1/ In September 1993, then-Microsoft exec Nathan Myhrvold wrote his landmark memo "Road Kill on the Information Highway", laying out a dozen-ish predictions on the rise of the internet

27 years later, I think it's a super interesting case study. Let's evaluate the predictions -

27 years later, I think it's a super interesting case study. Let's evaluate the predictions -

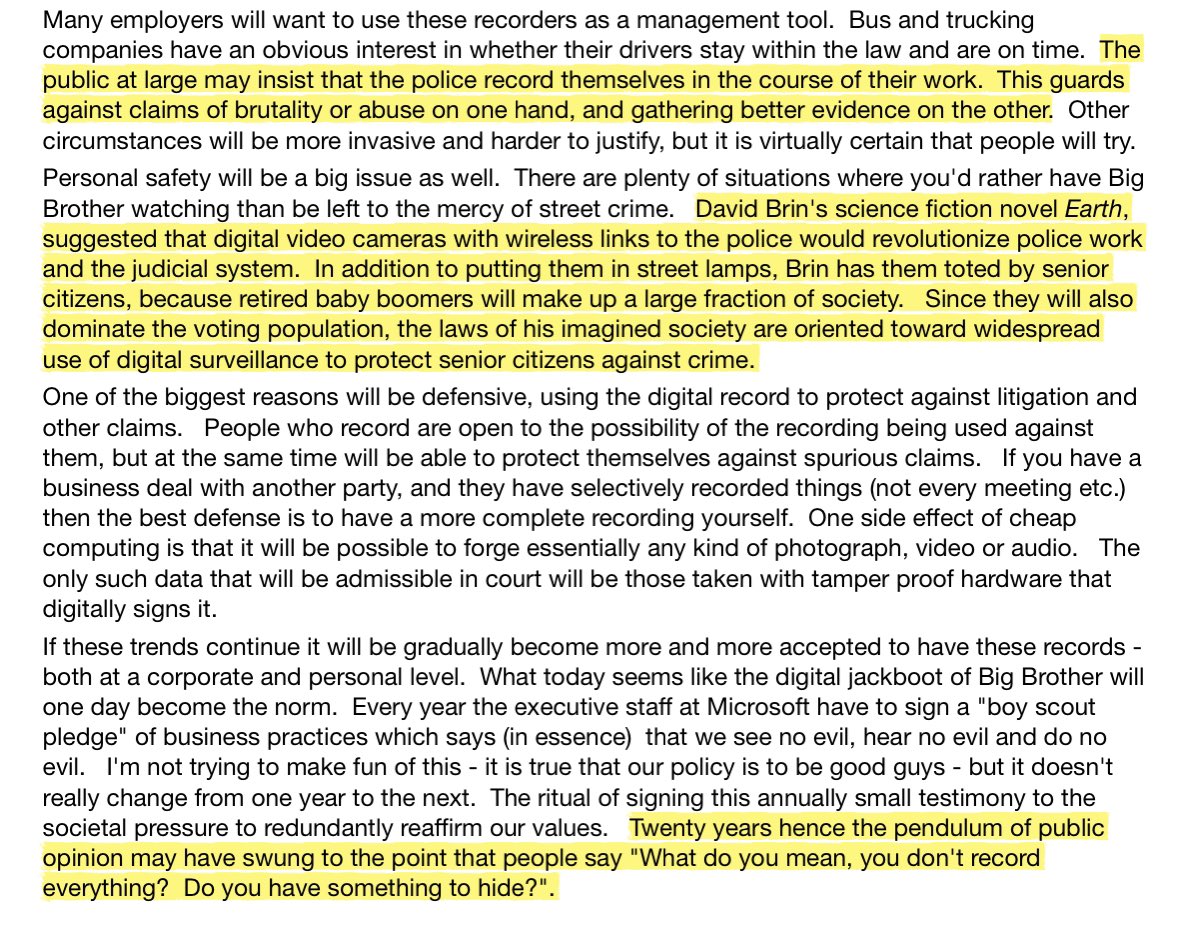

2/ PREDICTION #1: The rise of a surveillance society - police bodycams, CCTV, 24/7 personal recording, and deepfakes

GRADE: A-

Pretty close!

GRADE: A-

Pretty close!

