*The machines are listening.* Executives are now engaged in a cat and mouse game with AI-powered trading algorithms, and constantly changing how they talk to avoid negative words, phrases and verbal tics that the algos might react to. on.ft.com/3mFkFIO

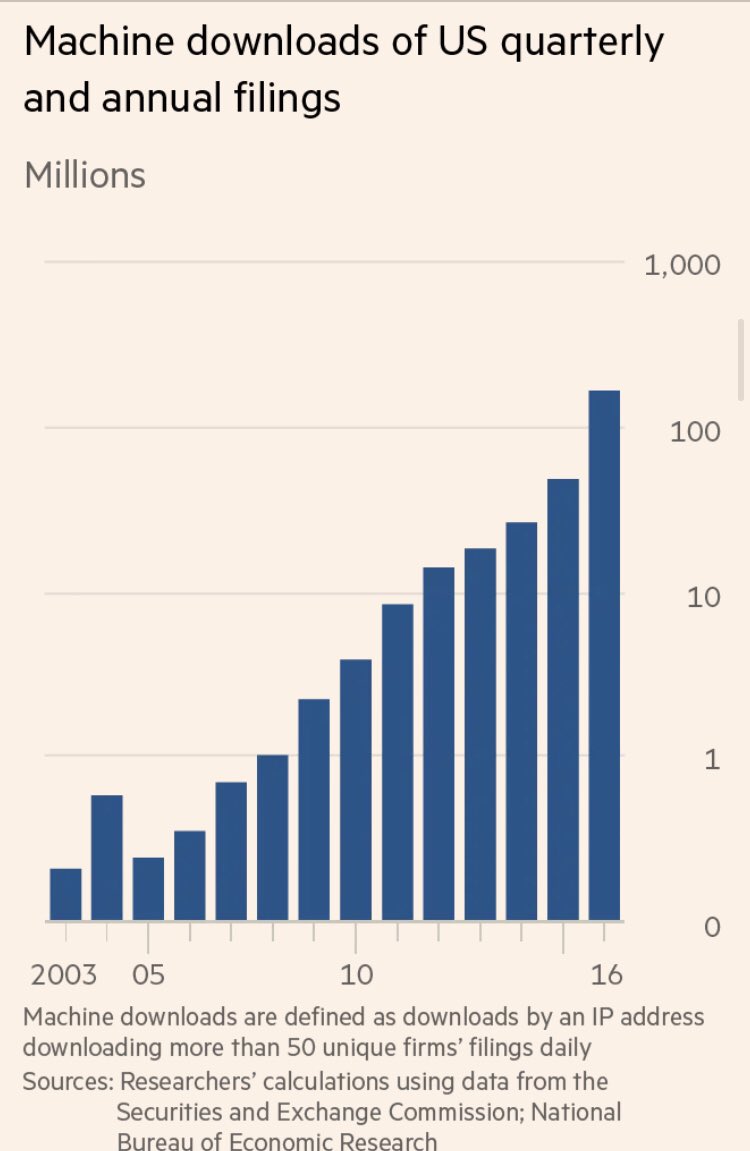

There’s been an explosion of high-frequency machine downloads of US regulatory filings in recent years, as quant hedge funds simply train algorithms to instantaneously read and trade thousands of reports - volumes that no human portfolio manager could ever hope to read.

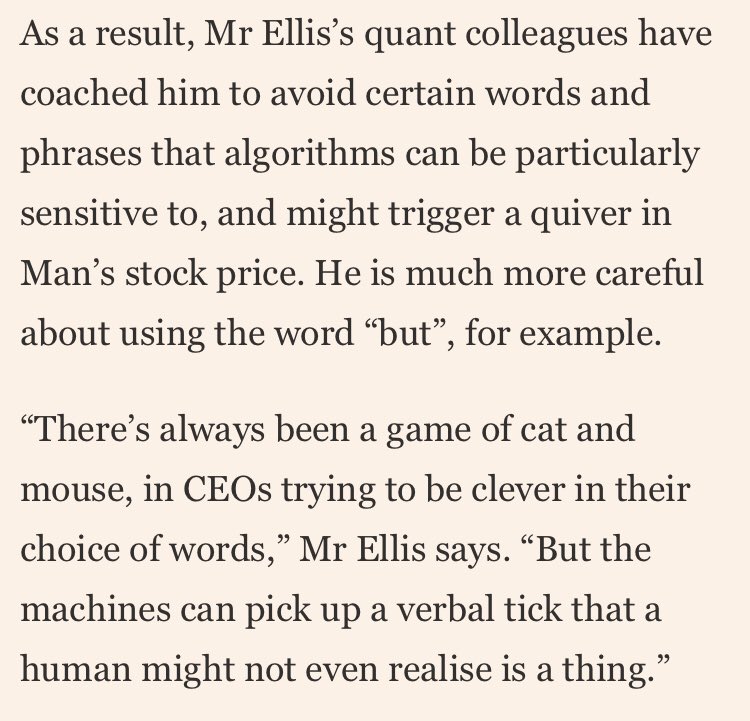

Man Group’s Luke Ellis is one of the CEOs who has as a result of machine reading been coached to avoid certain phrases and words.

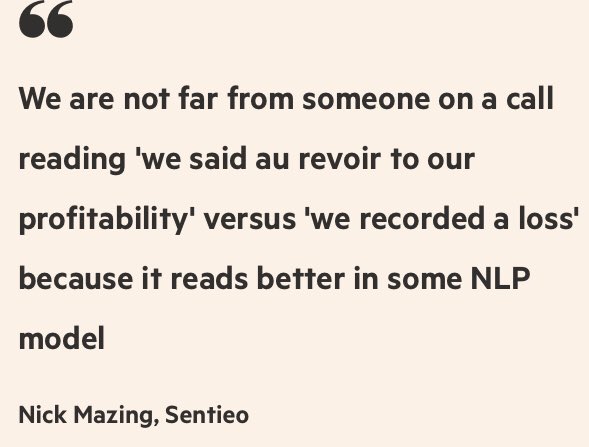

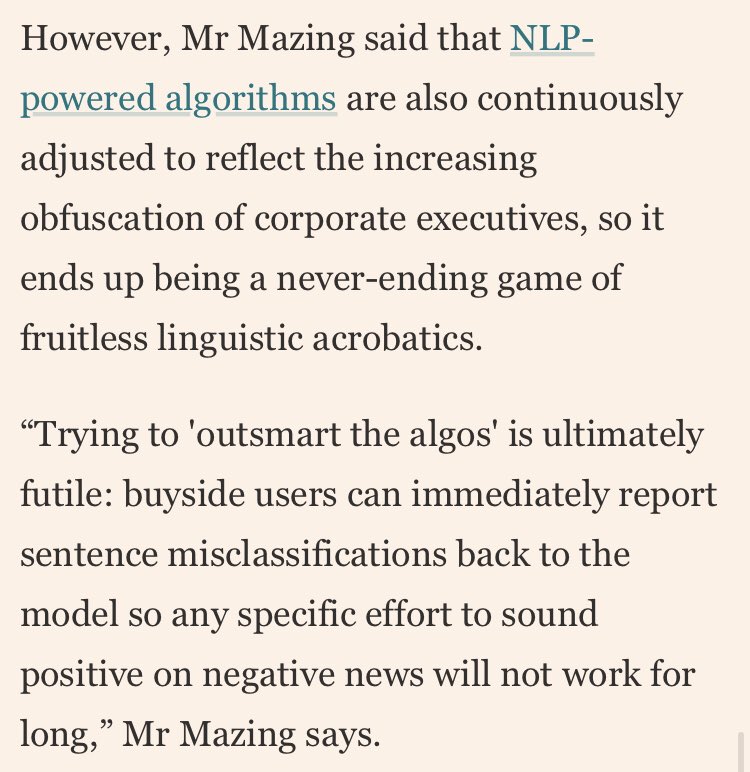

This is becoming a phenomenon, with some specialised services saying that some companies’ investor relations departments are running multiple versions of statements through NLP models to see which “scores” best with the algos. But Sentieo’s Mazing thinks it’s a hopeless battle.

Here is a fascinating new NBER paper on the subject, titled How to Talk When a Machine Is Listening: Corporate Disclosure in the Age of AI. nber.org/digest-202012/…

Have written a little about this in the past. It turns out jargon and obtuseness = negative signal. And if analysts say "great quarter guys", it's not just bullshit, it probably was, and upgrades are coming. ft.com/content/23ae43…

Disappointingly though, executive politeness - the frequency of "please" and "thank you" for a period seemed to correlate well with returns - turned out to be a spurious correlation. ft.com/content/f14db8…

• • •

Missing some Tweet in this thread? You can try to

force a refresh