[THREAD]

Bill Miller (@B3_MillerValue) is one of this generation's best investors.

There's 3 things we can learn from him:

1. Free cash flow above all else

2. Disregard investment style labels

3. Buy at points of lowest market expectations

Let's go!

macro-ops.com/bill-miller-le…

Bill Miller (@B3_MillerValue) is one of this generation's best investors.

There's 3 things we can learn from him:

1. Free cash flow above all else

2. Disregard investment style labels

3. Buy at points of lowest market expectations

Let's go!

macro-ops.com/bill-miller-le…

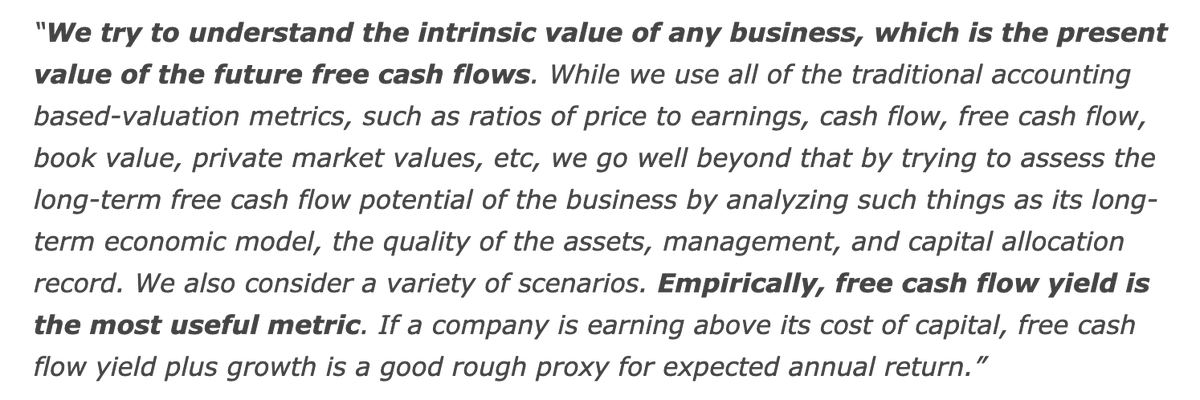

1/ FCF Is King

A biz is worth the sum of its future FCFs discounted back to the present.

Miller examines things like:

- LT economic model

- Quality of assets

- Management

- Capital allocation record

He wants to buy >6% FCF yields.

Important: Growth < COC = bad investment

A biz is worth the sum of its future FCFs discounted back to the present.

Miller examines things like:

- LT economic model

- Quality of assets

- Management

- Capital allocation record

He wants to buy >6% FCF yields.

Important: Growth < COC = bad investment

2/ No Labels Investment Approach

The thing I love about Miller the most is his disdain for investment labels.

It's not Growth vs. Value for him. It's paying less than what a biz is worth. Period.

In doing this, Miller avoids investing in value traps because "they're cheap"

The thing I love about Miller the most is his disdain for investment labels.

It's not Growth vs. Value for him. It's paying less than what a biz is worth. Period.

In doing this, Miller avoids investing in value traps because "they're cheap"

3/ Buy At Lowest Expectations

Miller notes one shared trait amongst his best winners: He bought at points of low expectations.

Profits are made on the gap b/w how a company performs and how it's expected to perform.

The wider that gap, the more profits.

h/t @mjmauboussin

Miller notes one shared trait amongst his best winners: He bought at points of low expectations.

Profits are made on the gap b/w how a company performs and how it's expected to perform.

The wider that gap, the more profits.

h/t @mjmauboussin

3a/ Another Point on Expectations

Miller says that a great idea can come from being MORE optimistic about a great biz than market.

Alpha doesn't have to come from buying s**t that turns to diamonds. It can come from higher expectations on a great biz than others.

Think big.

Miller says that a great idea can come from being MORE optimistic about a great biz than market.

Alpha doesn't have to come from buying s**t that turns to diamonds. It can come from higher expectations on a great biz than others.

Think big.

4/ Creating A Bill Miller Strategy

How can we implement this style? Investors can follow Miller's footsteps by:

- Focusing on FCF (now or in future) above all else

- A global style mandate w/out labels

- Paying for those CFs at points of lowest expectations

- LT time horizon

How can we implement this style? Investors can follow Miller's footsteps by:

- Focusing on FCF (now or in future) above all else

- A global style mandate w/out labels

- Paying for those CFs at points of lowest expectations

- LT time horizon

• • •

Missing some Tweet in this thread? You can try to

force a refresh