Open letter to all S&P 500 benchmarked managers:

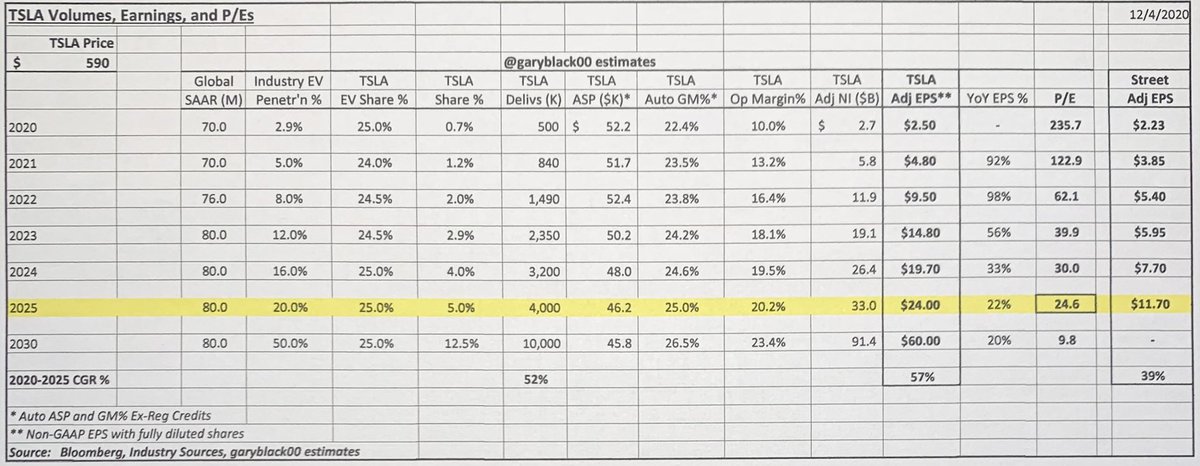

On Friday 12/18 at market close, $TSLA will enter the S&P 500 Index at an approximate 1.5% weight - the sixth largest weight in the S&P 500 index after $AAPL, $MSFT, $AMZN, $GOOGL, and $FB.

On Friday 12/18 at market close, $TSLA will enter the S&P 500 Index at an approximate 1.5% weight - the sixth largest weight in the S&P 500 index after $AAPL, $MSFT, $AMZN, $GOOGL, and $FB.

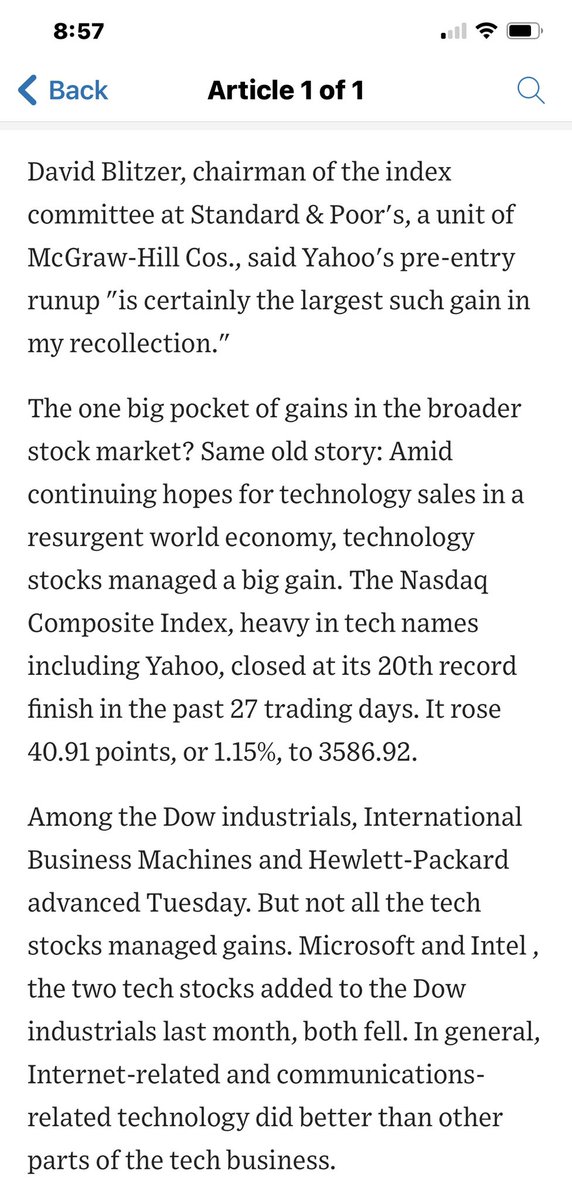

2/Goldman says 90% of you don’t own $TSLA, and you probably never had much interest in owning it, since it trades at 169x consensus 2021 EPS, and is +665% YTD. Surely you can ignore it for a little longer, and wait for it to come back down to Earth.