3/ PREDICTION #2: Telecommuting, an end to the "tyranny of geography" and gerrymandering

GRADE: B-

Alas, the electoral college still matters today. The WFH prediction hits closer, but turns out it took two and a half decades + a pandemic to get things going

GRADE: B-

Alas, the electoral college still matters today. The WFH prediction hits closer, but turns out it took two and a half decades + a pandemic to get things going

4/ PREDICTION #3: Telco convergence - phone companies become cable providers and vice versa

GRADE: A-

Honestly this one was a bit of a layup, although it took 15 years longer than anyone expected

GRADE: A-

Honestly this one was a bit of a layup, although it took 15 years longer than anyone expected

5/ PREDICTION #4: The rise of online neo-banks

GRADE: C

Three decades later, and physical banks still exist. Neobanks have a presence in emerging markets, UK, and basically nowhere else. Regulatory inertia: officially a thing

GRADE: C

Three decades later, and physical banks still exist. Neobanks have a presence in emerging markets, UK, and basically nowhere else. Regulatory inertia: officially a thing

6/ PREDICTION #5: "Newspapers are in probably the worst situation of any form of print media"

GRADE: A+

Frankly I was shocked by the prescience of this section. Newspapers were once local advertising monopolies. The internet broke that monopoly

GRADE: A+

Frankly I was shocked by the prescience of this section. Newspapers were once local advertising monopolies. The internet broke that monopoly

7/ PREDICTION #6: "Television broadcasters are some of the most likely fodder for roadkill of any of the current media companies"

GRADE: B+

Pretty much right, but 21 years too early. Broadcasters kept growing until 2014

GRADE: B+

Pretty much right, but 21 years too early. Broadcasters kept growing until 2014

8/ PREDICTION #7: The internet will expand the market for Hollywood content. Also, Blockbuster is toast

GRADE: A

The iron law of media investing is that over any long enough timeframe, value inexorably accrues to the content owner

GRADE: A

The iron law of media investing is that over any long enough timeframe, value inexorably accrues to the content owner

9/ PREDICTION #8: Traditional PCs will be replaced by lightweight, low-end internet terminals

GRADE: C+

Say what you will about low end disruption, but after all these years I still don't want to use a Chromebook

GRADE: C+

Say what you will about low end disruption, but after all these years I still don't want to use a Chromebook

10/ In retrospect, most of Myrhvold's predictions were pretty good. His call on the print media was spectacularly right. His calls on TV, Hollywood, and telcos took a while, but ultimately happened. Telecommuting and 24/7 surveillance are still shifting in realtime...

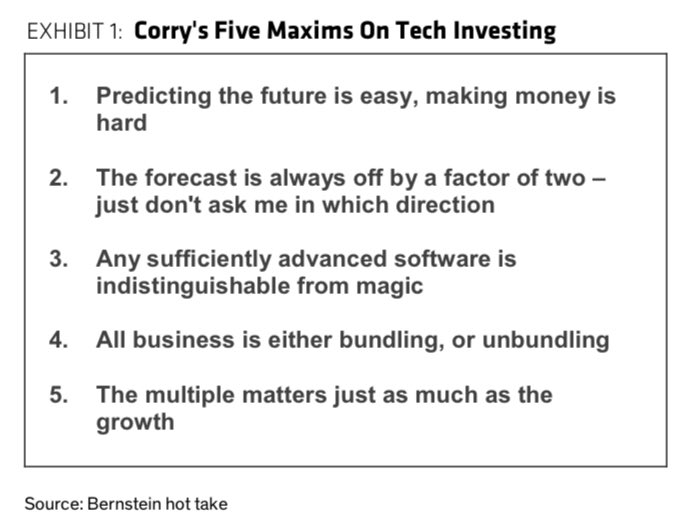

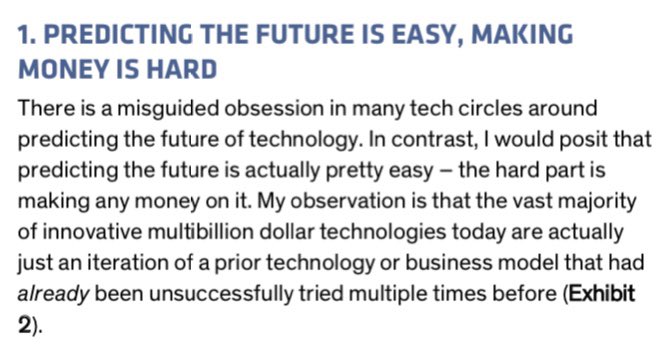

11/ The one catch? Timing

Nearly all these predictions took 15-20+ years to play out. WFH is still 25+ years in the making. Nothing in the memo (except shorting newspapers) would've been investable on any reasonable timeframe

Predicting the future is easy. Making money is hard!

Nearly all these predictions took 15-20+ years to play out. WFH is still 25+ years in the making. Nothing in the memo (except shorting newspapers) would've been investable on any reasonable timeframe

Predicting the future is easy. Making money is hard!

Several people have now messaged me that this prediction would’ve been much closer if you replaced “IHCs” with “smartphones”

Fair enough!

UPDATED GRADE: A-

Myrhvold wasn’t thinking about mobile devices in his original memo, but ex post facto, the parallels are hard to deny

Fair enough!

UPDATED GRADE: A-

Myrhvold wasn’t thinking about mobile devices in his original memo, but ex post facto, the parallels are hard to deny

• • •

Missing some Tweet in this thread? You can try to

force a refresh