1/

Zimbabwe Economy remittances paradox

The paradox can be stated as thus; The single most influential variable in the Zim economy is diaspora remittances, yet it’s the least researched, misunderstood & almost forgotten sub-sector.

Zimbabwe Economy remittances paradox

The paradox can be stated as thus; The single most influential variable in the Zim economy is diaspora remittances, yet it’s the least researched, misunderstood & almost forgotten sub-sector.

2/

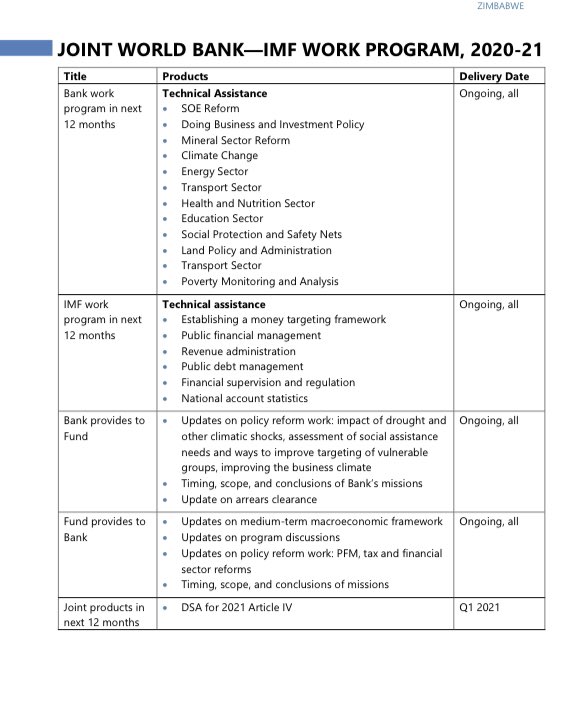

While GOZ in its incompetence can be easily forgiven, one wonders how the many multilateral organizations like WB, IMF ADB UNDP, DFID, USAID including NGO’s have played a part in the almost nonexistent , inconsistent and generally forgotten sub-sector

While GOZ in its incompetence can be easily forgiven, one wonders how the many multilateral organizations like WB, IMF ADB UNDP, DFID, USAID including NGO’s have played a part in the almost nonexistent , inconsistent and generally forgotten sub-sector

3/

Certainly from an Economics perspective, nothing requires more study and understanding than remittances. After 20 years of a growing diaspora, surely this is an area that demands careful policy direction since it has both opportunities & threats to an economy.

Certainly from an Economics perspective, nothing requires more study and understanding than remittances. After 20 years of a growing diaspora, surely this is an area that demands careful policy direction since it has both opportunities & threats to an economy.

4/

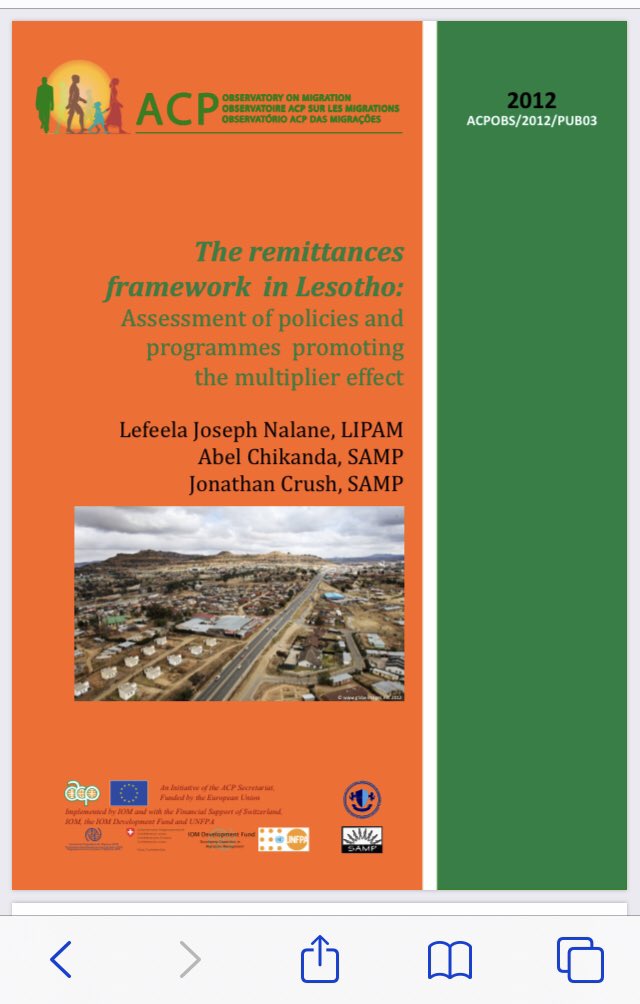

The Multilateral IFI’s spend and capacitate study and policy recommendations with direct facilitation in many other countries like India, SE Asia, North Africa, Latin America & close to home Lesotho. Yet 20 years later, nothing comprehensive has been done.

The Multilateral IFI’s spend and capacitate study and policy recommendations with direct facilitation in many other countries like India, SE Asia, North Africa, Latin America & close to home Lesotho. Yet 20 years later, nothing comprehensive has been done.

5/

This is the sort of support Zim requires especially if the economy has any chance in 10-20 years. We must ask why these IFI’s have not engaged fully?

This is the sort of support Zim requires especially if the economy has any chance in 10-20 years. We must ask why these IFI’s have not engaged fully?

6/

A Academics that have used their own resources & curiosity to nibble & attempt to deconstruct Zim remittances. Many of whom I will quote in this 3 part series. It is necessary that in 2021, as citizens we use as much pressure as possible to get remittances on the agenda.

A Academics that have used their own resources & curiosity to nibble & attempt to deconstruct Zim remittances. Many of whom I will quote in this 3 part series. It is necessary that in 2021, as citizens we use as much pressure as possible to get remittances on the agenda.

7/

From GOZ accounts we get GDP by production/income. It’s an easier way to compute GDP. GDP is the value creation/production by each sub sector. Primary industries are limited in their value creation while secondary industries like Ecocash create more value with less inputs.

From GOZ accounts we get GDP by production/income. It’s an easier way to compute GDP. GDP is the value creation/production by each sub sector. Primary industries are limited in their value creation while secondary industries like Ecocash create more value with less inputs.

8/

We can also deduct GDP through expenditure/consumption of the key components in an economy. These are Government, Consumers (as households), Investment ( a function of savings& credit market) and net of exports minus imports.

All income earned is spent or saved.

We can also deduct GDP through expenditure/consumption of the key components in an economy. These are Government, Consumers (as households), Investment ( a function of savings& credit market) and net of exports minus imports.

All income earned is spent or saved.

