Putting the Republican attempt to hobble the Fed in perspective: important to realize that financial crises have been a defining feature of the world economy these past 25 years 1/ nytimes.com/2020/12/17/us/…

The run arguably began with Mexico's tequila crisis in 1995; then there was the Asian crisis of 1997-8, the horrifying global crisis of 2008, the euro crisis of 2010-12, and a brief but very scary breakdown in March 2020 2/

I generally think of these crises in terms of the framework Shleifer and Vishny offered in 1997, explaining how it's possible for some assets to become massively underpriced; why don't buyers rush in? 3/

The answer is that the people/institutions who have the knowledge to buy also tend to already own a lot of the assets in question. When prices crash, they're left without cash or the collateral to borrow, so they can't play their usual stabilizing role 4/

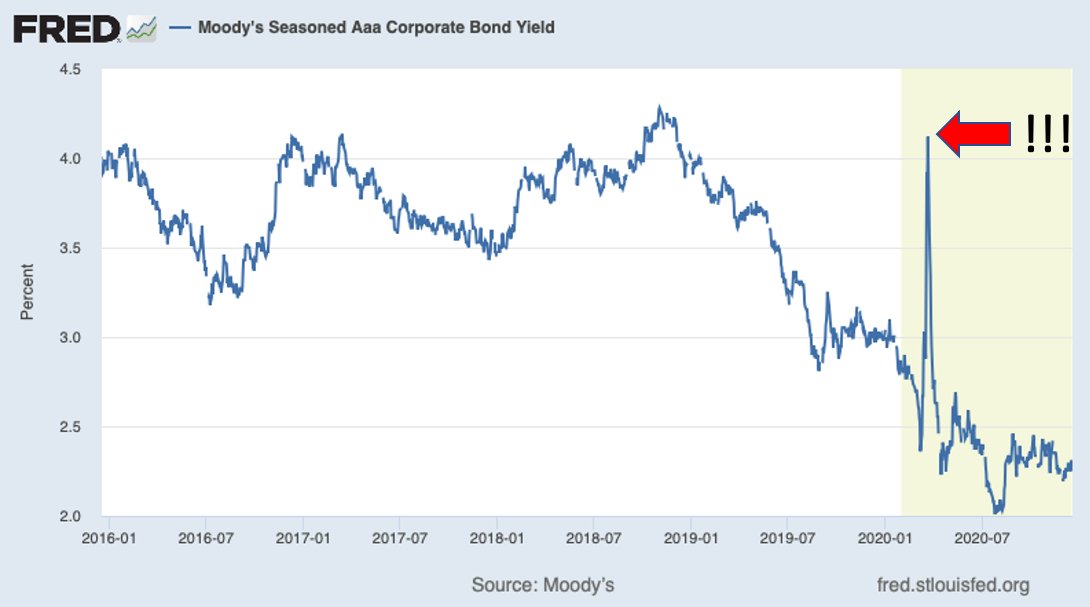

That's where the Fed and other central banks come in. When the financial system seizes up, they can step in — because they can print cash! — and prevent a self-reinforcing downward spiral. Often the promise that they will intervene if necessary ("whatever it takes") is enough 5/

Has the Fed ever abused this power? No. Right-wing complaints about the Fed's role have tended to be along the lines of "We're supposed to be having a crisis but the Fed is preventing it" which is not exactly a bad thing. 6/

But Republicans are trying to ensure that the Fed can't do its job if there's a crisis under Biden. They're barely even trying to offer a coherent rationale. And this attempt at sabotage may scuttle a Covid relief bill 7/

• • •

Missing some Tweet in this thread? You can try to

force a refresh