Tesla posted a new video about their secret Kato Road 4680 cell production lines a couple of days ago, and it contains a couple of technological gems I haven't seen widely mentioned elsewhere yet, so here's an attempt at listing these new disclosures.

1/

1/

2/

The first thing is that there appear to be no human workers/operators whatsoever in the main production process.

To the left is an image of line workers handling finished cells in a traditional facility. To the right is the 100% automated conveyance system Tesla has.

The first thing is that there appear to be no human workers/operators whatsoever in the main production process.

To the left is an image of line workers handling finished cells in a traditional facility. To the right is the 100% automated conveyance system Tesla has.

3/

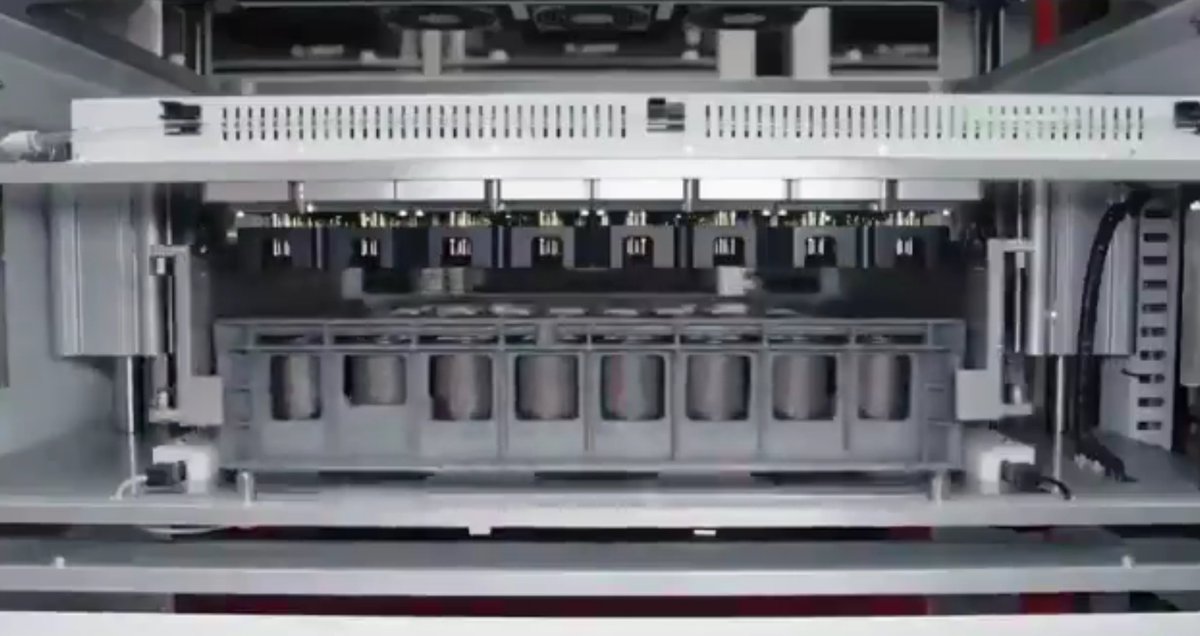

Here's how their 4680 cells are transported in racks of 8x8 cells: 64 cells each.

These standardized racks likely interface into automated pack production machines, made by Tesla Grohmann, or get directly integrated into the die-cast underbody (structural battery pack).

Here's how their 4680 cells are transported in racks of 8x8 cells: 64 cells each.

These standardized racks likely interface into automated pack production machines, made by Tesla Grohmann, or get directly integrated into the die-cast underbody (structural battery pack).

