Richard Heart: HEX.com 40% APR, 263x in 301d ⬣🚀🌘

19 Dec,

25 tweets, 12 min read

#Bitcoin and #Ethereum lawyers. I've shared the latest FinCEN proposed rulemaking for public comment. The goal is to leave no stone left unturned. I have identified novel arguments. docs.google.com/document/d/1n7…

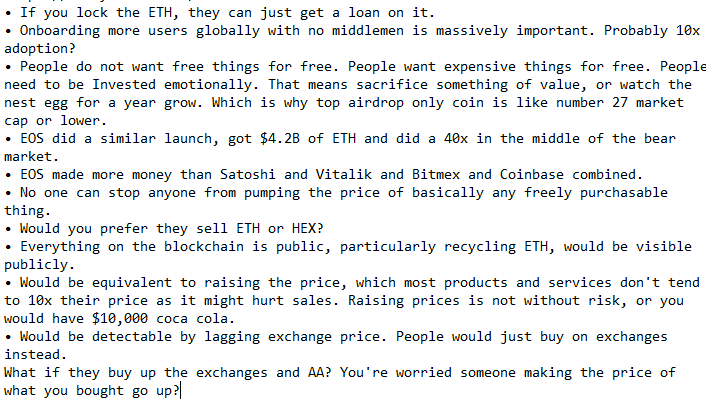

If you invoke a parade of imaginary horribles, you must be accept their rebuttals as well. An exchange knowing their customer does exactly 0 to affect ransomware payments. It also does 0 to affect cybersecurity attacks. It also does 0 for national security.

Do you think China is setting up a coinbase account to buy Bitcoin? To do what?

#Bitcoin addresses are not public keys.

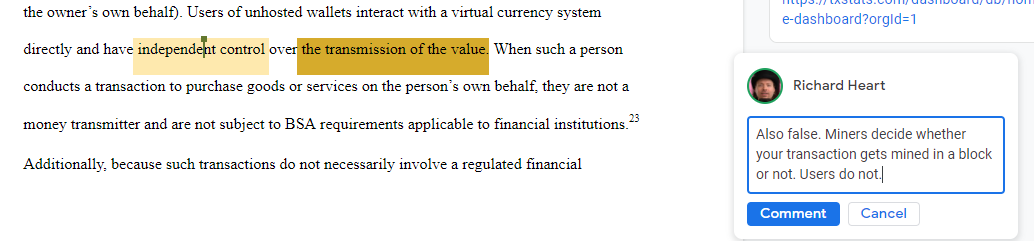

#Bitcoin Miners decide who transacts value, not users.

In game currencies have 1000 fold adoption as currencies than cryptocurrency does. Cryptocurrency is not currently a currency, though we hope that will change one day.

#Bitcoin is not like the 6 other non currencies encumbered by the Bank Secrecy Act. As you can't actually possess it.

If you guys could please tag all the crypto lawyers, that would be super. My work here is only as useful as it assists their submissions and our public comments during the 15 day window!

Useful novel arguments in the above doc for @thecryptolaw @CryptoLawRev @CryptoLawProf @amico_jeffrey @h_joshua_rivera @WinstonOnoWales @lex_node @NYcryptolawyer @VerityEsq @Fatalmeh @boironattorney @ZachSmolinski @msantoriESQ @WesWilliamsEsq @SH_Brennan @JDunsmoorEsq and more :)

Novel arguments for these folks too: @danrobinson @stevennerayoff @MishaGuttentag @heckerhut @valkenburgh @propelforward @jchervinsky @StaniKulechov @brianeklein @patio11

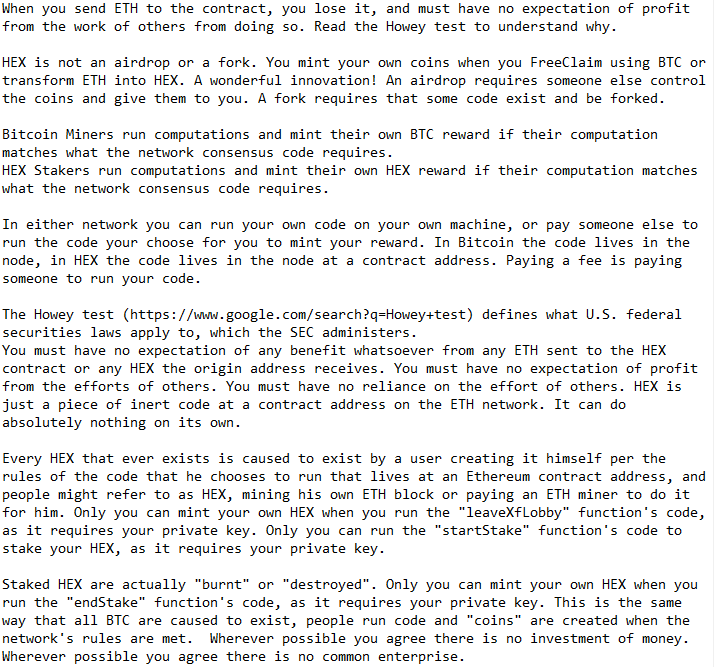

People, if you don't want regulated by finCEN you need to not be a currency or monetary instrument. So the arguments here are of that form. This isn't a thread to talk about how cool Bitcoin is, it's a thread to PRESERVE YOUR RIGHTS.

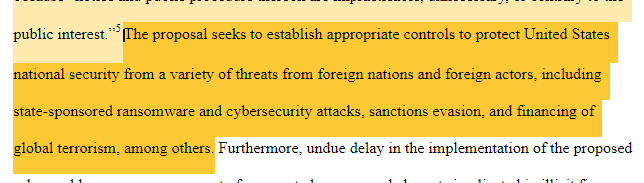

FinCEN spends quite a lot of time arguing they're exempt from the APA's requirements. They are not and their arguments are weak. Better regulations come from thoughtful consideration over time, not through rushing.

Adding a checkbox that says "this address is my own" when you withdraw isn't going to do a damn thing for national security or anything else. FinCEN already requires AML/KYC of exchanges.

I think I've picked all the low hanging fruit I'm good for here. The lawyers have addresses the rushed process already. I'll summarize my points next post.

Cryptocurrencies aren't yet used as currencies, so no FinCEN jurisdiction. You don't know if you have sole custody, you can't prove you do, you can only spend if miners let you or for many, multisig lets you. It's easier to track than cash, a tiny market, and there's no rush.

Their appeals to national security, ransomware and cybersecurity are nonsensical. Their appeals to being exempt from federal APA guidelines, thus only having 15 days to comment, are also nonsense. Law enforcement doesn't need more hay in their search for needles in haystacks.

If someone wants to merge in the more nuanced APA commentary and other things from some of the fine crypto lawyers, I'm cool with it. The goal here is to help create good material for submission by you, the people. Helps to have it all in one spot. Did my summary miss any angles?

FinCEN just had a data breech a couple months ago: thomsonreuters.com/en-us/posts/co… The only way to truly protect data is to not have it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh