A simple thread to help all understand ‘Futures and Options’ in an easy way. Though I would personally not recommend new investors to trade in F & O, but it is always good to know things. 👇🧵

#Investing #Investors #Options #Futures

#Investing #Investors #Options #Futures

1. What is a ‘Derivative’?

‘Derivative’ simply means a product which is derived or dependent on some asset. This asset is called as ‘underlying asset’.

Let me simplify this by putting this example.

‘Derivative’ simply means a product which is derived or dependent on some asset. This asset is called as ‘underlying asset’.

Let me simplify this by putting this example.

Both ‘Coffee’ and ‘Tea’ require ‘Milk’ for their making (assuming that you drink it that way, of course) . Hence, if the price of ‘Milk’ increases, the prices of ‘Tea’ and ‘Coffee’ will also increase.

To sum up:

1.‘Milk’ is the independent product. So, it will be considered as ‘Underlying Asset’.

2.‘Tea’ and ‘Coffee’ derive their prices from the price of ‘Milk’. Therefore, these are ‘Derivatives’ of Milk.

1.‘Milk’ is the independent product. So, it will be considered as ‘Underlying Asset’.

2.‘Tea’ and ‘Coffee’ derive their prices from the price of ‘Milk’. Therefore, these are ‘Derivatives’ of Milk.

Hence, the derivative of a company will derive its price from the price of the shares of a company. Thus, share of a company is the ‘underlying asset’.

2. Types of Derivative instruments (The most popular ones):

👉Forward and Futures contract

👉Options contract

👉Forward and Futures contract

👉Options contract

3. Forward and Futures contract:

‘Raju’ is a farmer selling cotton. ‘Raju’ fears that owing to some reason the price of the cotton will fall after one month from today. Hence, he approaches ‘Vivek’.

‘Raju’ is a farmer selling cotton. ‘Raju’ fears that owing to some reason the price of the cotton will fall after one month from today. Hence, he approaches ‘Vivek’.

‘Raju’ enters into a ‘forward contract’ with ‘Vivek’ and fixes the price of the cotton at Rs.100 per bale.

Now, Raju has secured himself through this forward contract. This is because even if the price falls below Rs.100 per bale after one month, ‘Raju’ will still be selling the cotton at Rs.100 per bale.

Needless to say, Vivek will be under the obligation to buy the cotton at Rs.100 per bale even if the price is below Rs.100 after one month. This way, Raju can hedge his risk.

Two things can happen here:

👉If after one month, the price of the cotton falls below Rs.100 to say, Rs.80, then ‘Raju’ will be at a profit of Rs.20 as he can sell the cotton at Rs.100 per bale which was pre-fixed whereas the market price after one month is only Rs.80.

👉If after one month, the price of the cotton falls below Rs.100 to say, Rs.80, then ‘Raju’ will be at a profit of Rs.20 as he can sell the cotton at Rs.100 per bale which was pre-fixed whereas the market price after one month is only Rs.80.

👉But if, after 1 month price of cotton instead of falling, actually increases to Rs.150 per bale, in such case, ‘Vivek’ will be at a profit of Rs.50. Because he will be buying the cotton at a pre-fixed price of Rs.100 and now after 1 month, he can sell it at Rs.150 per bale.

However, there is a twist in the tale. It may happen that:

1.When the price falls below Rs.100, ‘Vivek’ refuses to buy and breaches the contract or

2.When the price rises above Rs.100, ‘Raju’ refuses to sell and breaches the contract.

1.When the price falls below Rs.100, ‘Vivek’ refuses to buy and breaches the contract or

2.When the price rises above Rs.100, ‘Raju’ refuses to sell and breaches the contract.

These types of risk of non performance of contract arises in a forward trade where the transaction is done over-the-counter (OTC) without involving any middleman. Hence, Future contract is preferred over Forward contract.

Replace the underlying asset from ‘cotton’ to ‘shares’ and add a middleman (Stock exchange) to regulate the contract, that will how exactly a ‘Future contract’ would work in stock market.

4. Options contract:

Options, by the word itself implies that there is an option available and that there is no compulsion.

The options instruments give the person an option to either ‘buy’ or ‘sell’ the asset at a prefixed price which is called as the strike price.

Options, by the word itself implies that there is an option available and that there is no compulsion.

The options instruments give the person an option to either ‘buy’ or ‘sell’ the asset at a prefixed price which is called as the strike price.

5.There are 2 types of options contract.

👉Call option: It gives the person an option to buy asset at a prefixed price called as ‘Strike Price’. Someone who is optimistic about a price rise (bulls), buys a call option. But for this he needs to pay an amount called as ‘Premium’.

👉Call option: It gives the person an option to buy asset at a prefixed price called as ‘Strike Price’. Someone who is optimistic about a price rise (bulls), buys a call option. But for this he needs to pay an amount called as ‘Premium’.

👉Put Option: It gives the person an option to sell asset at a prefixed price called as ‘Strike Price’. Someone who is pessimistic & is anticipating a price fall (bears), buys a put option. Again there are no free lunches as for this he needs to pay an amt called as ‘Premium’.

6. How a ‘Call option’ works?

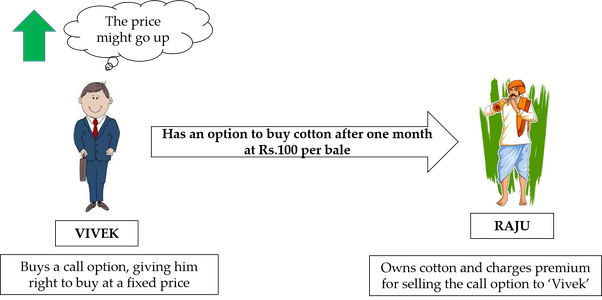

Continuing with ‘Raju’ and ‘Vivek’. ‘Raju’, owns cotton and ‘Vivek’ is anticipating an increase in the price of cotton.

Continuing with ‘Raju’ and ‘Vivek’. ‘Raju’, owns cotton and ‘Vivek’ is anticipating an increase in the price of cotton.

So, ‘Vivek’ is optimistic about price rise. Hence, he buys a call option of cotton instead of buying the cotton itself. He is only willing to trade the price difference and cash in the profit.

Say, the price which is fixed for buying cotton after one month is Rs.100. This is called as strike price. For this suppose ‘Vivek’ pays a premium to ‘Raju’ of Rs.10.

Let us discuss the possibilities here:

👉If after one month the price of cotton increases to Rs.150. Here, ‘Vivek’ can buy at Rs.100 and sell at Rs.150. Hence, here the profit shall be Rs.50. But, he paid Rs.10 as premium too. So, in nutshell he will earn Rs.40 as net profit.

👉If after one month the price of cotton increases to Rs.150. Here, ‘Vivek’ can buy at Rs.100 and sell at Rs.150. Hence, here the profit shall be Rs.50. But, he paid Rs.10 as premium too. So, in nutshell he will earn Rs.40 as net profit.

👉If after 1 month the cotton price declines to Rs.80 then there is no use of the call option. Mind you, here ‘Vivek’ is not under an obligation to buy. Remember, it is an option! So, his Rs.10 paid as premium would be his loss.

This is how a call option works in stock market.

This is how a call option works in stock market.

7. How a ‘put option’ works?

Say, ‘Vivek’ and ‘Amit’ are two cotton traders. ‘Vivek’ is of the opinion that the cotton price may fall down in a month.

Say, ‘Vivek’ and ‘Amit’ are two cotton traders. ‘Vivek’ is of the opinion that the cotton price may fall down in a month.

Hence, ‘Vivek’ buys a put option from ‘Amit’ which gives him an option to sell the cotton at a pre-fixed price of Rs.100 per bale. This is the strike price. For this ‘Amit’ charges a premium of Rs.10.

Let us discuss the possibilities here:

👉If, the price of cotton falls below Rs.100 to Rs.60, then ‘Vivek’ can still sell it at Rs.100 and his net profit shall be Rs.30 (Rs.100-Rs.60- Rs.10).

👉If, the price of cotton falls below Rs.100 to Rs.60, then ‘Vivek’ can still sell it at Rs.100 and his net profit shall be Rs.30 (Rs.100-Rs.60- Rs.10).

👉If, the price of cotton rises above Rs.100 to Rs.150, then ‘Vivek’ shall lose the premium money so paid.

This is how a put option works in stock market.

This is how a put option works in stock market.

The End.

This was originally posted on Quora. The link to which is here: qr.ae/TUnblN

@Dinesh_Sairam, @KhotteDePuttar

This was originally posted on Quora. The link to which is here: qr.ae/TUnblN

@Dinesh_Sairam, @KhotteDePuttar

• • •

Missing some Tweet in this thread? You can try to

force a refresh