Excellent in-depth article about Moats by @CBinsights👏

Studying the Moats/Management (real engines behind enduring growth & returns of great Co's over time) is a fascinating subject.

@richard_chu97 @saxena_puru @FromValue @dhaval_kotecha @adventuresinfi

cbinsights.com/research/repor…

Studying the Moats/Management (real engines behind enduring growth & returns of great Co's over time) is a fascinating subject.

@richard_chu97 @saxena_puru @FromValue @dhaval_kotecha @adventuresinfi

cbinsights.com/research/repor…

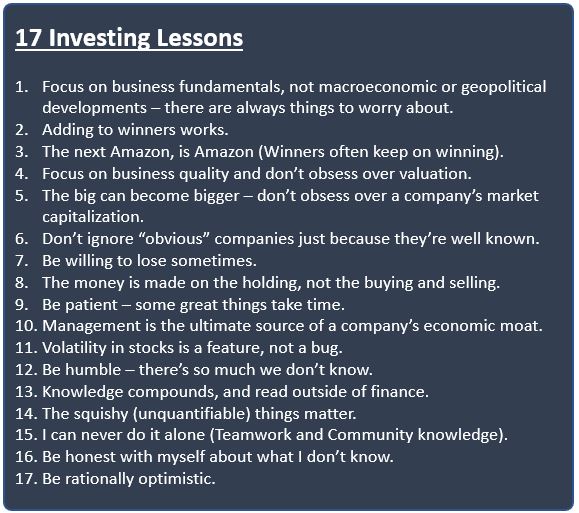

Big returns from LT positions in great Co's is what we all aim for.

Clearly understanding what makes a specific Co great (Moat, Mgmt, Trends, Optionality...) & what's actually contributing to all that growth, Fin results & LT stock prices is a very enjoyable/rewarding process.

Clearly understanding what makes a specific Co great (Moat, Mgmt, Trends, Optionality...) & what's actually contributing to all that growth, Fin results & LT stock prices is a very enjoyable/rewarding process.

Overall an excellent article with great visuals and tons of (theoretical & practical) information and a framework that's immensely useful when doing Fundamental/Quality analysis of Companies. 👏👏

/END.

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh