Just sharing this great blog "The Good Investors - Singapore" & some of my fav articles. (Not sure if they are on Twitter).

Very interesting/useful stuff for individual, long-term investors.👏

@saxena_puru @Gautam__Baid @dmuthuk

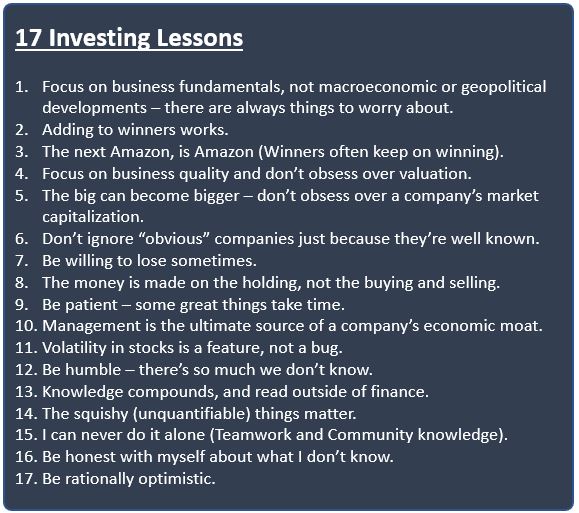

1⃣ 17 Investing Lessons

thegoodinvestors.sg/saying-goodbye…

Very interesting/useful stuff for individual, long-term investors.👏

@saxena_puru @Gautam__Baid @dmuthuk

1⃣ 17 Investing Lessons

thegoodinvestors.sg/saying-goodbye…

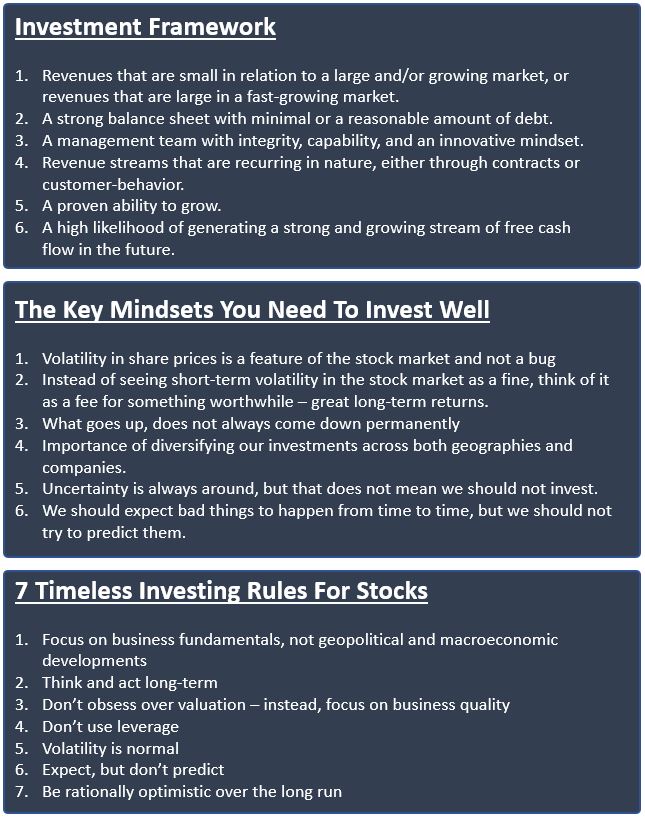

2⃣ 24 Things Every Investor Should Know About Investing (To Become Better)

Some great pts on

✔️Market facts

✔️Investing psychology

✔️How to invest

thegoodinvestors.sg/things-every-i…

Some great pts on

✔️Market facts

✔️Investing psychology

✔️How to invest

thegoodinvestors.sg/things-every-i…

5⃣ How To Find Multi-baggers? 👏👏

✔️Potential market opportunity

✔️Clear path to profitability

✔️An enduring moat

✔️Management that can execute

✔️Comparing current market cap with the potential market cap

thegoodinvestors.sg/how-to-find-mu…

✔️Potential market opportunity

✔️Clear path to profitability

✔️An enduring moat

✔️Management that can execute

✔️Comparing current market cap with the potential market cap

thegoodinvestors.sg/how-to-find-mu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh