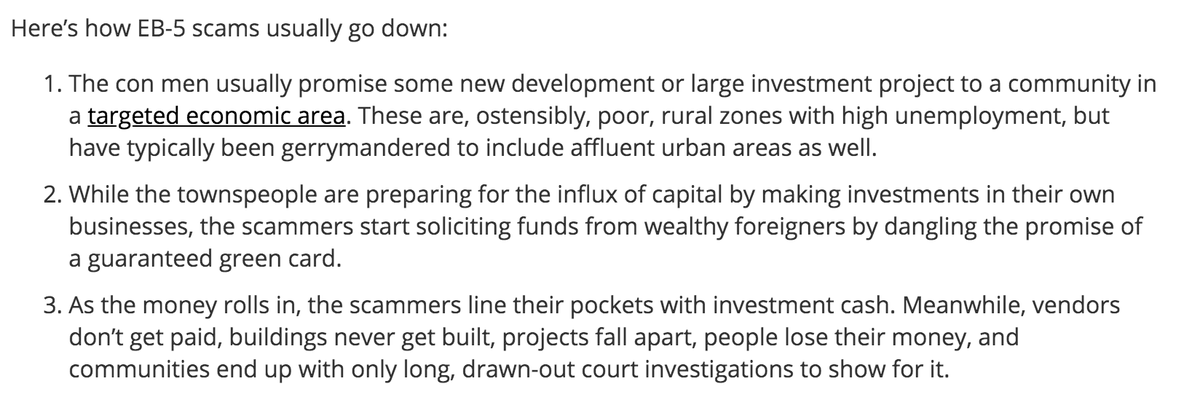

Corporate Profits =

Investment

+ Dividends

- Household Saving

- Government Saving

+ Current Account Surplus

Charts & useful links coming up 👇

1/

Household & government savings subtract from profits.

@RomanchukBrian has a really good primer on the profit equation here:

bondeconomics.com/2018/06/primer…

2/

macromusings.libsyn.com/srinivas-thiru…

3/

Approach is very similar to the one used by @Jesse_Livermore in this blog post, which I highly recommend:

philosophicaleconomics.com/2013/11/cp/

4/

Subtracting this term results in a perfect match.

With that, now we can look at the components of the profit equation i.e. profit sources.

6/

It was 10 yrs ago that Pres. Obama said "Like any cash-strapped family, we will work within a budget" in his State of the Union.

We got the Budget Control Act of 2011 & sequester in 2013.

10/

Note: in addition to tax cuts, we also got repeal of sequester, and an increase in spending caps for 2020 & 2021.

13/

h/t @SethHanlon

brookings.edu/interactives/h…

As @teasri points out: "Were it not for the deficit, the economy would probably be in recession", via @aarontask

stitcher.com/podcast/seekin…

17/

But the degree to which deficit spending counters falloff in investment in recessions is notable.

Speaks to the size of govt & counter-cyclical policies in place.

It prevents a depression spiral (Minsky), and puts a floor on profits.

18/

Technically, we're not in a recession & so we have "pro-cyclical" fiscal policy - but that's clearly making up for anemic business investment.

Question is: does this continue?

Ultimately a political decision. cc: @TheStalwart

/19

"Who the hell cares about the budget? We're going to have a country"

And profits.

/End