1/Tesla cars offer incredible VALUE.

Value is defined as benefits (perceived or otherwise) divided by PRICE.

So...the more benefit the customer perceives from the product, the higher the perceived value. Similarly, the lower the price, the higher the perceived value.

Value is defined as benefits (perceived or otherwise) divided by PRICE.

So...the more benefit the customer perceives from the product, the higher the perceived value. Similarly, the lower the price, the higher the perceived value.

2/ A strong brand enables a company to price its product high while maintaining high perceived value.

What happens when you combine a strong brand + best-in-class features, technology & performance - at a LOWER price than similarly-sized and positioned cars?

Market shr ⏫

What happens when you combine a strong brand + best-in-class features, technology & performance - at a LOWER price than similarly-sized and positioned cars?

Market shr ⏫

3/ This is what has happened in every market Tesla has entered. Of course, bears will argue about "X" market and "Y" period of time (Norway, bro).

Its easy to blend markets & products & market shares & get everything & everyone all confused.

Its easy to blend markets & products & market shares & get everything & everyone all confused.

4/ Alas, this thread isn't about market share. It's about VALUE. The recent launch of MiC Model Y is a perfect example of why Tesla is winning in China, and why the German big 3 are so screwed. I'll use BMW as my example, but BMW, Audi & Mercedes are competitive with each other..

5/ ...and so the principle applies to all 3. Why did I choose BMW? Because they're EV laggards, and bc it was easier for me to navigate their Chinese website (😅).

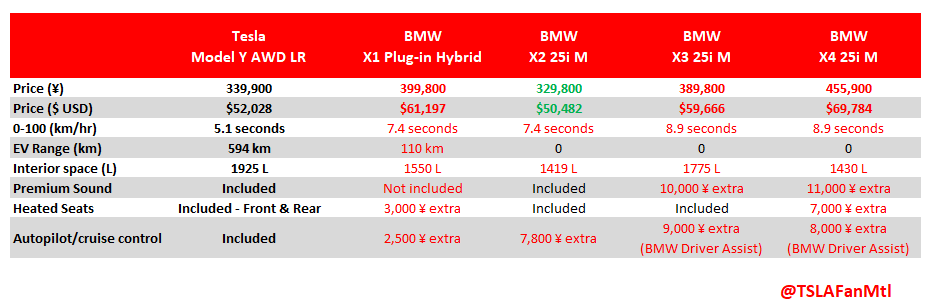

Here is how the AWD LR MiC Model Y compares to similarly-priced crossover BMWs.

Green = BMW wins

Red = M-Y wins

Here is how the AWD LR MiC Model Y compares to similarly-priced crossover BMWs.

Green = BMW wins

Red = M-Y wins

6/ As you can see, the Tesla offers incredible value for money. And these comparables are but the tip of the iceberg. Many other features that come standard on the Tesla are either not available or cost extra on the BMW:

Some examples:

Some examples:

7/

- Automatic transmission

- Heated rear seats

- Heated steering wheel

- Sport seats

- Keyless entry

- WiFi

- Parking assist

- Phone wireless charging

Not to mention.. Tesla also offers FREE OTA software updates that keep adding features and improving the car after purchase.

- Automatic transmission

- Heated rear seats

- Heated steering wheel

- Sport seats

- Keyless entry

- WiFi

- Parking assist

- Phone wireless charging

Not to mention.. Tesla also offers FREE OTA software updates that keep adding features and improving the car after purchase.

8/ So what are the Germans to do? What can they do? If they lower price or throw in some of these features for free, they lose margin and earn less cash. They're already strapped with debt and have to somehow invest in their long-term survival (EV) while generating cash from...

9/...their legacy businesses. Should they just do nothing and ignore Tesla? We see the specs...we know from the US market how this plays out. Should they perhaps launch a compelling EV to compete? They're nowhere close to Tesla on (range + performance)/price...and Tesla isn't...

10/...exactly slowing down.

As the premium market in China grows and Tesla is still ramping production, the OEMs may be able to weather the storm for a year or two. As Tesla hits a 5-6k weekly production rate of a Model Y in Q3-Q4 21, it will start to hurt.

$TSLA $TSLAQ

As the premium market in China grows and Tesla is still ramping production, the OEMs may be able to weather the storm for a year or two. As Tesla hits a 5-6k weekly production rate of a Model Y in Q3-Q4 21, it will start to hurt.

$TSLA $TSLAQ

We didnt even discuss the other obvious benefits of owning a Tesla vs an OEM car:

Fuel savings

Maintenance

Convenience

Less depreciation

Regulatory impact

Etc.

Fuel savings

Maintenance

Convenience

Less depreciation

Regulatory impact

Etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh