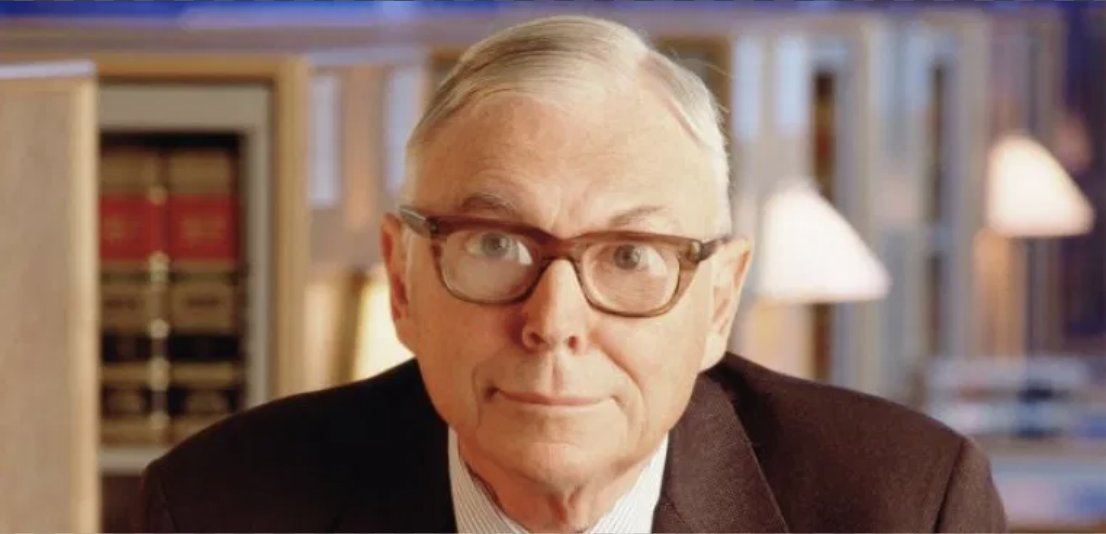

1/ Charlie Munger turned 97 yesterday (thread)

Here are my favorite quotes, thoughts, and stories about this fountain of wisdom

Happy Birthday, Charlie!

More:⬇️⬇️⬇️⬇️⬇️

Here are my favorite quotes, thoughts, and stories about this fountain of wisdom

Happy Birthday, Charlie!

More:⬇️⬇️⬇️⬇️⬇️

2/ Charlie Munger is a reading FANATIC

He lost an eye earlier in life to cataract surgery

He was later told by doctors that he was at serious risk of losing the eyesight in his remaining eye

His response to his friends?

“It’s time for me to learn braille”

What a mindset

He lost an eye earlier in life to cataract surgery

He was later told by doctors that he was at serious risk of losing the eyesight in his remaining eye

His response to his friends?

“It’s time for me to learn braille”

What a mindset

3/

"Acquire worldly wisdom and adjust your behavior

accordingly.

If your new behavior gives you a little

temporary unpopularity with your peer group ...

then to hell with them."

"Acquire worldly wisdom and adjust your behavior

accordingly.

If your new behavior gives you a little

temporary unpopularity with your peer group ...

then to hell with them."

4/

"It's remarkable how much long-term advantage people

like us have gotten by trying to be consistently not stupid,

instead of trying to be very intelligent.

"It's remarkable how much long-term advantage people

like us have gotten by trying to be consistently not stupid,

instead of trying to be very intelligent.

5/

"A great business at a fair price

is superior to a fair business at a great price."

"A great business at a fair price

is superior to a fair business at a great price."

6/

"People are trying to be smart

all I am trying to do is not to be idiotic,

but it's harder than most people think."

"People are trying to be smart

all I am trying to do is not to be idiotic,

but it's harder than most people think."

7/

"if it makes sense in the long term,

we just don't give a damn what it looks like in the short term.

After all, we're running a cult, not a normal company."

"if it makes sense in the long term,

we just don't give a damn what it looks like in the short term.

After all, we're running a cult, not a normal company."

8/

"It's a real pleasure to earn the trust of your customers

slowly over time by doing what's right."

"It's a real pleasure to earn the trust of your customers

slowly over time by doing what's right."

9/

"If you're glued together right and honorable,

you will succeed.

Get in there and get rid of stupidities

and avoid bad people.

Try teaching that to your grandchildren.

The best way is by example. Fix yourself."

"If you're glued together right and honorable,

you will succeed.

Get in there and get rid of stupidities

and avoid bad people.

Try teaching that to your grandchildren.

The best way is by example. Fix yourself."

10/

"The first rule of compounding;

never interrupt it unnecessarily."

"The first rule of compounding;

never interrupt it unnecessarily."

11/

"You can't live a successful life

without doing some difficult things that go wrong."

"You can't live a successful life

without doing some difficult things that go wrong."

12/

"I had a considerable passion for getting rich,

not because I want Ferraris.

I wanted independence."

"I had a considerable passion for getting rich,

not because I want Ferraris.

I wanted independence."

13/

"I'm a great believer in solving hard problems

by using a checklist."

"I'm a great believer in solving hard problems

by using a checklist."

14/

"Acknowledging what you don't know

is the dawning of wisdom."

"Acknowledging what you don't know

is the dawning of wisdom."

15/

"It's extraordinary how resistant some people are

to learning anything."

"It's extraordinary how resistant some people are

to learning anything."

16/

"Show me the incentives,

and I will show you the outcome."

"Show me the incentives,

and I will show you the outcome."

17/

"People calculate too much

and think too little."

"People calculate too much

and think too little."

18/

"...the fundamental algorithm of life:

repeat what works."

"...the fundamental algorithm of life:

repeat what works."

19/

"Figure out what you don't want and avoid it,

and you'll get what you do want."

"Figure out what you don't want and avoid it,

and you'll get what you do want."

20/

"It's not that we're so smart,

it's that we stayed sane."

"It's not that we're so smart,

it's that we stayed sane."

21/

"The secret to being successful in any field

is getting very interested in it."

"The secret to being successful in any field

is getting very interested in it."

22/

"Remember that reputation and integrity

are your most valuable assets

and can be lost in a heartbeat."

"Remember that reputation and integrity

are your most valuable assets

and can be lost in a heartbeat."

23/

"If you want to get smart

the question you've got to keep asking is:

Why? Why? Why? Why?"

"If you want to get smart

the question you've got to keep asking is:

Why? Why? Why? Why?"

• • •

Missing some Tweet in this thread? You can try to

force a refresh