That would be a huge mistake.

That would be a huge mistake.

3/ CNBC talking heads who know nothing about $TSLA have long proclaimed it to be overvalued. Celebrity shorts and sell side analysts who blindly compare it to other auto companies have been wrong about TSLA for years. Investors who I think are smart sound like empty suits...

4/ when they try to explain why $TSLA keeps going up.

I’ll tell you why $TSLA keeps going up, and why it could double again in 2021 (at 1.5% wt, a double will cost you 150 bp performance).

First, EVs will soon replace gas-powered cars, yet EVs today are just 3% of global SAAR.

I’ll tell you why $TSLA keeps going up, and why it could double again in 2021 (at 1.5% wt, a double will cost you 150 bp performance).

First, EVs will soon replace gas-powered cars, yet EVs today are just 3% of global SAAR.

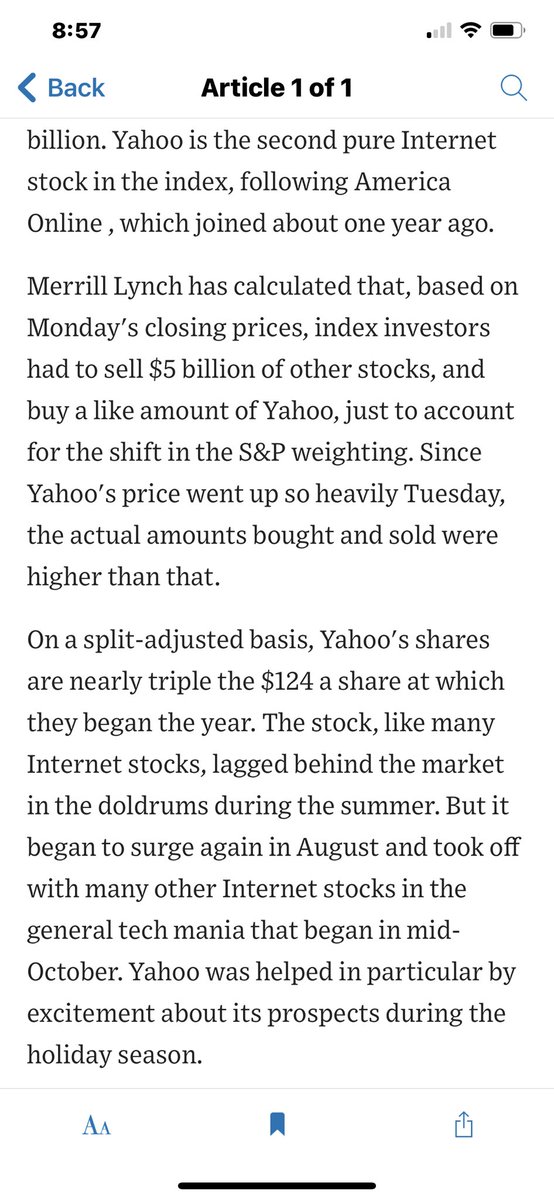

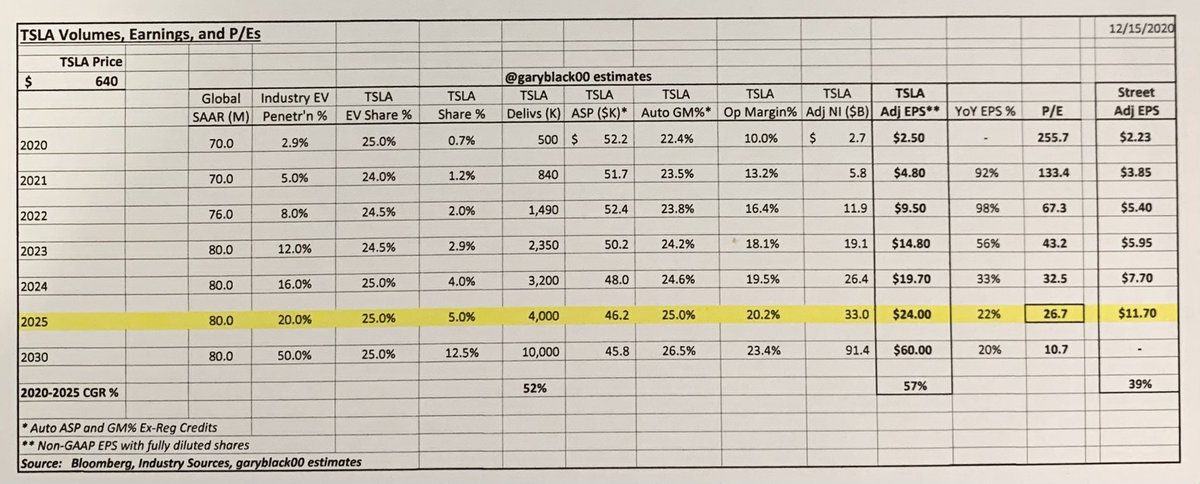

5/ As with IPhone, once a customer goes EV, he/she never goes back. By 2025, EVs are likely to be 20% of global SAAR. Do the math: 20/3 = 6.7x = 46% CAGR.

Second, $TSLA is by far the global EV market leader, with 25% YTD global EV share. TSLA continues to grow its share...

Second, $TSLA is by far the global EV market leader, with 25% YTD global EV share. TSLA continues to grow its share...

6/ because $TSLA keeps increasing its TAM. The Y CUV almost tripled US TAM from 24% to 65%; in 2021, the Cybertruck iwill expand it to 86%. Like iPhone, ICE-brand EVs can’t compete with TSLA’s iconic brand, battery range, power, FSD/software, and cost. And ICE-brands are tainted.

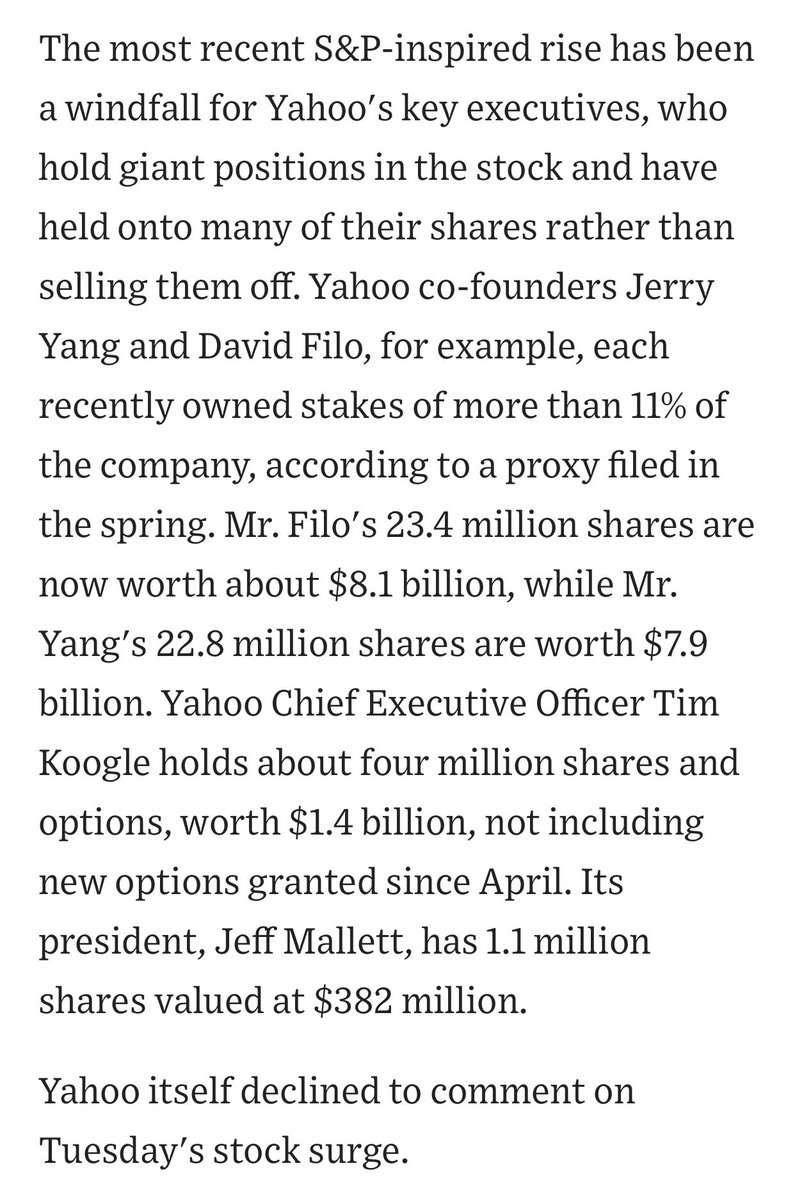

7/ Valuation: This is where normally smart people get off track. With $TSLA vols and EPS growing by 50%+ per year, no portfolio mgr would put a auto mfr P/E of 8-10x on TSLA. If one looks at 2022/2023, my P/Es are 67x 2022 EPS and 43x 2023 EPS. That’s a 2022 PEG of 1.3x.