4/

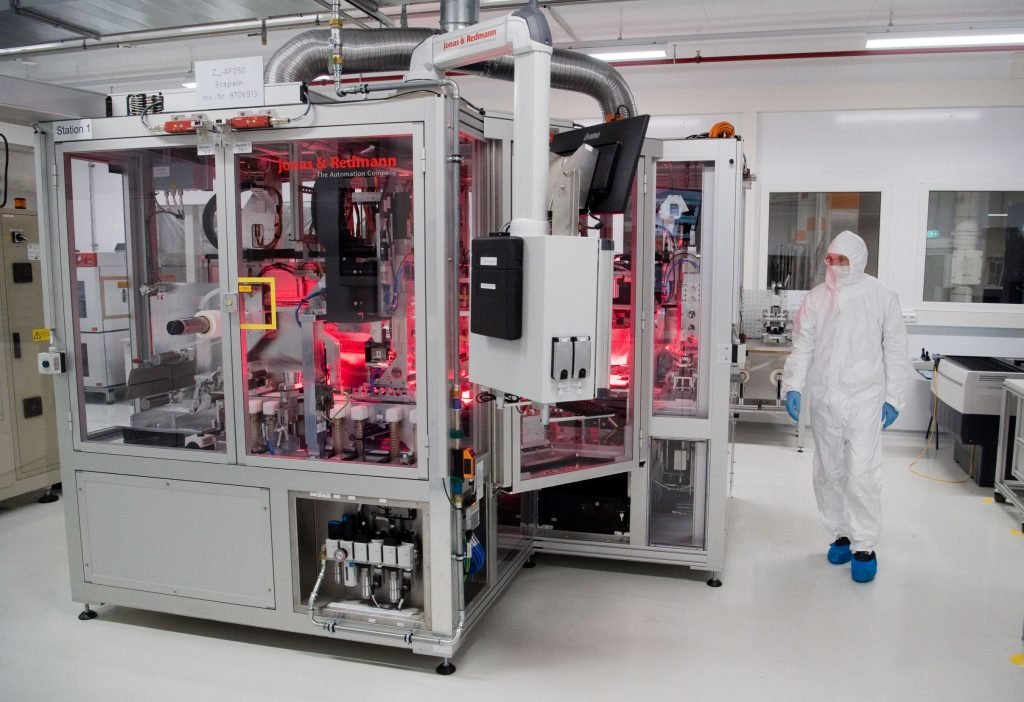

There's an interesting detail in one of the frames: glimpse of a facility worker observing an industrial robot moving a rack.

There's an interesting detail in one of the frames: glimpse of a facility worker observing an industrial robot moving a rack.

5/

What is interesting is that:

✅ Cell production facilities are Class 7 clean rooms, while the worker doesn't wear the usual "bunny suit" protective gear.

✅ There's a barrier between the worker and the robot: likely separating clean-room air from unprotected air.

What is interesting is that:

✅ Cell production facilities are Class 7 clean rooms, while the worker doesn't wear the usual "bunny suit" protective gear.

✅ There's a barrier between the worker and the robot: likely separating clean-room air from unprotected air.

6/

This suggests that much - maybe all - of the Kato Road production floor is in an isolated high grade clean-room with no human presence. Even finished cells are handled in what appear to be a clean-room environment.

Only maintenance would require humans to enter this space.

This suggests that much - maybe all - of the Kato Road production floor is in an isolated high grade clean-room with no human presence. Even finished cells are handled in what appear to be a clean-room environment.

Only maintenance would require humans to enter this space.

7/

The internal unit of handling finished cells appears to be a group of "4" cells in a single holder. A rack would have 16 of these.

The internal unit of handling finished cells appears to be a group of "4" cells in a single holder. A rack would have 16 of these.

8/

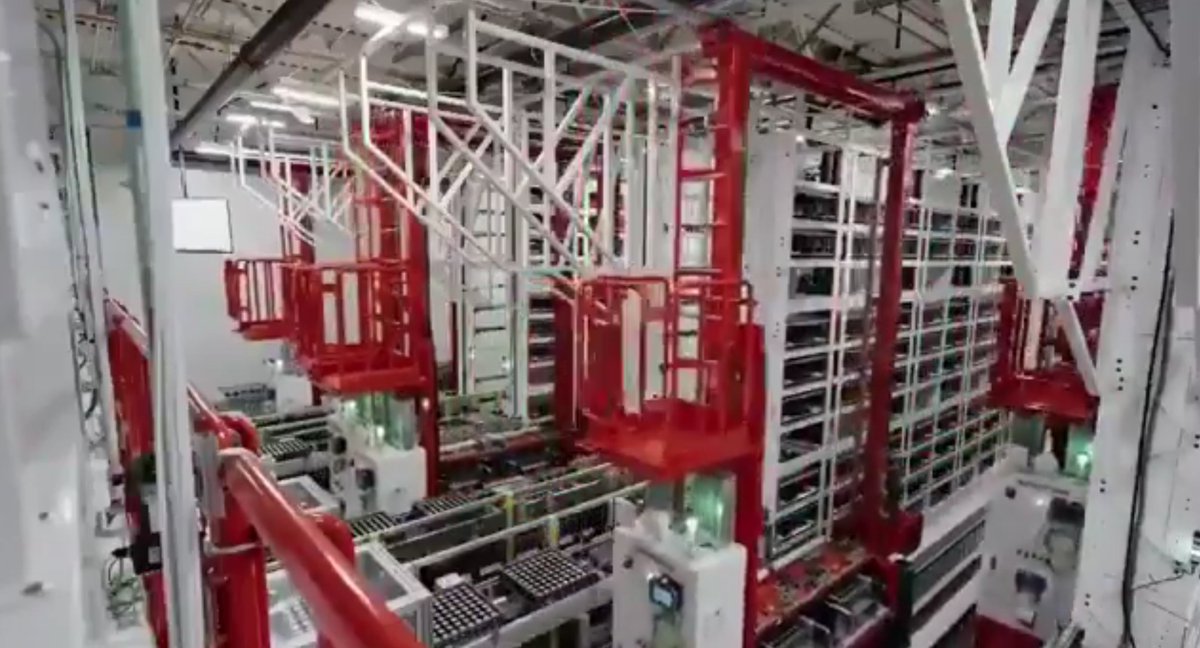

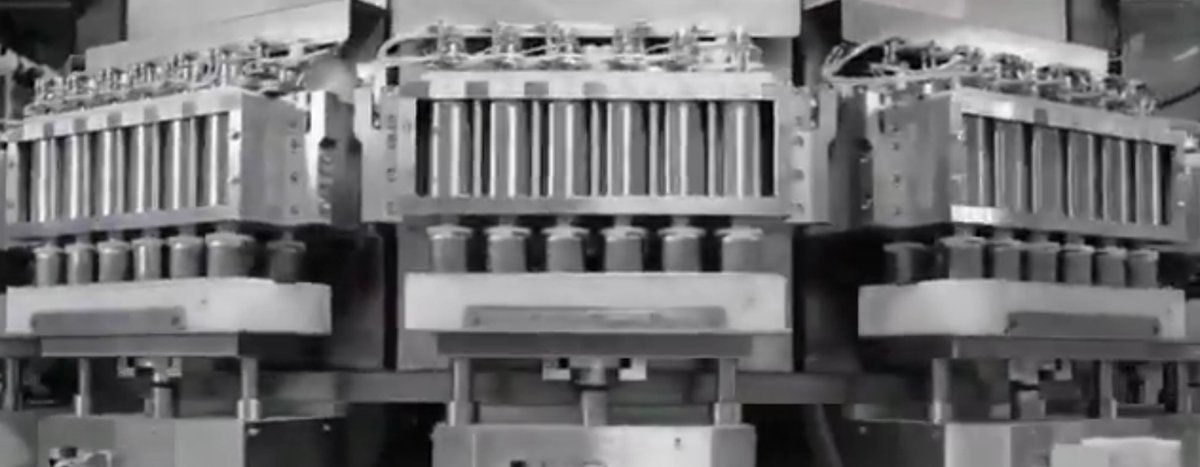

This large "wall" of Tesla labeled units appears to be high volume storage for 64-cell racks - possibly QA testing and initial formation (charging) of the cell.

Cell formation is usually done by third party equipment - but Tesla clearly uses their own equipment now.

This large "wall" of Tesla labeled units appears to be high volume storage for 64-cell racks - possibly QA testing and initial formation (charging) of the cell.

Cell formation is usually done by third party equipment - but Tesla clearly uses their own equipment now.

9/

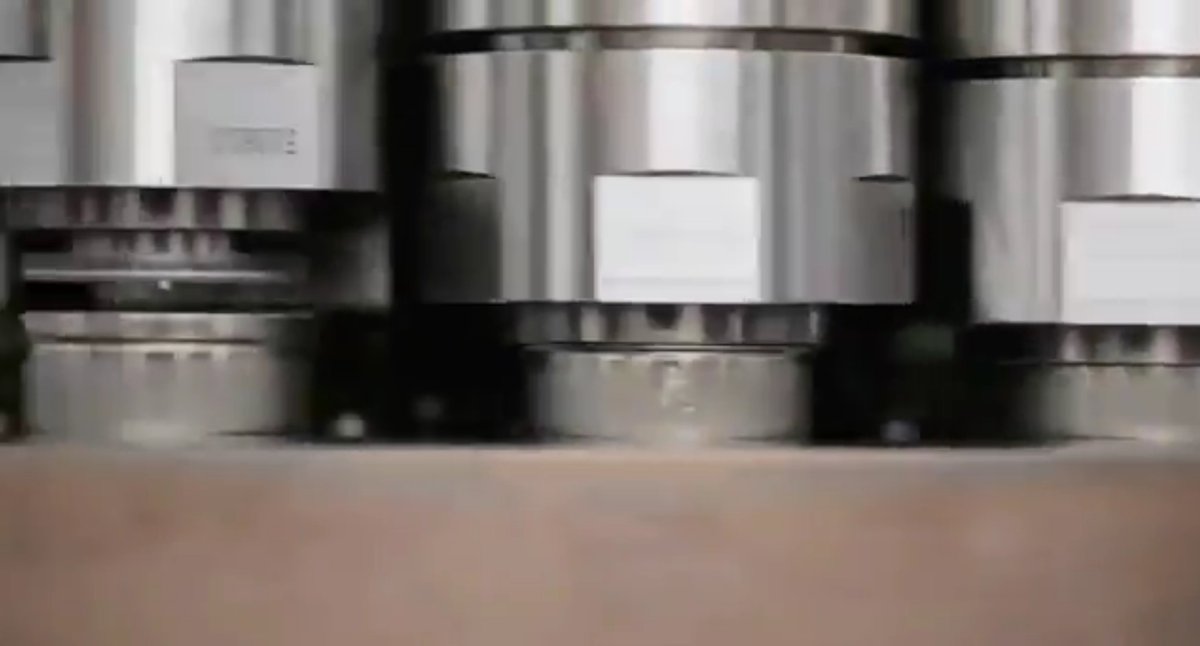

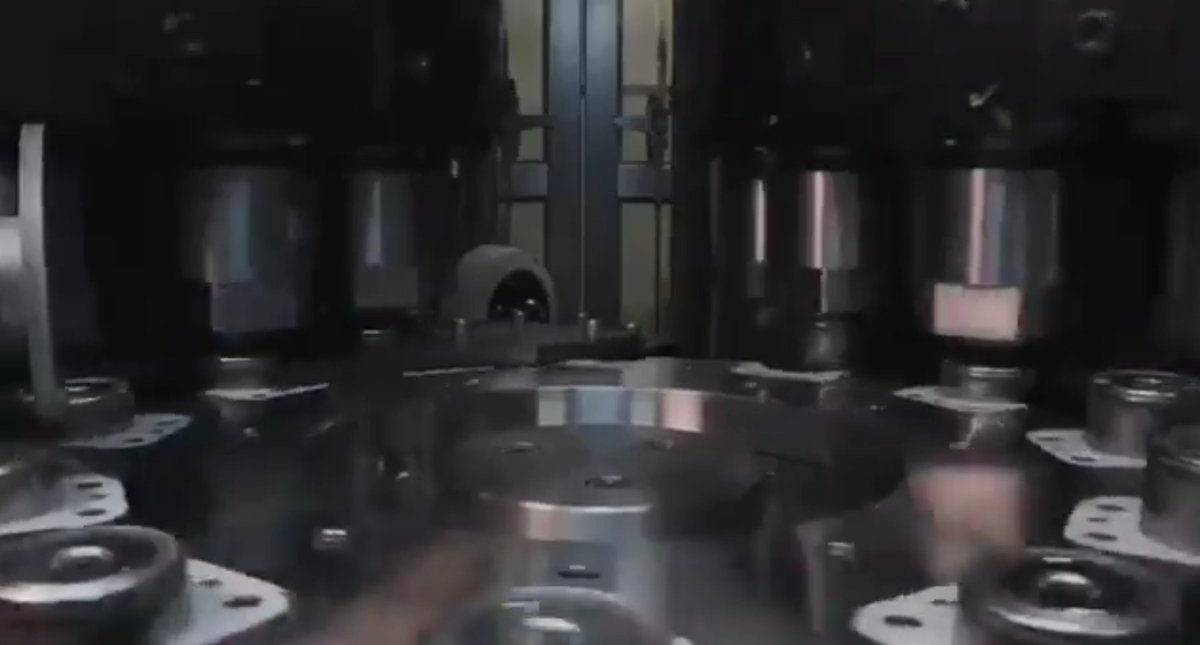

At 0:20 there appears to be rare footage of the "jelly roll" (inner roll of the cell) being carefully pressed into the "can", creating much of the final cell body.

At 0:20 there appears to be rare footage of the "jelly roll" (inner roll of the cell) being carefully pressed into the "can", creating much of the final cell body.

10/

At 0:26 I think we see how the top of the cells get pressed to the bottom of the cell.

The famous "tab-less" picture on the right was disclosed on Battery Day. I believe Tesla is pressing the continuous metal surface of electrodes to the can surface, creating good contact.

At 0:26 I think we see how the top of the cells get pressed to the bottom of the cell.

The famous "tab-less" picture on the right was disclosed on Battery Day. I believe Tesla is pressing the continuous metal surface of electrodes to the can surface, creating good contact.

11/

Tesla's goal with releasing this video was clearly recruitment - as can be seen in the final frames of the video. 🙂

Tesla's goal with releasing this video was clearly recruitment - as can be seen in the final frames of the video. 🙂

12/

𝐓𝐋;𝐃𝐖: this video IMO demonstrates that Tesla's Kato Road facility is a full scale cell production pilot line & factory that is far more ahead in commercializing & scaling their new cell technologies than the "R&D project" impression @elonmusk gave on Battery Day. 😉

𝐓𝐋;𝐃𝐖: this video IMO demonstrates that Tesla's Kato Road facility is a full scale cell production pilot line & factory that is far more ahead in commercializing & scaling their new cell technologies than the "R&D project" impression @elonmusk gave on Battery Day. 😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh