In this #IPO frenzy market, lets talk (Thread) about some basics around

-Angle/VC/PE

-Allotment process

-IPO Funding

-Grey Market

Hit the ‘re-tweet’ & help us educated more investors (1/n)

-Angle/VC/PE

-Allotment process

-IPO Funding

-Grey Market

Hit the ‘re-tweet’ & help us educated more investors (1/n)

Why do companies come out with an IPO?

(a) Funding needs

- Business expansion plans

- Debt payoff

(b) Non-Funding requirement

- Enhancing corporate stature

- Exit options to large investors like the VCs & PEs (2/n)

(a) Funding needs

- Business expansion plans

- Debt payoff

(b) Non-Funding requirement

- Enhancing corporate stature

- Exit options to large investors like the VCs & PEs (2/n)

While most of us believe IPOs are for funding requirements, you deep dive and understand it’s more of an exit channel for large investors (VC/PE). Let me explain the same concept from a start-up's perspective (3/n)

If u r starting off ur entrepreneurial journey & need capital, how do u raise funds?

-Self Funding

-Friends & Relatives (F&R)

-Bank Loan

-Angel Investor

Angel investors r the 1s who invest @ the idea stage & PE/VC who invest in the growth phase of the company.(4/n)

-Self Funding

-Friends & Relatives (F&R)

-Bank Loan

-Angel Investor

Angel investors r the 1s who invest @ the idea stage & PE/VC who invest in the growth phase of the company.(4/n)

- Self funding can be the best option but everyone’s not prepared

- F&R I wish helped

- Bank loans need collateral and

- Angel investors invest only when they see scalability in the business and hence a belief that they will get their investments back. (5/n)

- F&R I wish helped

- Bank loans need collateral and

- Angel investors invest only when they see scalability in the business and hence a belief that they will get their investments back. (5/n)

Lets assume ur business idea is brilliant, Investors think this is solving a problem & hence this is worth their investments. Lets say after valuation discussions, u part away 20% equity 2 them for their investments, but, how do they make returns on the investments? (6/n)

Unlike a working partner who would take away 20% of the profits/year, Investors r in a bigger game. They don’t remove profits, they can pump cash if required 4 business 2 reaches a point of maturity where investors would like to make the best of their investments by exiting (7/n)

How would investors get exit?

-Some other big investor buys the stake at higher valuation

-Promoters buy back from the investors

-Let many investors buy from the current Investors – IPO, the easiest of all in a raging bull market & hence IPOs become a medium for exit (8/n)

-Some other big investor buys the stake at higher valuation

-Promoters buy back from the investors

-Let many investors buy from the current Investors – IPO, the easiest of all in a raging bull market & hence IPOs become a medium for exit (8/n)

Now, a lot of us have lately applied for IPOs but have not got the allotment right? How does the allotment process for retail investors work?

In case the IPO undersubscribes – all applicants will get full allotment (9/n)

In case the IPO undersubscribes – all applicants will get full allotment (9/n)

In case of oversubscription,

a) First all applicants will be allotted 1 lot worth of shares each. In case, after allotting one lot each to all applicants, there are still shares available in the retail quota, those shares can be allotted proportionately (10/n)

a) First all applicants will be allotted 1 lot worth of shares each. In case, after allotting one lot each to all applicants, there are still shares available in the retail quota, those shares can be allotted proportionately (10/n)

b) On the other hand, if the applicants are so large in numbers that allotment of one lot is not possible to each of them then role of luck comes in play. Larger the oversubscription, lower the number of stocks that get allotted. (11/n)

Now think of an HNI, what option she has 2 increase her allotment size? Recent IPOs, best case would have got allotment of 1 lot of shares. There comes in the concept 4 IPO funding, financial institutions fund the application of HNIs 2 increase their allotment size (12/n)

The HNI opens a designated bank account with the Lender's/Financial Institution's preferred bank along with a demat account. HNI then issues a Power of Attorney (PoA) granting all operational rights in the favour of the Lender for both bank account and demat account.(13/n)

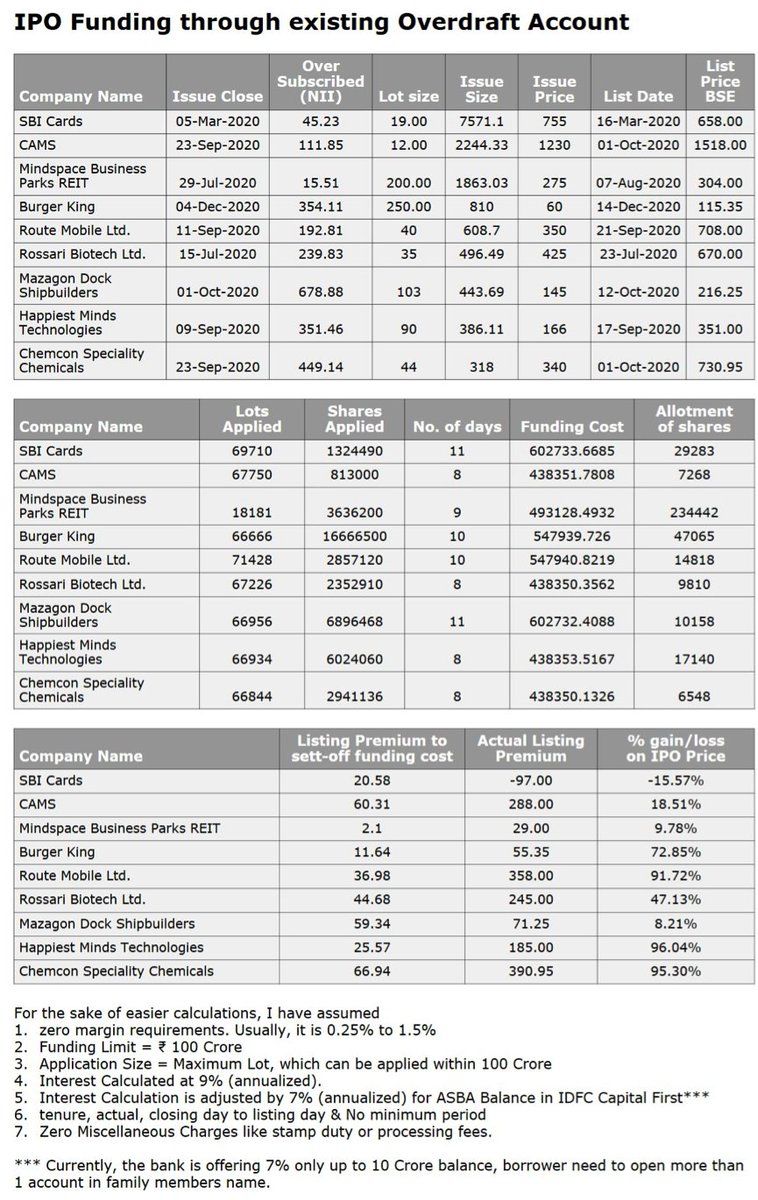

Depending upon the oversubscription, the lender decides the interest & margin 4m the investor. Margin is the amount the HNI has 2 bring. Generally, the interest is in the range of 8-10% & margin in the range of 0.25% to 1.5%. SBI Cards IPO was an exception where interest was 16%

Look @ the over subscription in Mazagon Dock IPO, whopping 678X & premium on listing was 49%. Due 2 such a high response 2 the IPO, the allotment vs the IPO fund amount came down significantly & this IPO required a listing premium of ~ 132% just to set-off the funding cost(15/n)

If u want 2 make money in leveraged IPO application after adjusting 4 the cost of funding then u need a fusion of reasonable oversubscription & ample listing premium. IPO funding is not as elementary as it appears to be, it eats away the major portion of listing gains.(16/n)

Suggestion - Be ready before the IPO by opening an Overdraft Account where collateral can be MF/Stocks & charge 8.5%. On the last date of subscription (provided the IPO is already decently subscribed), u can transfer funds 4m OD 2 IDFC Bank & apply 4m there under ASBA (17/n)

ASBA is Applications Supported by Blocked Amount. Money in the bank will keep earning 7% & OD will keep charging 8.5%, net differential will be 1.5%. This saving in Funding Cost will significantly bring down the required “Listing Premium to set-off funding cost”. (18/n)

Below chart calculates the return on this basis. In the same Mazagon Dock example where you made a loss of -83.86% using traditional funding route, you make a profit of 8.21% using this recommended route. (19/n)

Lets talk about the Grey market now. Grey Market for IPO is a market where deals are done in-person only among the closed trusted group of investors. These deals are usually facilitated by the broker in neighbourhood and are cash settled on the day of listing. (20/n)

In the grey market, an investor could sell buy/sell IPO shares before the company gets listed on the stock exchange as these transactions are off the market. The premium at which this deal happens with respect to the issue price of the IPO is called Grey Market Premium (21/n)

One can also sell the IPO application (irrespective of whether the allotment comes or not) for a fixed price, this rate is called Kostak Rate. (22/n)

And in case the IPO application is sold in the grey market, subject to allotment only, the deal is called 'Subject to Sauda'. In case the seller of the application doesn’t get allotment, the deal is nullified. (23/n)

To read more about the grey markets, process of an IPO, participants in an IPO and multiple other things, read our detailed blog 'A to Z of IPO' by @stepbystep888 (24/25)

Hope the thread added value :) Hit the 're-tweet' and help us reach more investors.

We have written multiple similar educative threads on personal finance. You can find them as a pinned tweet on my profile or click the link below (**END**)

We have written multiple similar educative threads on personal finance. You can find them as a pinned tweet on my profile or click the link below (**END**)

https://twitter.com/kirtan0810/status/1337953717274832896?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh