Virtue signaling and FUDDing algorithmic stablecoins without evidence is pretty lame

At the end of the day, no one knows for sure whether a workable model can be found or not

Crypto is all about experimentation and innovation - Let’s keep it that way

At the end of the day, no one knows for sure whether a workable model can be found or not

Crypto is all about experimentation and innovation - Let’s keep it that way

The fact that we can battle test these models with billions of $ summoned on this timeline rather than limited simulations is fucking awesome

Economic studies have always been limited by being retrospective, small scale or slow

Crypto allows us to experiment 100x better

Economic studies have always been limited by being retrospective, small scale or slow

Crypto allows us to experiment 100x better

This isn’t kindergarten. Anyone that has ever heard of crypto knows that it’s a high risk field

Maybe stick with something like legacy finance if you can’t accept it.

Maybe stick with something like legacy finance if you can’t accept it.

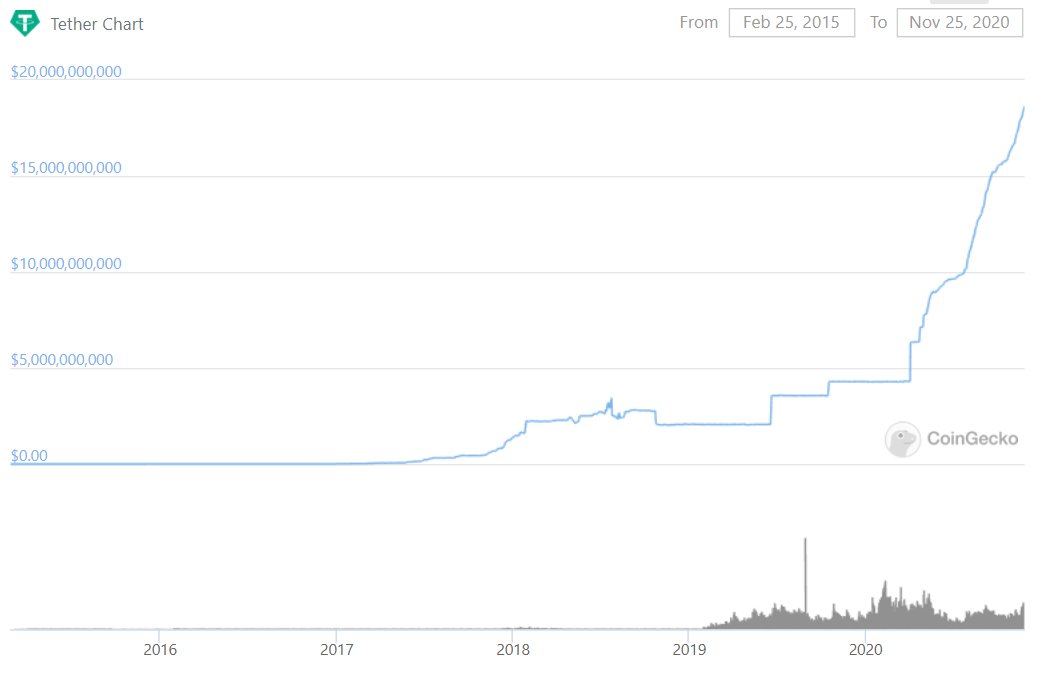

Some of the sentiment I see from haters reminds me of the same sentiment towards token projects and DeFi in 2018/2019

We see now how that turned out

@FUTURE_FUND_ sums it up nicely - fortune favors the brave, not the fearful

We see now how that turned out

@FUTURE_FUND_ sums it up nicely - fortune favors the brave, not the fearful

https://twitter.com/future_fund_/status/1344423530474086400

• • •

Missing some Tweet in this thread? You can try to

force a refresh