Thread on USDINR Trading:

Part of my capital i trade in USDINR - non-directional.

Past few months it traded in very narrow band - which is paradise for non-direction trading.

check chart.. last 3 months in just 2 Rs. Range

Today will share my December 2020 trade in USDINR

(1/4)

Part of my capital i trade in USDINR - non-directional.

Past few months it traded in very narrow band - which is paradise for non-direction trading.

check chart.. last 3 months in just 2 Rs. Range

Today will share my December 2020 trade in USDINR

(1/4)

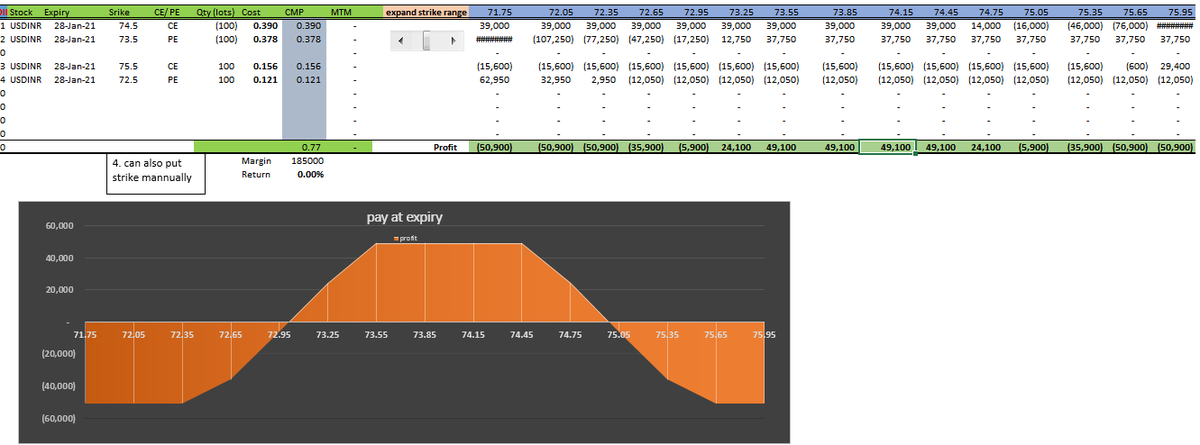

Entry Date: 8th December [normally i take position 40 - 45DTE]

Trade: iron condor

Strikes: sold 74.5 Ce and 73.5 PE [Jan 21 expiry]

Hedge: bought 75.5Ce and 72.5PE [Jan 21 expiry]

qty: for illustration shown 100 lots..

margin needed : 1,81,000

(2/4)

Trade: iron condor

Strikes: sold 74.5 Ce and 73.5 PE [Jan 21 expiry]

Hedge: bought 75.5Ce and 72.5PE [Jan 21 expiry]

qty: for illustration shown 100 lots..

margin needed : 1,81,000

(2/4)

This is how pay off graph looks:

Risk reward: little under 1:1 [good for iron condors]

Adjustments: we are covered for 1 Rs on both sides. but in case of drastic move adjustments will be needed.

how to adjust: refer my video on youtube

(3/4)

Risk reward: little under 1:1 [good for iron condors]

Adjustments: we are covered for 1 Rs on both sides. but in case of drastic move adjustments will be needed.

how to adjust: refer my video on youtube

(3/4)

Current status: date 16th December

strategy in profit of 7,400 which is approx 4 % return on margin.

when to book ? typically when we get 7 -8% we can book part and tighten the hedge for balance..

lets watch how this closes - will update here

@jitendrajain @yogeeswarpal

(4/4)

strategy in profit of 7,400 which is approx 4 % return on margin.

when to book ? typically when we get 7 -8% we can book part and tighten the hedge for balance..

lets watch how this closes - will update here

@jitendrajain @yogeeswarpal

(4/4)

USDINR trade update:

We are right at the centre..

strategy in profit of 9350 almost 5% return...

no adjustments yet..

#USDINR

We are right at the centre..

strategy in profit of 9350 almost 5% return...

no adjustments yet..

#USDINR

USDINR update:

strategy in profit almost 6.5% + ..

book half and carry balance .. no adjustment yet.

strategy in profit almost 6.5% + ..

book half and carry balance .. no adjustment yet.

USDINR update:

Strategy in profit of 7.5% on margin

No adjustment yet - holding 50% of original qty.

Strategy in profit of 7.5% on margin

No adjustment yet - holding 50% of original qty.

USDINR Adj 1:

exit from 74.5CE and Sell 73.75CE [30%-40% extra quantity]

Note: if you cover 50 lots of 74.5CE sell 70 lots of 73.75CE

exit from 74.5CE and Sell 73.75CE [30%-40% extra quantity]

Note: if you cover 50 lots of 74.5CE sell 70 lots of 73.75CE

USDINR Update: Closing Trade

closing this trade for 8.25% return.

still there is no risk and we can get 2-3% more in next one week.

closing this trade for 8.25% return.

still there is no risk and we can get 2-3% more in next one week.

• • •

Missing some Tweet in this thread? You can try to

force a refresh