2020 saw a huge turnaround within the S&P 500 index after the vaccine news broke on 11/9/20.

Stocks that fared the worst through 11/9/20 saw the largest increases post-vax (on average, through year-end).

Sector attributions below 👇

1/

Stocks that fared the worst through 11/9/20 saw the largest increases post-vax (on average, through year-end).

Sector attributions below 👇

1/

Tech/Cons. Dis/Comm. made up all the returns until 11/6 with Financials/Energy dragging.

Post-vax news, Financials was the biggest contributor, though Tech was still #2.

Energy continued to dragged!

2/

Post-vax news, Financials was the biggest contributor, though Tech was still #2.

Energy continued to dragged!

2/

Big reason for Tech continuing to shine post-vax was $AAPL - the top contributor to S&P 500 returns pre- & post 11/9/20.

But large shifts below.

Pre-vax, #2-5 was $AMZN $MSFT $GOOG $NVDA & all others had net negative contribution.

Post-vax, #2-5 was $DIS $JPM $BAC $BRK.

end/

But large shifts below.

Pre-vax, #2-5 was $AMZN $MSFT $GOOG $NVDA & all others had net negative contribution.

Post-vax, #2-5 was $DIS $JPM $BAC $BRK.

end/

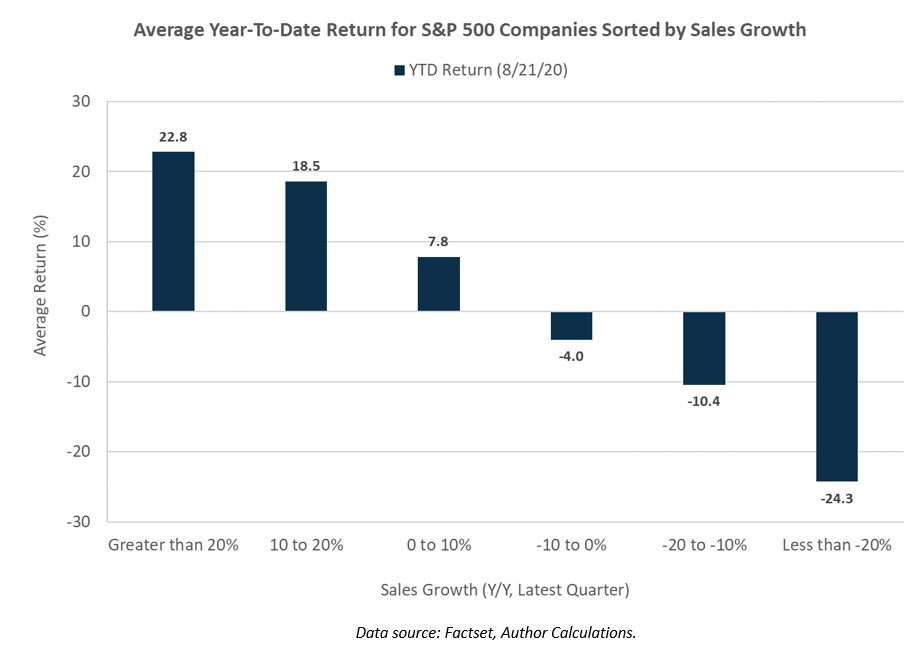

Extending the thread to look at return distributions against fundamental metrics.

Gives another perspective to the post-vax momentum reversal posted on top of this thread.

Chart shows 2020 returns for S&P 500 companies by sales growth:

>20% y/y: +44%

<-20% y/y: -21%

4/

Gives another perspective to the post-vax momentum reversal posted on top of this thread.

Chart shows 2020 returns for S&P 500 companies by sales growth:

>20% y/y: +44%

<-20% y/y: -21%

4/

But again, we see a huge reversal post-vax news on 11/6.

Companies with the the worst sales growth had the best returns on average from 11/6 through year-end.

Reversing what we saw prior to that.

5/

Companies with the the worst sales growth had the best returns on average from 11/6 through year-end.

Reversing what we saw prior to that.

5/

Similar story if you sort by forward P/E ratios.

1st chart:

Stocks with the highest P/Es significantly outperformed those on the other end of the spectrum (incl. those with -ve eps).

2nd chart:

Shows big shift post-vax, when stocks with no eps estimates or P/E < 10 surged.

6/

1st chart:

Stocks with the highest P/Es significantly outperformed those on the other end of the spectrum (incl. those with -ve eps).

2nd chart:

Shows big shift post-vax, when stocks with no eps estimates or P/E < 10 surged.

6/

Post-vax reversal existed even across market cap.

1st chart:

Larger stocks vastly outperformed over the entire year.

2nd chart:

Smaller firms < $25 billion cap (~ 50% of index) surged on average post-vaccine news, reversing their pre-vax losses on average.

/end

1st chart:

Larger stocks vastly outperformed over the entire year.

2nd chart:

Smaller firms < $25 billion cap (~ 50% of index) surged on average post-vaccine news, reversing their pre-vax losses on average.

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh