$arkk $arkg becoming the dog wagging the tail...

https://twitter.com/EricBalchunas/status/1341518377114865666

... more $arkk pieces from this week:

@DaveNadig interview with ARK COO did a deep dive into the ETF family's liquidity/capacity hypotheticals (spoiler alert: ARK's ETF-mandated transparency means investors are buying $arkk, et al to own the underlying)

etftrends.com/ark-coo-tom-st…

@DaveNadig interview with ARK COO did a deep dive into the ETF family's liquidity/capacity hypotheticals (spoiler alert: ARK's ETF-mandated transparency means investors are buying $arkk, et al to own the underlying)

etftrends.com/ark-coo-tom-st…

... and from Morningstar:

"ARK owns more than 10% of 26 companies... it would take more than 52 trading days for it to completely exit [$cers, were they to liquidate 25% of average volume per diem]"

morningstar.com/articles/10276… $arkk

"ARK owns more than 10% of 26 companies... it would take more than 52 trading days for it to completely exit [$cers, were they to liquidate 25% of average volume per diem]"

morningstar.com/articles/10276… $arkk

... tbh, ARK's Cathie Wood probably never expected to get this big

... I trust she would not have chosen an ETF structure had she foreseen such scale – there's no way to soft/hard close an ETF, which creates some philosophical, strategic, and structural quagmires $arkk

... I trust she would not have chosen an ETF structure had she foreseen such scale – there's no way to soft/hard close an ETF, which creates some philosophical, strategic, and structural quagmires $arkk

... but, "the best laid plans of mice and (wo)men" 🤷♂️:

Expectations don't matter now that ARK *is* this big; its risks are known-knowns; so they really should be adapting!

$arkk

Expectations don't matter now that ARK *is* this big; its risks are known-knowns; so they really should be adapting!

$arkk

... an ETF is merely a conduit for market mechanism (animal sprits), but the active vs passive distinction matters:

To keep plowing active allocations into small cap/low volume eqs – knowing the empirical externalities – is either naive or short sighted

To keep plowing active allocations into small cap/low volume eqs – knowing the empirical externalities – is either naive or short sighted

https://twitter.com/EconomPic/status/1341815574033141760?s=20

... again, the active discretion of the ETF's PM is itself a part of the "market mechanism" too – not even a surrogate, but an animal spirit itself

... but, again, "known-knowns": If inflows/creations take you beyond the pale, maybe, idk, adapt 😏

$arkk

... but, again, "known-knowns": If inflows/creations take you beyond the pale, maybe, idk, adapt 😏

$arkk

https://twitter.com/AnthPB/status/1233484433979822082?s=20

... adapting meant doing right thing for both market structure/efficacy and clients/investors

... given empirical reflexivity, ARK had to have known it had gotten to the point where it was on a treadmill of greater fools – what was the end game!?

... given empirical reflexivity, ARK had to have known it had gotten to the point where it was on a treadmill of greater fools – what was the end game!?

https://twitter.com/AnthPB/status/1361868338683645952?s=20

... N.B. This is not a 'breach of fiduciary duty' or 'market manipulation' argument; rather, just a 'they should have known better' one

$arkk

$arkk

... many failures stem from either our inability to predict the future (Dunning–Kruger effect/illusory superiority/overconfidence thereof) or our mismanagement of the probabilities thereof

$arkk

$arkk

... but ARK is not a failure and did not err on either account

... more than anything, $arkk was/is right about the long term, but disregarded the short term – focused too much on the ends and not enough on the means

... hope they adapt, cuz I like what they bring to the table

... more than anything, $arkk was/is right about the long term, but disregarded the short term – focused too much on the ends and not enough on the means

... hope they adapt, cuz I like what they bring to the table

... re: ARK Invest's 2025 Tesla $tsla forecasts (N.B. should be "entire global transportation value chain", not merely "auto"):

https://twitter.com/AnthPB/status/1373299542205079552?s=20

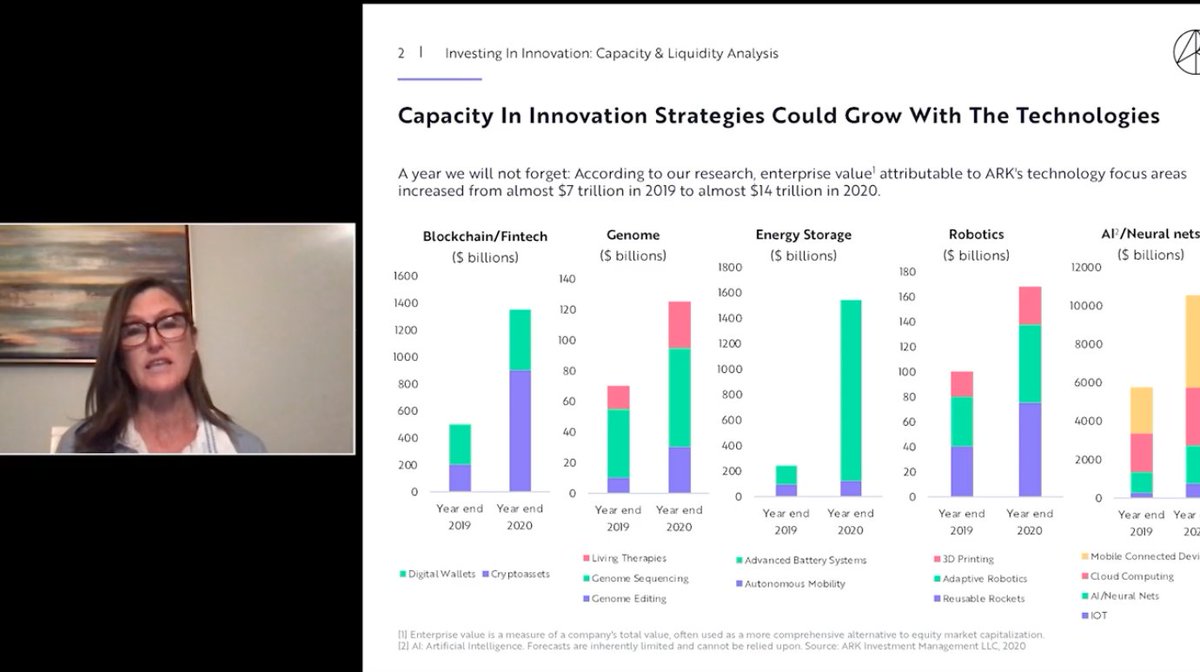

... still nuanced and empathetic wrt ARK, but then Cathie Wood hosts a call (ark-funds.com/innovation-web…) about their capacity/liquidity and leads with this:

"capacity created just from performance" 😩

... and again I'm reminded of $arkk 'focusing on ends with disregard for means'

"capacity created just from performance" 😩

... and again I'm reminded of $arkk 'focusing on ends with disregard for means'

... later (~17:20 mark), @CathieDWood added:

'concerns about ARK's liquidity/capacity are failures of imagination – our inability to think exponentially, as opposed to linearly, about multi-year top line CAGRs (and consequently market caps/daily average dollar volumes)'

$arkk

'concerns about ARK's liquidity/capacity are failures of imagination – our inability to think exponentially, as opposed to linearly, about multi-year top line CAGRs (and consequently market caps/daily average dollar volumes)'

$arkk

... were growth in underlying holdings to provide more *relative* liquidity, ARK's ETF inflows and ownership % both have to wane

... which is possible (esp if ARK trades countercyclically), but still relies way too much on rational/orderly markets:

... which is possible (esp if ARK trades countercyclically), but still relies way too much on rational/orderly markets:

https://twitter.com/AnthPB/status/1367893465821032449?s=20

... don't want to straw man ARK – @CathieDWood did add (~10:50 mark):

'during a bull market run, we add large cap holdings to increase liquidity... so when we get to a risk off scenario like last week, we will sell those liquid large caps and rotate back into smaller pure plays'

'during a bull market run, we add large cap holdings to increase liquidity... so when we get to a risk off scenario like last week, we will sell those liquid large caps and rotate back into smaller pure plays'

... oyy, Cathie Wood (36:00 mark):

"[I prefer the ETF wrapper over a mutual fund or SMA] mostly because of flows. I don't have to worry about flows; all I have to do is worry about [portfolio management] investment decisions."

$arkk #inflows #outflows

"[I prefer the ETF wrapper over a mutual fund or SMA] mostly because of flows. I don't have to worry about flows; all I have to do is worry about [portfolio management] investment decisions."

$arkk #inflows #outflows

https://twitter.com/AnthPB/status/1367893457084223491?s=20

... on that ARK 2025 price target for Tesla (and their valuation model/share count/dilution estimates):

https://twitter.com/ChrisBloomstran/status/1375894783491719169?s=19$arkk $tsla

• • •

Missing some Tweet in this thread? You can try to

force a refresh