SM | How Entrepreneurs became Millionaire (Mln)

28 Dec,

19 tweets, 6 min read

Indian Insurance - Comparison of Insurance leaders on key parameters

Time for a thread ...

#HDFCLife #Insurance

@dmuthuk

(1/n)

Time for a thread ...

#HDFCLife #Insurance

@dmuthuk

(1/n)

Non-Par Savings: Future growth in this segment is function of favourable FRA rate environment and supply of partly paid debentures (PPD)

(4/n)

(4/n)

Non-Par Savings: HDFCLIFE relied on back book (credit protect) to under write Non- Par Savings in FY20, PPD + FRAs exposure lower than peers

(5/n)

(5/n)

Cash flow hedging is reflected in the manageable interest rate sensitivity for most of the covered insurers.

(6/n)

(6/n)

Participating products: After normalization of yield curve, focus would be on Par segment to grow APE (if ULIP demand remains muted)

(7/n)

(7/n)

Participating Products : PAR AUM has failed to grow for most the Pvt insurers, which could be a hindrance to improve bonus rates

(8/n)

(8/n)

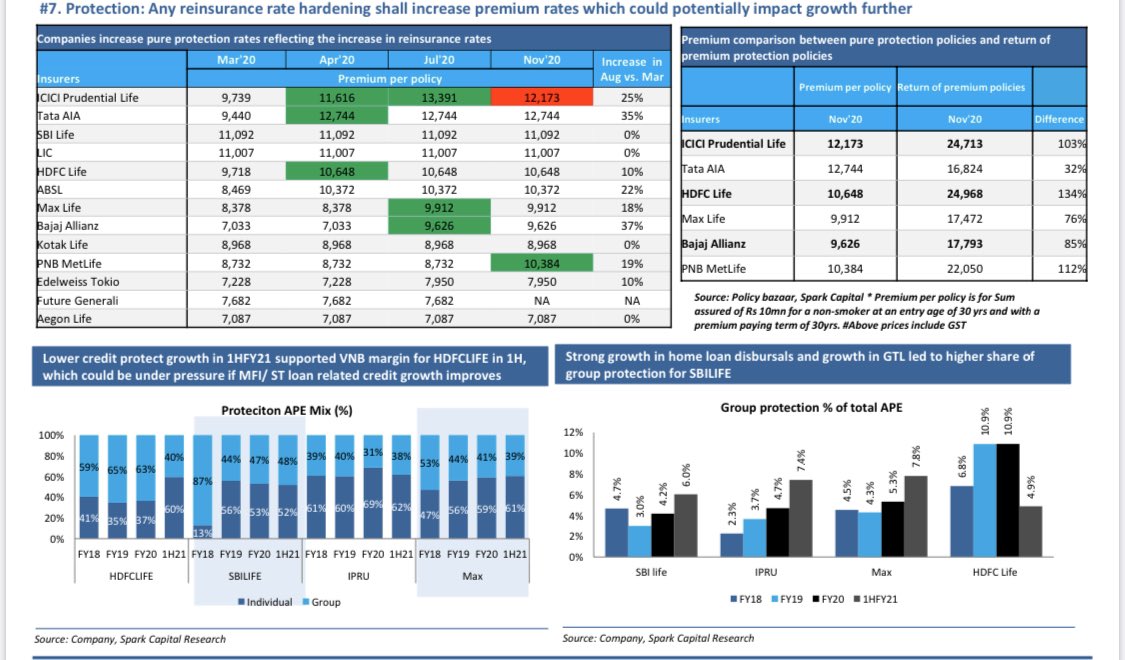

Protection: Sharp growth in reinsurance premium ceded vs. sum assured (SA) growth, reflect significant hardening of reinsurance rates

(9/n)

(9/n)

Protection: HDFLCIFE, IPRU and MAX heavily dependent on reinsurers to underwrite high Sum Assured Individual protection

(11/n)

(11/n)

Protection: IPRU life lost market share in individual sum assured which is reflected in decline the individual protection business in 1HFY21

(12/n)

(12/n)

Protection: With slowdown in number of person insured in individual protection, we believe, growth for this segment to peak out

(13/n)

(13/n)

Protection: Any reinsurance rate hardening shall increase premium rates which could potentially impact growth further

(14/n)

(14/n)

ULIP: Most of the insurers have reduced reliance on linked business; even weak demand for ULIP also impacted contribution

(16/n)

(16/n)

ULIP: Persistency key for ULIP profitability has been clearly under pressure for all insurers

(17/n)

(17/n)

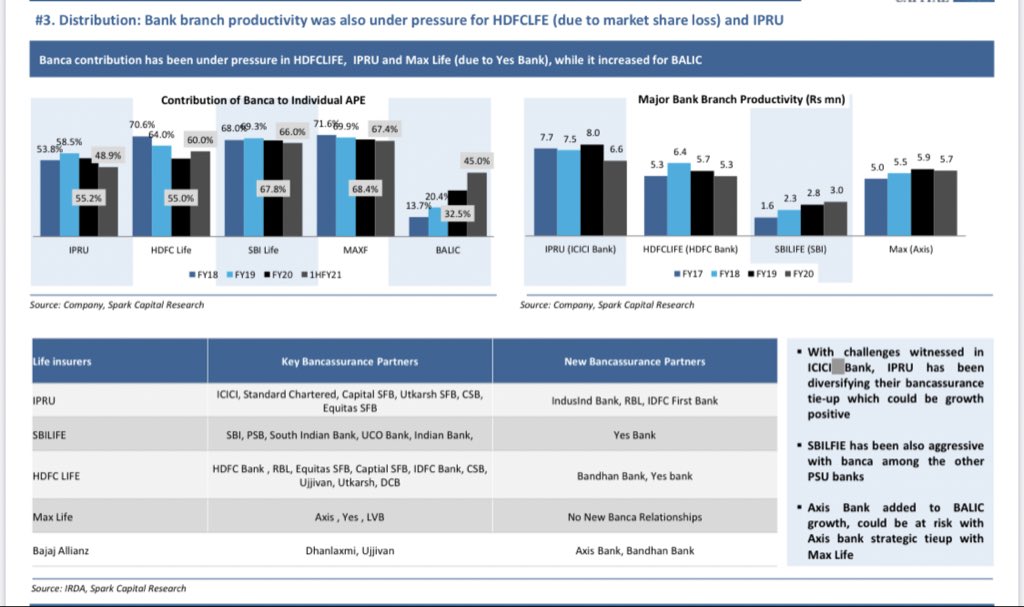

Distribution: Bancassurance supported the growth, which could be at risk if CD ratio and yield curve normalizes

(19/n)

(19/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh