Why has Trump apparently blown up the economic relief deal? I don't care, and neither should anyone else. In 24 days we can stop worrying about this terrible person's motives, and focus on the GOP backed him all the way. But there are more interesting questions 1/

One is whether $2K for most Americans is a good idea. Even some Democrats, notably Larry Summers, don't think so 2/ bloomberg.com/news/videos/20…

LS should always be listened to, but I think he's wrong here. I agree that across-the-board checks are not an ideal policy — much better to extend enhanced unemployment benefits until the economy recovers — but that's not politically on the table 3/

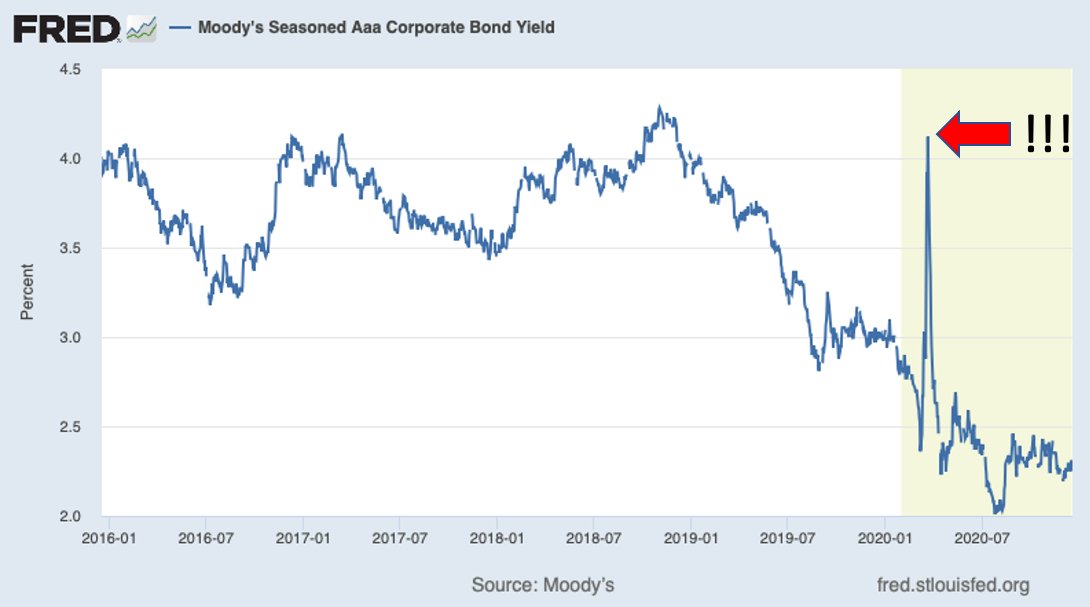

Maybe Ds should have fought harder for more weeks of UI, but I don't see the harm in borrowing some more money at negative real interest rates; at least some of it will go to people who need it 4/

Larry appears to be worried that across-the-board checks will overheat the economy, leading to inflation. Again, I agree that the economy is likely to recover fast once there's a vaccine, so that demand-side stimulus won't be crucial. But inflationary pressure? Not a worry 5/

Increasing the checks from $600 to 2K would be a fiscal stimulus of <2% of GDP — and a fairly low-multiplier stimulus, bc many will save their checks. So yes, it might give an already high-employment economy extra fuel, but not that much 6/

And everything we've seen over the past 20 years says that the short-run Phillips curve is pretty flat — that is, low unemployment pushes inflation up very slowly. So the inflation risks if the economy runs somewhat hot for a year are small 7/

Wait, there's more. While I'm optimistic for the 2nd half of 2021, there's good reason to believe that the economy was suffering from persistent weakness of demand pre-pandemic. It's called secular stagnation, an idea pushed by ... Larry Summers. 8/

In a secstag economy you actually want the government pushing up demand with deficit spending, even when there isn't a crisis. Better if that spending takes the form of public investment, but as with extended UI, that's not on the table right now 9/

So sending most people $2K checks isn't great policy, but it's not a "big mistake". And it's politically popular, so it makes sense for Dems to highlight R refusal to do it 10/

• • •

Missing some Tweet in this thread? You can try to

force a refresh