9/

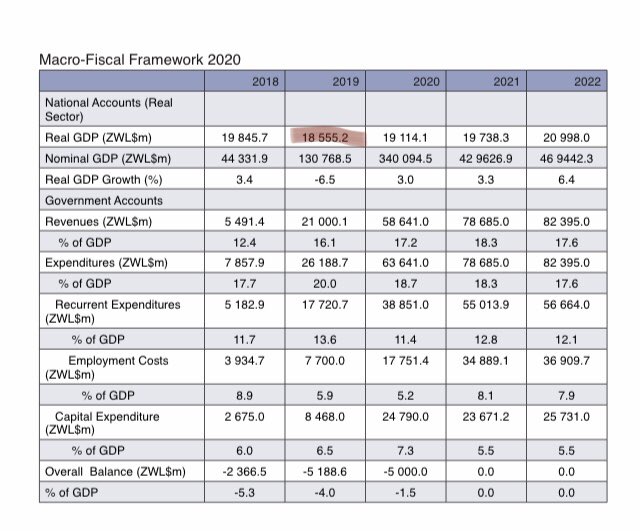

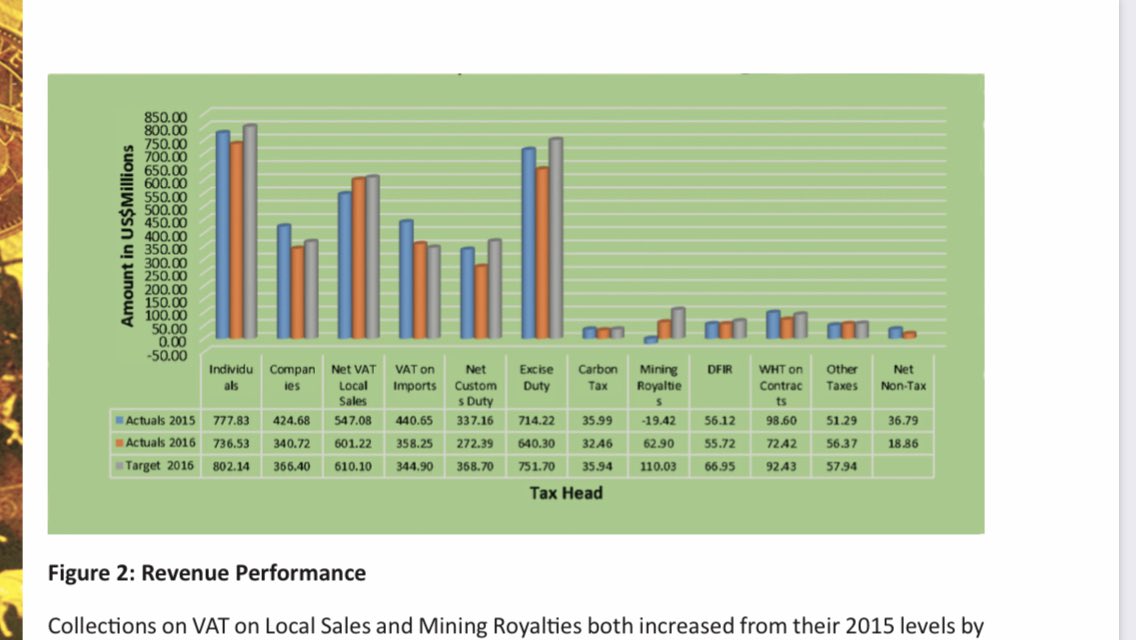

GOZ expenditure is driven by public taxes. It only spends what it is given by the public. Even when it borrows, it’s the public that eventual pays the debt through taxes. GOZ over the last ten years receives on average US$3bn a year in taxes. Of this, 60% is VAT & VAT related.

GOZ expenditure is driven by public taxes. It only spends what it is given by the public. Even when it borrows, it’s the public that eventual pays the debt through taxes. GOZ over the last ten years receives on average US$3bn a year in taxes. Of this, 60% is VAT & VAT related.

10/

Of this, 60% is VAT & VAT related. I include exercise duty as VAT related. The 2% transaction tax is an extortion tax that did little to broaden the tax base but rather increase taxes from the same.

Of this, 60% is VAT & VAT related. I include exercise duty as VAT related. The 2% transaction tax is an extortion tax that did little to broaden the tax base but rather increase taxes from the same.

11/

PAYE- related to workers in Zimbabwe & corporate tax including royalties is low at 30%. It’s household consumption tax that contributes the majority of GOZ collections.

PAYE- related to workers in Zimbabwe & corporate tax including royalties is low at 30%. It’s household consumption tax that contributes the majority of GOZ collections.

12/

C is consumer expenditure. From formal direct VAT collections of 60% we get US$1.8bn. Vat is 15% meaning total VAT related expenditure is $12bn.

From corporate tax & own estimates Firm consumption is US$3bn.

C is consumer expenditure. From formal direct VAT collections of 60% we get US$1.8bn. Vat is 15% meaning total VAT related expenditure is $12bn.

From corporate tax & own estimates Firm consumption is US$3bn.

13/

It is worth noting the bulk of PAYE is civil servants. GOZ deduction is notional & NOT real!

New Investments is negligible, less than US$1bn (incl FDI)& BOP balance US$1bn

We have gone through this process to understand that Zim’ GDP is household consumption led. At 60%.

It is worth noting the bulk of PAYE is civil servants. GOZ deduction is notional & NOT real!

New Investments is negligible, less than US$1bn (incl FDI)& BOP balance US$1bn

We have gone through this process to understand that Zim’ GDP is household consumption led. At 60%.

14/

AD = G+C+F+I+Xn

AD = $3bn+$12bn+$3bn+$1bn-$1bn = $18bn

F = proxy for firm consumption which I’ve disaggregated from C.

AD = G+C+F+I+Xn

AD = $3bn+$12bn+$3bn+$1bn-$1bn = $18bn

F = proxy for firm consumption which I’ve disaggregated from C.

15/

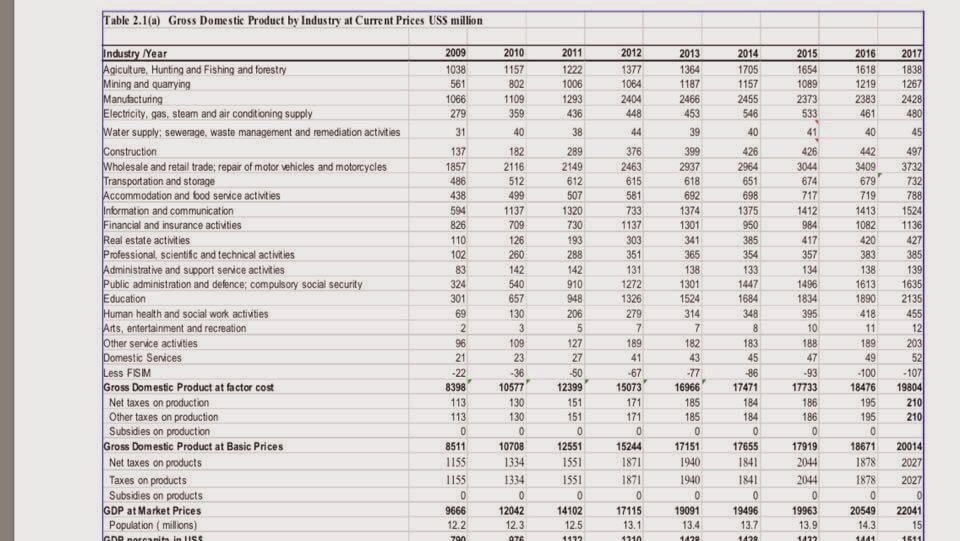

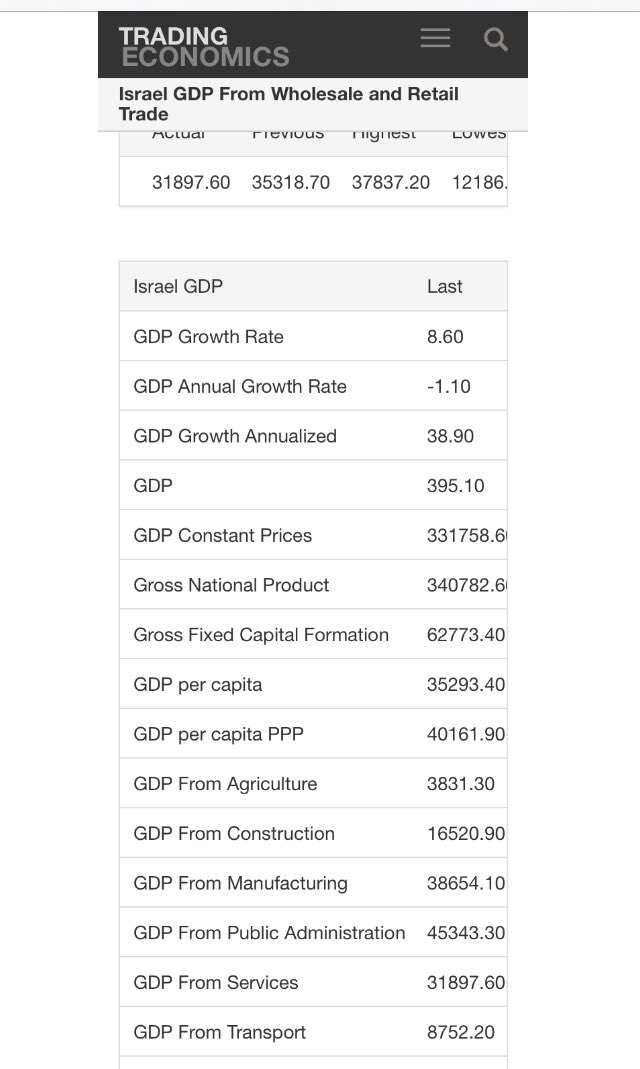

Looking at wholesale & retail sub sector GDP which is the highest contributor, it’s in tandem with the assumption of Household consumption led economy.

Even highly industrialised nations like Israel with its highly mechanized agriculture is nonetheless service sector driven

Looking at wholesale & retail sub sector GDP which is the highest contributor, it’s in tandem with the assumption of Household consumption led economy.

Even highly industrialised nations like Israel with its highly mechanized agriculture is nonetheless service sector driven

16/

But for Zim, how can household consumption drive the economy? This is at variance with often quoted unemployment rate of at least 80%. But we know this unemployment to be true. So where are the households getting money to consume?

But for Zim, how can household consumption drive the economy? This is at variance with often quoted unemployment rate of at least 80%. But we know this unemployment to be true. So where are the households getting money to consume?

17/

Thus our study from hereon tries to understand household income. For the greater part of the last decade Civil servants average salary is US$250. High’s of $500 & lows of US$100. We shall assume this to be the proxy for formal employment. Informal employment fares no better.

Thus our study from hereon tries to understand household income. For the greater part of the last decade Civil servants average salary is US$250. High’s of $500 & lows of US$100. We shall assume this to be the proxy for formal employment. Informal employment fares no better.

18/

Over the last decade;

(1) Mining had low commodity prices, gold price was $1100. The industry grew marginally. Chiadzwa went through a boom & bust.

(2) Agriculture barely had 3 good seasons.Vagaries of climate & incapable farmers.

(3) FDI averaged US$400m

Over the last decade;

(1) Mining had low commodity prices, gold price was $1100. The industry grew marginally. Chiadzwa went through a boom & bust.

(2) Agriculture barely had 3 good seasons.Vagaries of climate & incapable farmers.

(3) FDI averaged US$400m

19/

Yet the economy grew from US$8bn to US$18bn

This was driven by household consumption & investment.

Formal remittances jumped from US$200m to US$600m. Highs above a U$1bn. This consistent inflow stabilized growth.

Informal remittances grew as well.

Yet the economy grew from US$8bn to US$18bn

This was driven by household consumption & investment.

Formal remittances jumped from US$200m to US$600m. Highs above a U$1bn. This consistent inflow stabilized growth.

Informal remittances grew as well.

20/

This is the end of Part 1. The purpose was to show Zim as a household consumption led economy.

Though households are unemployed & poor, their consumption is inconsistent with those unemployed.

Having identified the supplementary income as remittances, part 2, will dive in.

This is the end of Part 1. The purpose was to show Zim as a household consumption led economy.

Though households are unemployed & poor, their consumption is inconsistent with those unemployed.

Having identified the supplementary income as remittances, part 2, will dive in.

• • •

Missing some Tweet in this thread? You can try to

force a refresh