.

- When a hunch hits, ask whether a big enough library of data could exist in mind to have generated that hunch. Never lean on hunches too hard.

The Eighth Major Axiom

ON RELIGION AND THE OCCULT

- It is unlikely that God's plan for the universe includes making one rich. Sometimes occult beliefs can get in the way of sound speculative thinking. Leaning on such beliefs may not be hazardous to health, but it is to money.

ON RELIGION AND THE OCCULT

- It is unlikely that God's plan for the universe includes making one rich. Sometimes occult beliefs can get in the way of sound speculative thinking. Leaning on such beliefs may not be hazardous to health, but it is to money.

- A superstition need not be exorcised. Money and the supernatural beliefs have to be kept separately. In the matters of money, one is entirely on his own and should believe in his own self.

The Ninth Major Axiom

ON OPTIMISM AND PESSIMISM

- Optimism means expecting the best, but confidence means knowing how to handle the worst. Never make a move solely on optimism. In poker, if a pro arrives at a situation where the odds say he shouldn’t bet then he doesn’t.

ON OPTIMISM AND PESSIMISM

- Optimism means expecting the best, but confidence means knowing how to handle the worst. Never make a move solely on optimism. In poker, if a pro arrives at a situation where the odds say he shouldn’t bet then he doesn’t.

- In the same case an amateur might keep investing in a losing hand.

- Optimism feels much better than pessimism. It has a hypnotic allure. That’s why bulls outnumbers bears.

- Optimism feels much better than pessimism. It has a hypnotic allure. That’s why bulls outnumbers bears.

- When one is feeling optimistic, he should try to judge whether that feeling is justified by rationality.

- Optimism leads to the ventures with no exits and when there is an exit, it persuades to not to use it.

- Optimism leads to the ventures with no exits and when there is an exit, it persuades to not to use it.

The Tenth Major Axiom

ON CONSENSUS

- Majority opinions are probably wrong. One should try to come to his own conclusion.

- Never follow speculative fads. Unseen pressure of the majority can not only dislodge a good hunch but can also create doubts on one’s judgments.

ON CONSENSUS

- Majority opinions are probably wrong. One should try to come to his own conclusion.

- Never follow speculative fads. Unseen pressure of the majority can not only dislodge a good hunch but can also create doubts on one’s judgments.

- The best defense against the majority pressure is simple awareness of its existence of its coercive power.

- Various entities like brokers and people giving hot tips can constantly bombard an active speculator to buy whatever the majority is buying.

- Various entities like brokers and people giving hot tips can constantly bombard an active speculator to buy whatever the majority is buying.

- This doesn’t mean one should do whatever the majority is not doing. One should study and analyse the situation himself and come to the conclusion independently.

The Eleventh Major Axiom

ON STUBBORNNESS

- One must defeat the emotion of perseverance when it is leading one astray.

- Perseverance is not a good idea for speculators. One must persevere to learn, improve and grow rich.

ON STUBBORNNESS

- One must defeat the emotion of perseverance when it is leading one astray.

- Perseverance is not a good idea for speculators. One must persevere to learn, improve and grow rich.

- But one must not let perseverance trap himself in every speculative venture.

- Never try to save a bad investment by averaging down. Don’t hold your investments in the spirit of stubbornness.

- Value the freedom to choose investments on their merits alone.

- Never try to save a bad investment by averaging down. Don’t hold your investments in the spirit of stubbornness.

- Value the freedom to choose investments on their merits alone.

The Twelfth Major Axiom

ON PLANNING

- Long-range plans engender the dangerous belief that the future is under control. It gives an illusion of order.

- One should not let a plan immobilize oneself, instead one should accommodate unknowable events as they unfold.

ON PLANNING

- Long-range plans engender the dangerous belief that the future is under control. It gives an illusion of order.

- One should not let a plan immobilize oneself, instead one should accommodate unknowable events as they unfold.

- Shun long-term investments. “Betting on tomorrow is chancy enough. Betting on a day twenty or thirty years in the future is absolutely crazy.” Every investment should be reevaluated every three months or so.

• • •

Missing some Tweet in this thread? You can try to

force a refresh