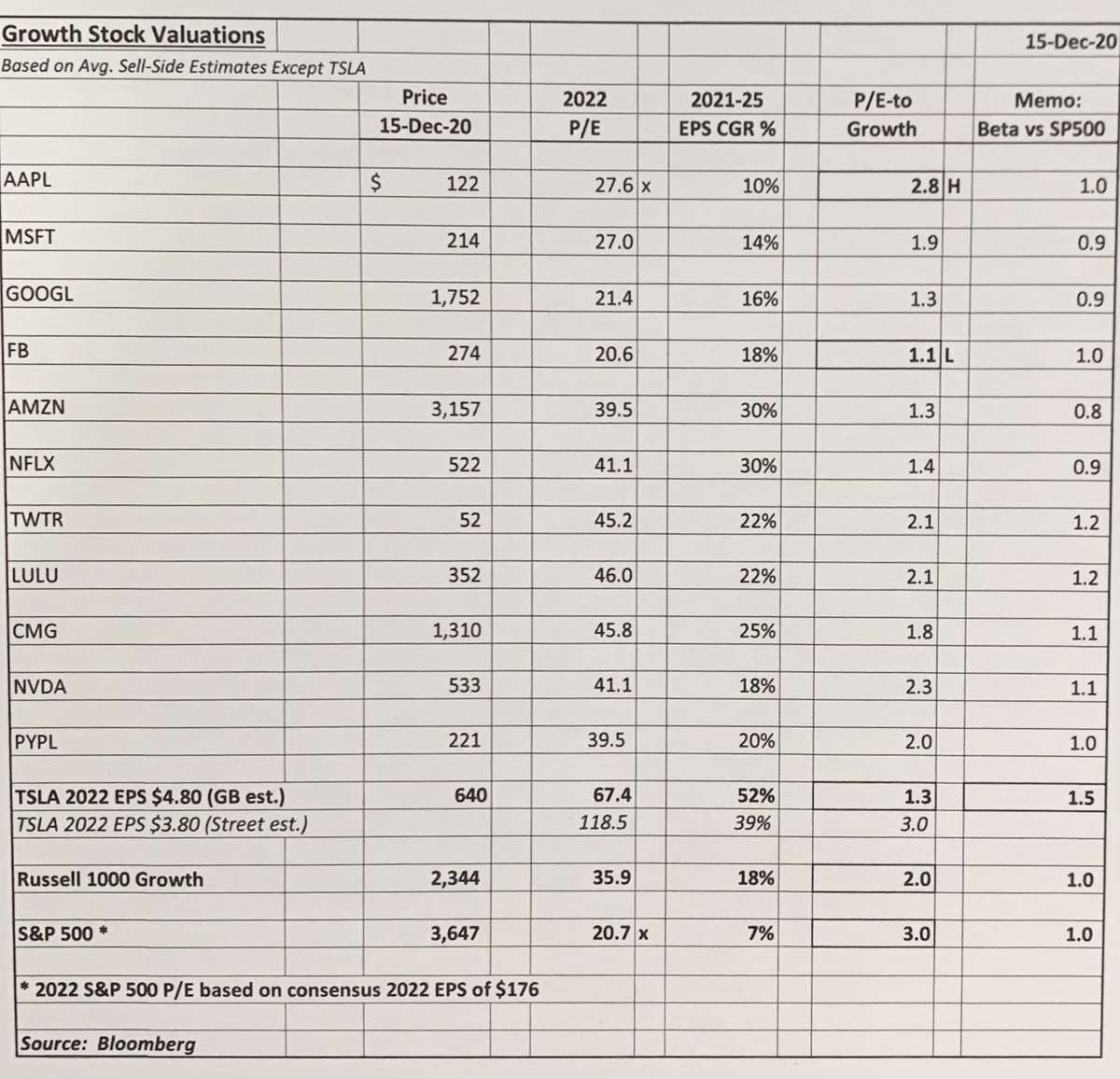

8/ There are no mega cap growth companies forecasted to grow by 50%+ per year trading at $TSLA ‘s 1.3X 2022 PEG. FB has the cheapest PEG at 1.1x; AMZN and GOOG are both at 1.3x, but all with lower growth. R1000G trades at 2x forward growth. S&P 500 trades at 3x forward growth.

9/ What is $TSLA worth? With an 2025 EV adoption rate of 20% and assuming TSLA holds its 25% EV share, with lower ASP, and no Reg Credits, I get 2025 EPS of $24. At a 50x P/E (2x PEG), that’s $1,200 by 2025. At a 9.5% disct rate, that’s $830. With a 100x P/E, both values double.

10/ Between now and Friday 12/18 at the close, the trade for S&P index funds will be: Buy $TSLA, sell everything else in the S&P 500 benchmark.

You might want to think about doing the same. Then you can sleep at night, knowing that holding TSLA at a 1.5% weight can’t hurt you.

You might want to think about doing the same. Then you can sleep at night, knowing that holding TSLA at a 1.5% weight can’t hurt you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh