1/22 MEGATHREAD: Long $TBR (ASX)

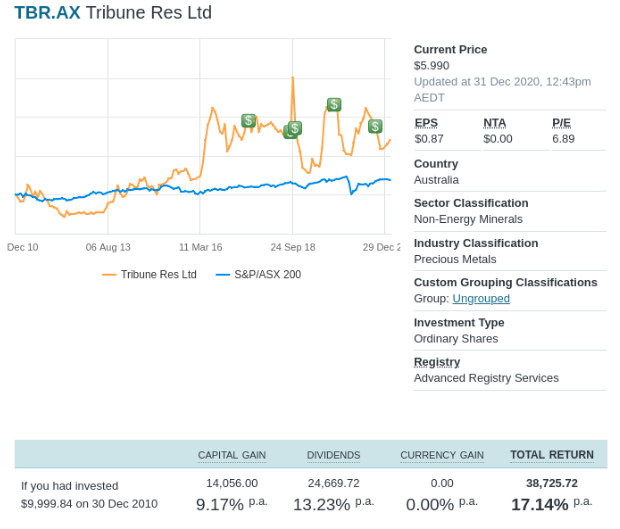

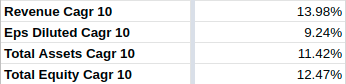

Extremely undervalued #gold play. 17% return p.a compounded over the last 10 years.

Let’s start with some history:

Extremely undervalued #gold play. 17% return p.a compounded over the last 10 years.

Let’s start with some history:

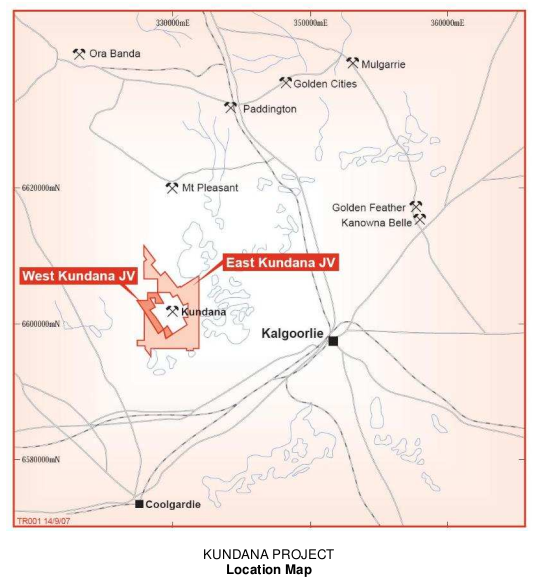

2/ $TBR is a gold producer & explorer listed on the #ASX in 1989. Anton Billis is founder & still CEO. The major asset for $TBR is the East Kundana Joint Venture (EKJV), in Western Australia. $TBR holds a 36.75% interest in #EKJV. Billis first pegged the EKJV in the late 80's.

3/ $RND, sister company to $TBR (same founder / ceo) holds a 12.25% interest, the current operator and JV partner, $NST, holds a 51% interest in the EKJV. Open pit mining started here in 2006 and there are three deposits currently being worked.

4/ $TBR has 2 exploration targets, Japa (80% interest, Ghana), & Diwalwal (80% economic interest, Philippines).

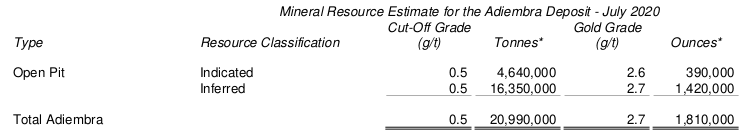

Japa mining lease was granted in 2019. Japa was announced (Aug 2020) as a 1.81M oz JORC resource (Adiembra deposit) & poses as a low cost mine. Exploration continues.

Japa mining lease was granted in 2019. Japa was announced (Aug 2020) as a 1.81M oz JORC resource (Adiembra deposit) & poses as a low cost mine. Exploration continues.

5/ $TBR gained the Diwalwal tenement in 2008, giving them the right to explore, develop & process mineral resources for 25 years, renewable up to 50. Previous exploration outlined non-JORC resources of 2M oz. $TBR has an exploration target of 1.5-2Mt @ 7.5-9g/t Au for Diwalwal.

6/ CURRENT OPERATIONS

$TBR has current mineral resources of 2.6M oz gold. This is a combination of EKJV (0.75M oz), and Japa (1.81M oz). Diwalwal is not counted, as it is non-JORC.

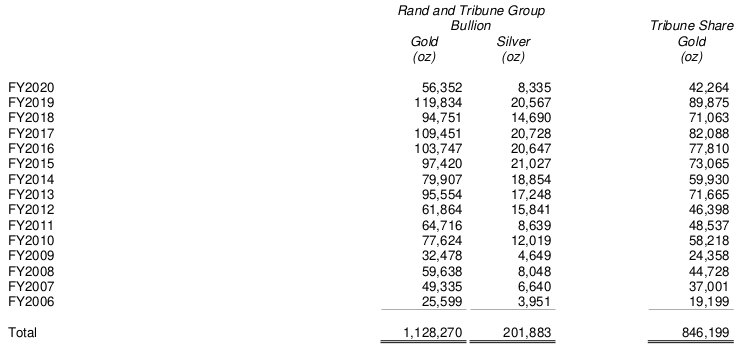

FY2020 $TBR produced 42,264 oz gold from EKJV, significantly down from FY19 at 89,875 oz.

Why?

$TBR has current mineral resources of 2.6M oz gold. This is a combination of EKJV (0.75M oz), and Japa (1.81M oz). Diwalwal is not counted, as it is non-JORC.

FY2020 $TBR produced 42,264 oz gold from EKJV, significantly down from FY19 at 89,875 oz.

Why?

7/ The $TBR & $NST relationship has soured recently. $TBR CEO Billis has a controlling stake in $TBR & $RND, directly & indirectly. In 2018, ASIC found that his holdings were in breach of ASIC regulations, which he had to correct. Billis did so & the investigation ended Mar 2019.

8/ During this time (Nov 2018), $NST made an offer of $150m for the remaining 49% stake in EKJV. Billis rejected this as grossly undervalued. Billis was already unsatisfied with $NST ’s EKJV management, as costs had reportedly increased 50% since $NST began processing EKJV ore.

9/ $NST then announced in Oct 2019 that they would only process 35,000 of EKJV ore, which $TBR is challenging in the courts, and seeking damages. From these actions it seems $NST is trying to bully $TBR out of EKJV.

10/ The limited EKJV ore processing led to $TBR ’s reduced gold production for FY2020, and their stockpiles rose by 107,131 tonnes and 18,862 oz. Since then, $TBR has secured 386,000 tonnes of alternative toll milling contracts to help reduce stockpiles and produce more gold.

11/ BALANCE SHEET

$TBR has $169m of inventories at cost. TBR has one of the lowest all-in sustaining costs (AISC) on the ASX, around $1,100/oz. I estimate this is 85,000 oz on hand & 37,000 oz in stockpiles. At current market value this is ~$300m or 5.71/share.

$TBR has $169m of inventories at cost. TBR has one of the lowest all-in sustaining costs (AISC) on the ASX, around $1,100/oz. I estimate this is 85,000 oz on hand & 37,000 oz in stockpiles. At current market value this is ~$300m or 5.71/share.

12/ At the current share price (SP) you get their gold at market price & their 30m+/year FCF generating EKJV as well as exploration targets for a few cents/share. EKJV has an estimated 0.75M oz & exploration targets have 1.8M oz, likely to be more pending a Diwalwal announcement.

13/ MANAGEMENT

Management is highly skilled. Share buy-backs when SP is low, holds a large personal stake (& bought another 60k shares at $5.53 in Dec 2020), 20c dividend for the last 4 years & a special dividend of $3.50/share in 2018.

Management is highly skilled. Share buy-backs when SP is low, holds a large personal stake (& bought another 60k shares at $5.53 in Dec 2020), 20c dividend for the last 4 years & a special dividend of $3.50/share in 2018.

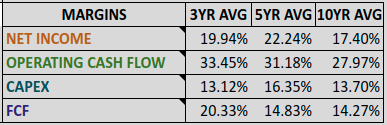

14/ $TBR has returned the same amount to shareholders as gold producers many times their size. Revenue has been growing 14% CAGR over 10 years. 10 year avg ROIC is 11% & increasing. Management run one of the lowest cost producers on the ASX, with low AISC & overheads.

15/ MOAT

As with all producers, $TBR has little moat. The moat is their low AISC, which is in the lowest cost quartile for AUS gold producers. The other moat is their existing EKJV, Japa & Diwalwal stakes. Management have extensive experience, demonstrated by growing margins.

As with all producers, $TBR has little moat. The moat is their low AISC, which is in the lowest cost quartile for AUS gold producers. The other moat is their existing EKJV, Japa & Diwalwal stakes. Management have extensive experience, demonstrated by growing margins.

16/ RISKS

Why is $TBR trading at such a discount? I have a few theories why.

1. It is a <100K oz producer, which the market discounts.

2. Billis’s control of TBR and ASIC issues may raise eyebrows of investors.

3. The current court case with $NST.

Why is $TBR trading at such a discount? I have a few theories why.

1. It is a <100K oz producer, which the market discounts.

2. Billis’s control of TBR and ASIC issues may raise eyebrows of investors.

3. The current court case with $NST.

17/ 4. Lumpy returns (negative FCF because of production reduction and exploration increase).

5. Declining EKJV speculation.

6. It’s too small for institutions. (~300m AUD market cap)

7. Political risks for Japa and Diwalwal.

8. Unhedged gold price risk.

5. Declining EKJV speculation.

6. It’s too small for institutions. (~300m AUD market cap)

7. Political risks for Japa and Diwalwal.

8. Unhedged gold price risk.

18/ CATALYSTS

Japa & Diwalwal announcements in the next year should drive SP, along with an increasing gold price. As $TBR becomes a larger producer, it may re-rate as a mid-size producer. Currently, it's trading at a steep discount to its peers & historical multiples.

Japa & Diwalwal announcements in the next year should drive SP, along with an increasing gold price. As $TBR becomes a larger producer, it may re-rate as a mid-size producer. Currently, it's trading at a steep discount to its peers & historical multiples.

19/ SUMMARY

$TBR is a unhedged bet on gold prices, as a low-cost producer $TBR offers cushion in a gold downturn, & prints money in a gold up-swing. Unlike typical value plays $TBR has big upside, with exploration targets having the potential to massively increase the SP.

$TBR is a unhedged bet on gold prices, as a low-cost producer $TBR offers cushion in a gold downturn, & prints money in a gold up-swing. Unlike typical value plays $TBR has big upside, with exploration targets having the potential to massively increase the SP.

20/ Management have shareholders interests at heart, with the CEO having a large stake. The moat is almost as good as it gets for a gold producer. $TBR is at a ~50% discount to its peers on a multiples basis. Quality is undeniable with inventory covering most of the current SP.

21/ Exploration projects give room to grow revenue massively. I see this as a long-term compounder. With $5.71/share in gold + 14m cash - 39m liabilities, you have $5.24/share of gold/cash. If you discount the exploration projects to $0, $TBR still offers an attractive return.

22/22 (End) I have a more in depth, quantitative analysis of TBR on my website:

valueinvestingscientist.com/valuation-anal…

As always, DYOR!

valueinvestingscientist.com/valuation-anal…

As always, DYOR!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh