1/4 And all you Celsians who were rooting for Texas to win in the Supreme Court, here’s a little thing you didn’t know about Texas and why you should abandon that state and that Texas Republican Party: Texas is doing everything it can to keep you poor. It passed a law that

https://twitter.com/otisa502/status/1337722615323037696

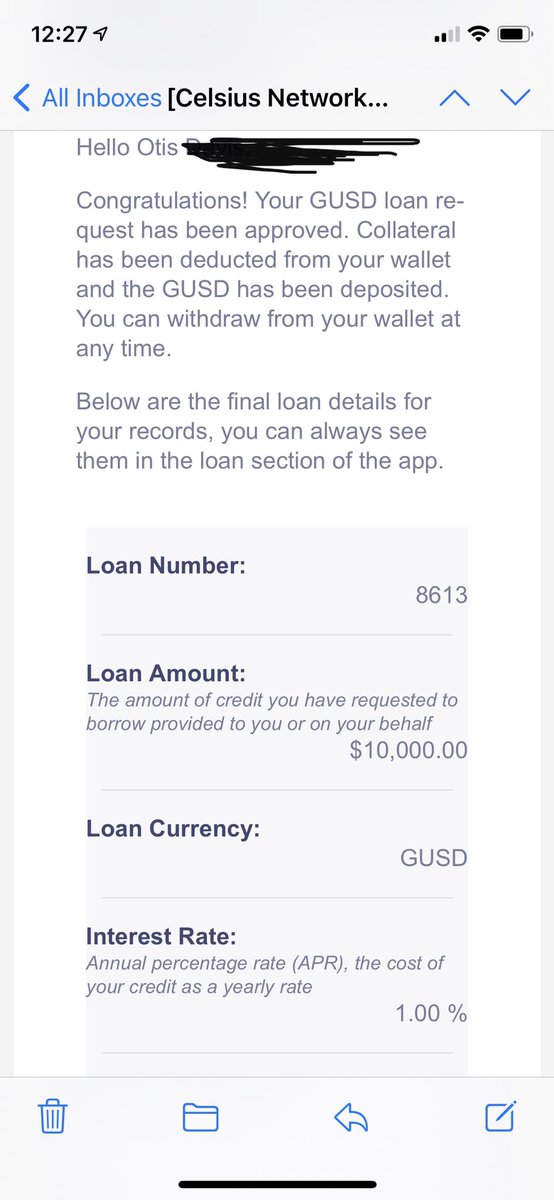

2/4 prevents any crypto company, including @CelsiusNetwork, from doing any transaction with Texas residents involving stablecoins. So you can’t earn 10.5% APY on your USD — which is USDC, GUSD, USDT, etc — you can’t take a loan in stablecoins, you as a Texas resident can’t handle

3/4 stablecoins in any way, shape or form. So cheer for these Texas GOP clowns while they team up with the criminal cartel banks to keep you poor. The Texas legislature passed this law against you and the Texas governor signed it on behalf of its client, the bank lobby. So while

4/4 you’re cheering for the Texas Attorney General to win in SCOTUS and overturn the will of the voters in 4 key states — MI, WI, PA and GA — these same exact Texas politicians has fucked you where stablecoins are concerned. Just thought you as a Texas resident would like to know

• • •

Missing some Tweet in this thread? You can try to

force a refresh