// What are trend-lines?

Trend-lines are support and resistance lines which are formed by connecting Important swing points.

The beauty of using them is that We can use them when stock is not Respecting the Horizontal S&R zones, they can indicate us when the trend may change.

Trend-lines are support and resistance lines which are formed by connecting Important swing points.

The beauty of using them is that We can use them when stock is not Respecting the Horizontal S&R zones, they can indicate us when the trend may change.

// Things To consider while Making trendlines?

• A trendline formed by using 3 Major-Swing points is a potential trendline, But we will also use 2 points to form a trendline, will discuss how, as you read further.

• Trendline can be formed by two ways-

• A trendline formed by using 3 Major-Swing points is a potential trendline, But we will also use 2 points to form a trendline, will discuss how, as you read further.

• Trendline can be formed by two ways-

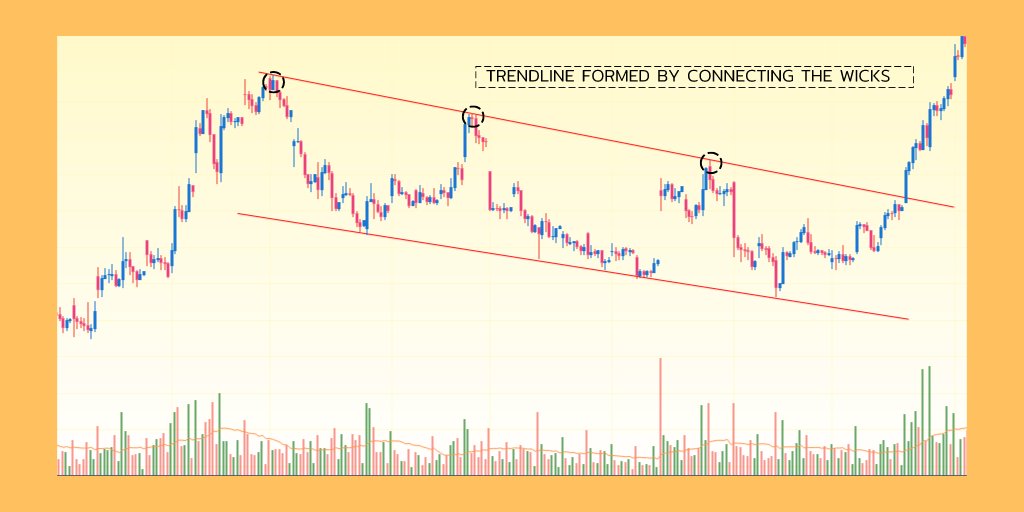

1. Wicks-

In this method we only connect the wicks to make a trendline, this is a precise way of making a trendline.

In this method we only connect the wicks to make a trendline, this is a precise way of making a trendline.

// Why only connect the wicks?

There are two type of levels - Precise and Less precise (Which we call zones).

So what we are doing is by only connecting the wicks we are making a precise level where we can take trades, either Mean reversion or Breakout trades.

Examples-

There are two type of levels - Precise and Less precise (Which we call zones).

So what we are doing is by only connecting the wicks we are making a precise level where we can take trades, either Mean reversion or Breakout trades.

Examples-

// Why use precise levels?

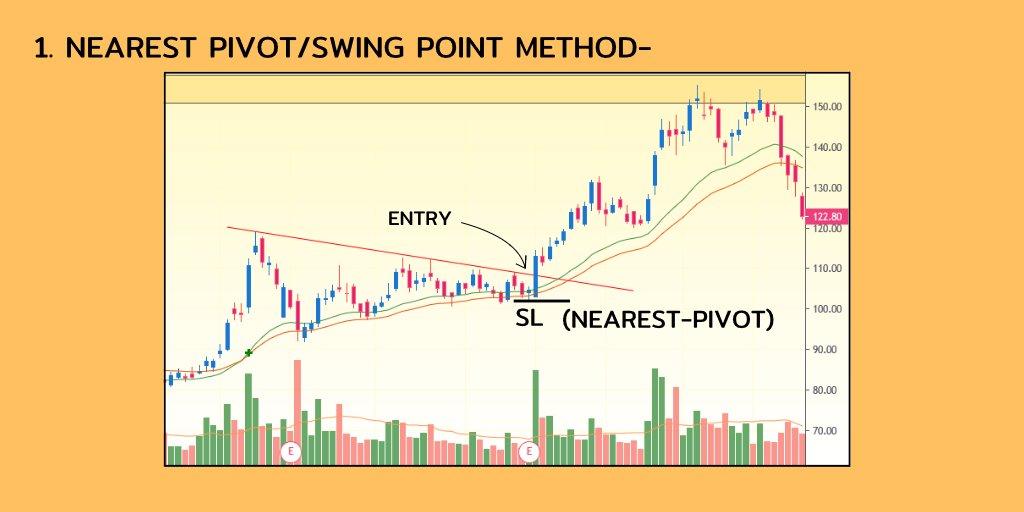

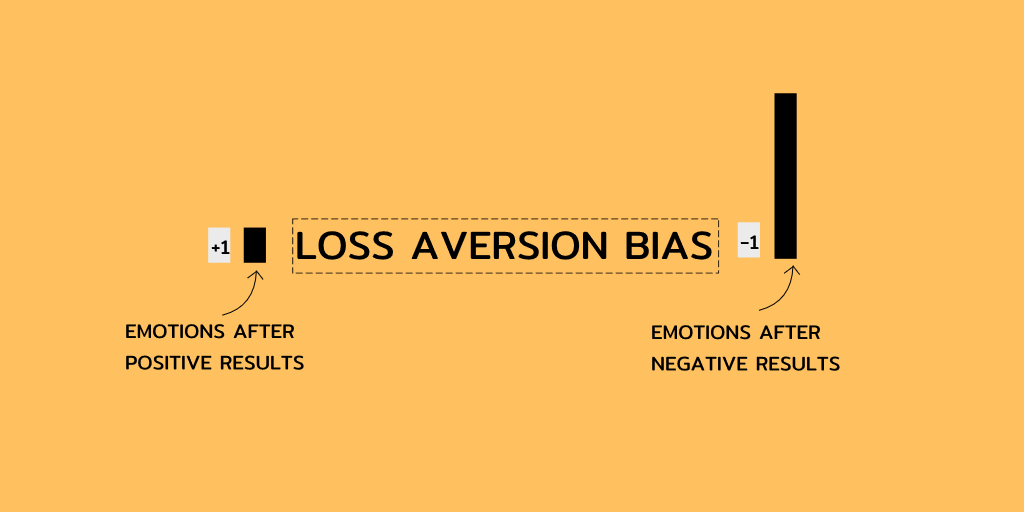

• Because it gives us better R:R trades.

• small Stop level is needed for me to decide when the trade is failed.

• Because it gives us better R:R trades.

• small Stop level is needed for me to decide when the trade is failed.

// How to trade these?

We simply buy/sell at the break of these trendlines, Or take Mean reversion trades at these trendlines with small risks as we have clear negation levels.

We simply buy/sell at the break of these trendlines, Or take Mean reversion trades at these trendlines with small risks as we have clear negation levels.

2. Confluence of the wick and the bodies.

The basis of drawing trendlines, is to find Levels from which the stock react, and in doing this the stock may cross those levels but closes below it (in case of resistance)

The basis of drawing trendlines, is to find Levels from which the stock react, and in doing this the stock may cross those levels but closes below it (in case of resistance)

Likewise, any candle wick can go above the trendline but if closes below it then its still considered a valid trendline.

// How to trade these?

Trading these is different , and there are few ways how I approach them-

// How to trade these?

Trading these is different , and there are few ways how I approach them-

1. Buy when the candles closes above the trendline, if you are trading of 15min tf, wait for a 15min candle to close above the trendline.

2. Now, as I said we can also use 2 points to form a trendline, this approach is more useful when the general market is in an overall uptrend and when we incorporate certain patterns which are made using trendlines.

• As you can see the chart is of nifty midcap 100, where we have formed a trendline by using 2 major points, usually we take 3 points if we have to draw a trendline but in case we have certain patterns which develops frequently, we can only use 2 points to draw a trendline.

• But its better to wait for the candle to close above the trendline, as many times we see rejection immediately after crossing when we have only 2 points, so wait for the closing.

• Also check the candle strength when taking a breakout trade, with a trendline formed with only 2 points, take trade only when you see strength candles.

• We will discuss about patterns further.

• We will discuss about patterns further.

// So now we know how to draw trendlines,There are different ways how you can use them-

1. Trend channels

We can use trendlines as trend-channels, these are formed when the stock moves between two trendlines,these can formed as up-trending, down-trending and horizontal channels

1. Trend channels

We can use trendlines as trend-channels, these are formed when the stock moves between two trendlines,these can formed as up-trending, down-trending and horizontal channels

2. Patterns -

Patterns means repetition, these are market structures which are formed frequently and are used from a very long time in technical analysis.

Trendlines play an important role in forming many of the patterns that we know.

Patterns means repetition, these are market structures which are formed frequently and are used from a very long time in technical analysis.

Trendlines play an important role in forming many of the patterns that we know.

// Some examples of patterns-

1. Flag pattern - These have more occurrence then other patterns, these are continuation patterns.

1. Flag pattern - These have more occurrence then other patterns, these are continuation patterns.

2. Triangle patterns-

There are many triangle patterns and these are more trickier to trade.

1. My favorite is the descending triangle

These are formed when the stock is in sideways period after a short term uptrend, these have mostly flat base,and a downward sloping trendline

There are many triangle patterns and these are more trickier to trade.

1. My favorite is the descending triangle

These are formed when the stock is in sideways period after a short term uptrend, these have mostly flat base,and a downward sloping trendline

In one example you can see we have 3 points so we have clear point of entry, but in another example we have only 2 major points, so we wait for the breakout candle to close above the trendline to take a trade.

// One tip for this pattern, the steeper the trendline the higher the chance the breakouts will fail, so focus on those patterns which have less steeper trendlines.

2. Wedge-

Well this pattern is quite famous, because some of the best traders have blown there accounts trading this. But those who know how to trade it love it.

Well this pattern is quite famous, because some of the best traders have blown there accounts trading this. But those who know how to trade it love it.

// Why its hard to trade this?

Because it’s a reversal pattern and you know trend is our friend.

So by trading this pattern we are going against the trend and many times this pattern fail, As most of the times the major trend wins.

Because it’s a reversal pattern and you know trend is our friend.

So by trading this pattern we are going against the trend and many times this pattern fail, As most of the times the major trend wins.

But we can still trade this if we keep few things in mind-

1. As I said previously the steeper the trendline the higher the chance the breakout will fail or will give whipsaw moves.

• So look for a wedge with less steeper trendline.

1. As I said previously the steeper the trendline the higher the chance the breakout will fail or will give whipsaw moves.

• So look for a wedge with less steeper trendline.

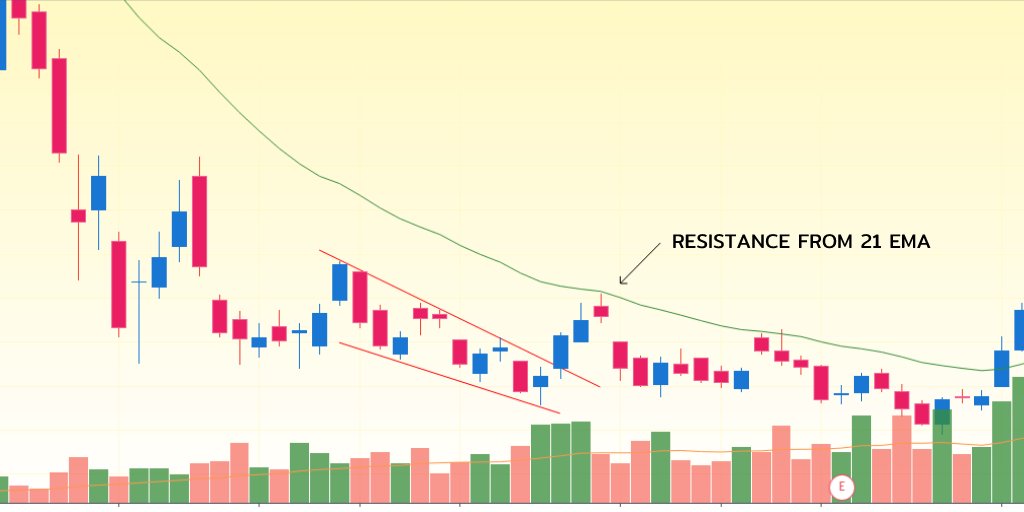

2. Look for rejection at higher levels( If bearish wedge) in this example its bullish

3. Book profits at major levels,21 EMA,major swing points

• Usually I will say to trail your sl, but in using this pattern I mostly look for major points to exit, or use aggressive trail sl.

3. Book profits at major levels,21 EMA,major swing points

• Usually I will say to trail your sl, but in using this pattern I mostly look for major points to exit, or use aggressive trail sl.

// Some important points

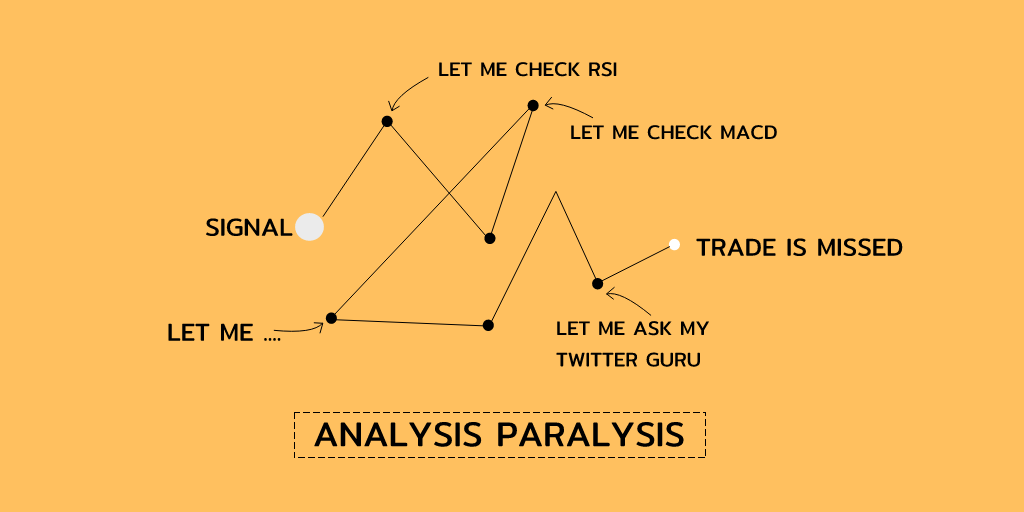

1. How to find these trendlines easily?

• Well it comes only with time, You just cant go one the first day and try to find some of the best trendline and patterns

• With time your ability to find them increases and you will know when not to use them

1. How to find these trendlines easily?

• Well it comes only with time, You just cant go one the first day and try to find some of the best trendline and patterns

• With time your ability to find them increases and you will know when not to use them

• The biggest teacher are your mistakes.

2. Try to draw these trendlines on the ongoing trend side, because even if you don’t draw them perfectly , the chances of your trade working will increase .

2. Try to draw these trendlines on the ongoing trend side, because even if you don’t draw them perfectly , the chances of your trade working will increase .

3. Try to use the starting point of your trendline from the wick of the candle and not the body of the candle.

4. These are just one part of the whole equation, these work best when you combine with other variables.

4. These are just one part of the whole equation, these work best when you combine with other variables.

/// These are not rules just the ways to trade trendlines, The number 1 rules of markets is that there are no rules.

These are only my views and not necessarily be yours.

Thanks for reading till here .

Cheers.

TRADER KNIGHT

These are only my views and not necessarily be yours.

Thanks for reading till here .

Cheers.

TRADER KNIGHT

• • •

Missing some Tweet in this thread? You can try to

force a refresh